Bonus Recap: Shipper Sentiment & 2023 Outlook

In early November, the Transfix team was among the electric swarm of supply chain leaders that descended upon the Freightwaves’ F3: Future of Freight festival in Chattanooga, Tennessee to find community in an uncertain market and hear from the most seasoned and sharp industry minds.

Inflation Updates From Freight Alley Economists

Transfix’s Principal Economist Ayeh Bandeh-Ahmadi took a seat next to Freightonomics hosts Zach Strickland and Anthony Smith to help unpack supply side inflation, the Fed’s existential need to overcorrect, and how dynamic pricing helps shippers and carriers keep agreements that both sides can trust for longer periods.

“Going into a period where we expect continued volatility, it’s really important to think about how to work with contracts that will stay relevant and stable for as long as possible,” explained Bandeh-Ahmadi. “Dynamic pricing has the opportunity to address this, but not all dynamic pricing is created equal.”

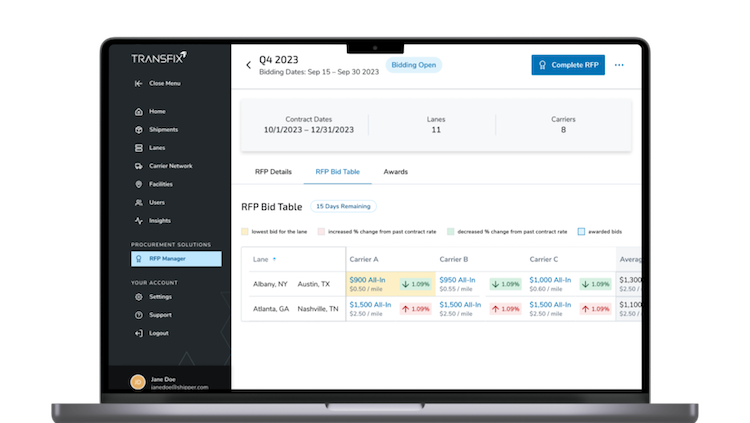

Transfix TrueRate+ Leads the Charge Beyond Broken Contracts

In a later conversation with FreightWaves’ Editorial Director Rachel Premack, our Chief Product Officer Tony Tzeng provided further color on Transfix’s dynamic pricing tool – Transfix TrueRate+ – specifically how shippers are in dire need of a pricing antidote to regularly broken contracts.

“What we are doing is really making sure the incentives are aligned,” Tzeng said. “It allows us to address traditional issues in cost-plus programs and the pain points.”

What sets TTR+ apart from other cost-plus programs is its rate transparency for shippers and pain-and-profit-sharing function, which FreightWaves’ John Kingston explained in a his article following the fireside chat: “If over the course of the contract the cost of moving goods increases, Transfix will assume 70% of the higher costs, with the shipper getting hit with the remainder. If the cost of shipping falls, which would normally fully benefit a 3PL in a traditional brokerage relationship, the shipper gets 70% of the savings.”

Shipper Sentiment and the Freight Recession Debate: Overheard in Freight Alley

While shipper sentiment and behavior may have been top of mind due to the falling-rate market, F3 was also rich with insights for brokers and carriers new to this softer side of the cycle.

In a market update discussion with FreightWaves founder Craig Fuller and Thom Albrecht, CFO/CRO of Reliance Partners, Albrecht called the past two years “the best stretch in the industry since deregulation.” For drivers and carriers, he advised to know their niches and ask shippers to haul the more difficult freight. For the industry at large, he said to pay attention to industrial production, as it’s “the straw that stirs the drink in freight and determines whether a year is strong or weak.”

Debates around a freight recession evoke a variety of perspectives, so we tracked down a couple of FreightWaves experts and personalities, Zach Strickland and Kevin Hill, to hear their projections for 2023.

When we weren’t absorbing fireside chats, the Transfix team was hauling a fun crew of freight professionals all over downtown Chattanooga for the Chattabrew Tour.

FreightWaves, with the heavy-lifting of countless partners, managed to infuse this market downturn with a sense of community. As a consultative partner for shippers and carriers, the Transfix team left F3 reignited to keep building a more transparent and more resilient industry.