Transfix Take Podcast | Ep. 53 – Week of June 2

Out with Memorial Day, In with Cherry Season: A Regional Run Down

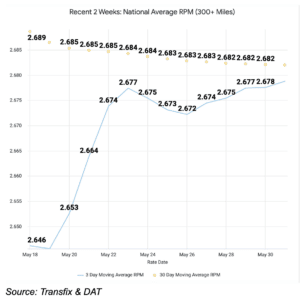

Memorial Day weekend brought carriers a more favorable market, with spot rates increasing nationally and a slight relief in fuel costs.

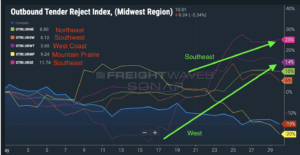

Carriers continue to favor the Southeast Coastal region and markets along the Mexico border, as we witnessed up to 5% increases in spot rates in those areas. This trend aligns with the tender rejection spike last week, ending the month of May 25% higher than it started in the Southeast.

While the East Coast has been stealing all the recent attention, capacity in the West Coast is tightening as cherry season heats up. Shippers are starting to feel pressure on rates and are witnessing a jump in tender rejections with almost a 20% increase from only two weeks prior.

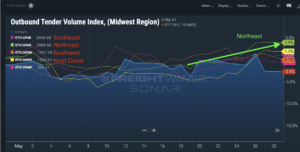

The Northeast continues to worry carriers due to spiking fuel prices, but shippers have been able to maintain control of capacity, preventing the rejection of contract freight for the spot market, even as volumes in the region climbed uncharacteristically throughout May.

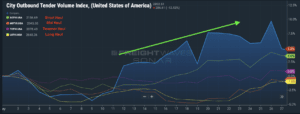

On a national level, tender rejections held flat, but we saw an increase in overall dry van volume as we drove out of May. Digging deeper into this pattern, we believe the increased volume is primarily driven by the rise in local and short hauls – likely the shifting inventory between nearby warehouses.

June: A Tall Test for Truckload Markets

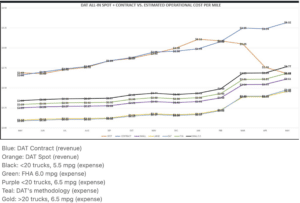

As drivers shift into gear coming off the holiday weekend, they will be able to take advantage of the last day of the month following the extended weekend. Still, shippers will jump back into the driver seat with more leverage in the spot market as soon as we turn into June. Driving through June will be a tall test for truckload markets. Shippers will likely be able to hold pricing power in most cases as volume continues to be taken by contract carriers through routing guide acceptance. Carriers and brokers will continue to see shippers flip the previous repricing trend and push partners to lower contractual freight as the gap between contract and spot rates only widens.

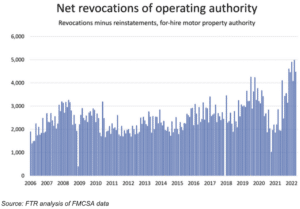

Continuing to advocate for change in the industry, I cannot emphasize the issue that the pricing whiplash between supply and demand brings to the industry. Over the past few weeks, I have been cautioning shippers on the negative impacts of repricing contractual freight. We continue to see a surge in revocations of operating authorities. The impact of this is yet to be seen and could be less impactful if these drivers are joining larger fleets and therefore reversing the trend of the past two years. In other words, we hope that owner operators are not removing capacity fully from the industry.

Data Analytics Advisor Kyle Litner recently highlighted just how difficult the current conditions are for smaller carriers that rely on the spot market, compared to large national carriers that have recently released impressive earnings.

East Coast Ports Heat Up

As the beaches along both coasts filled with people celebrating the holiday and kicking-off summer, were the shorelines also overcome by vessels waiting to berth?

While trucking markets remain calm and continue to work in favor of shippers, ports beyond those on the California coast are generating bottlenecks and concerns. The Ports of New York and New Jersey in recent weeks, for instance, are averaging 14 ships waiting to berth – the highest number since the pandemic’s outset.

Imports from Asia may be down over 3% on the West Coast, but they are significantly up in the East Coast and Gulf markets as some shippers may be preparing for contract negotiations to go sour out West. Compared to the same time frame year-over-year, Asian imports are up more than 9% on the East Coast and a whopping 35% in the Gulf through April. As you might expect, congestion caused by empty containers and a lack of chassis continue to plague the ports.

China Lockdowns Ease

On May 26th, lockdowns in China eased, and throughput at the world’s largest port in Shanghai saw an almost instant return to normal production, reaching 96% of pre-pandemic levels and trucking levels rebounding to 90% pre-pandemic levels.

The lockdown’s impact on U.S. imports is not looking to be as extreme as some experts feared. Why? Most large retailers adjusted their strategies from just-in-time to just-in-case, pulling freight forward and balancing high inventory levels. Industries such as the automotive sector will see the impact of the lockdowns more acutely on their supply chain. It is no secret that inventory levels have had differing effects on shippers this year. Though warehousing is no new challenge, this year, shippers will face tighter warehousing capacity and rising costs as they manage higher-than-usual levels of inventory.

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.