The Transfix Take Podcast: Ep. 13 – Week of Aug 30

Holiday, Hurricanes and Harbingers

The market has officially turned toward peak season. Load-to-truck ratios have significantly increased, and spot rates continued their slow rise — still pushing toward record highs. Hurricane Henri only made things in the Northeast worse for shippers, as capacity disappeared. The Midwest is also heating up, with some pockets, from St. Louis to Chicago to Cleveland, becoming just as favorable as the Northeast for carriers.

Some of the softer markets, including coastal states and even pockets in the South, are beginning to tighten. The Southeast continues to be the market where shippers can find lower rates, but even some major markets, such as Jacksonville, just are not running in shippers’ favor. The reefer segment is seeing increasing tender rejections and rates, as volume climbed to its highest point since the first week of June. Hopefully, shippers were able to push out as much volume as they could, because the market last week was much more favorable than what is to come.

As we roll into the last week of August, volumes are climbing nationally in preparation for peak season. We’re also facing a trifecta of market movers — end of the month, Labor Day weekend and a hurricane — leading to tight markets for the next two weeks. Any one of these events could drive rates up quickly and have a domino effect. This is especially true with a high-impact hurricane, so all three things at once could lead to massive impact. We are particularly watching large markets, such as Houston and Memphis, as capacity gets disrupted. The Midwest and Northeast will continue to have scarce capacity. The West Coast will start seeing rates trend upward, as volume on longer hauls starts to increase.

Out West, inbound containers are accelerating, with many large retailers touting their success at pulling forward inventory. Big-box stores, such as Target, Walmart and Home Depot, all say they are in good shape when it comes to higher year-over-year inventory levels for the holidays. But even with some of the largest importers claiming they are in a good position, imports are gaining momentum and causing longer wait times in multiple Northeast ports. They are also fueling the number of ships that need to anchor on the West Coast to as high as 75%. Congestion in every step of the supply chain is affecting the truckload market. Warehouse space is at all-time lows at around 4% — 2% in the Northeast and on the West Coast — as pull-forward freight is being pushed into whatever warehouse space is available near ports of entry until they get moved to their final destinations.

The freight market will continue to tighten throughout the country for the rest of 2021. The nature of the truckload freight market has been shifting throughout the year, and this will continue.

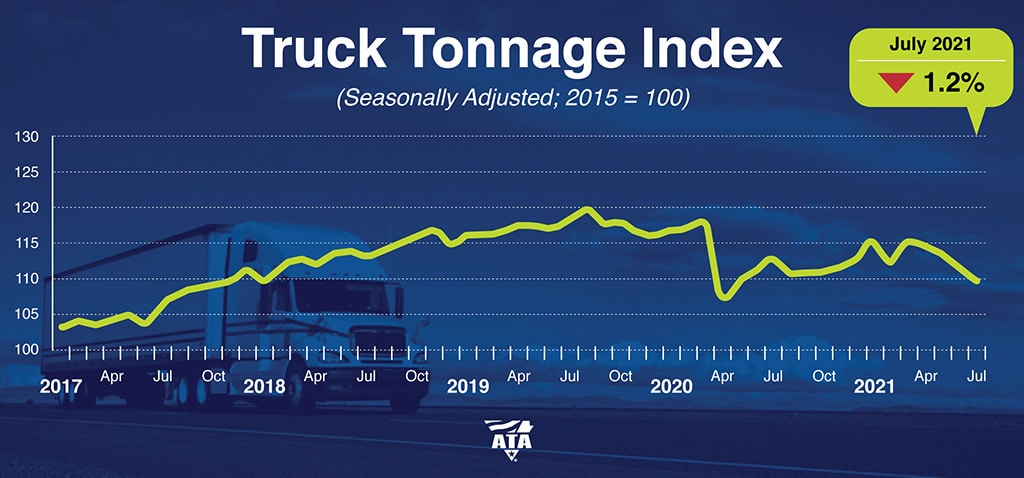

July Contract Freight Tonnage Decline Not a Reflection of Volumes

The American Trucking Association’s (ATA) advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 1.2% in July, following a 2% decrease in June. The July index of 109.8 (2015=100) was down 2.9% year over year.

“Softness in tonnage over the last few months is due more to supply constraints, rather than a big drop in freight volumes,” said ATA Chief Economist Bob Costello. “Not only are there broader supply chain issues, like semiconductors, holding tonnage back, but there are also industry-specific difficulties, including the driver shortage and lack of equipment. For-hire truckload carriers are operating fewer trucks than a year earlier. It is difficult to haul significantly more freight with fewer trucks and drivers.

“In addition to these supply issues, retail sales and housing starts, both large drivers of truck freight, retreated in July, although both rose on a year-over-year basis.”

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.