Freight Piles Up as Storms Take Control

The year began with some semblance of typical seasonality, with January marked by slowly dipping volumes, rejections and spot rates. February, however, has been dominated by the weather. Since the first week of the month, we have been battling bad weather in major freight markets throughout the country. This past week, multiple winter storms wreaked havoc on major markets from Texas through the Northeast, hitting states that were ill-prepared to handle winter storms and testing even those that thought they were prepared.

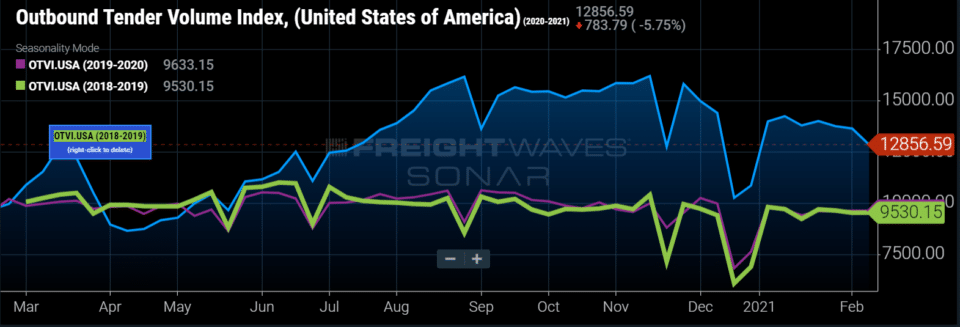

Tender volumes fell markedly week over week, and the Outbound Tender Volume Index (OTVI) sits at 12,857, down from 13,647 last week.

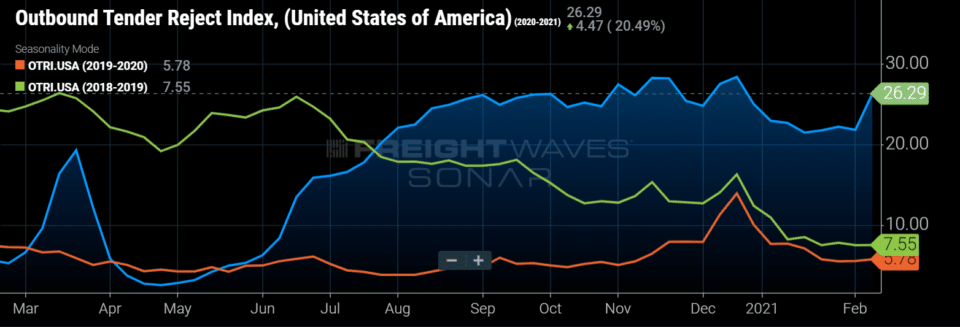

“Markets are very volatile, with demand still at extreme highs, so any small impact to major freight markets has a more exaggerated effect across the nation,” says Justin Maze, Transfix’s senior manager of carrier account management. “Supply (capacity) is being stretched thin and is easily breakable, which is leading to extreme tightness. These storms have had severe impacts on the transportation aspect of everyone’s supply chain, from over-the-road to rail movement around the country. We see this in the data already, as tender rejections and spot rates are increasing.”

“As we talk to carriers from Houston to Allentown, Pennsylvania, we clearly see a ton of carriers taking their fleets off the road during these weather events,” Maze says. “This will not have a short-term effect on capacity that will go away as the weather improves. This will leave a lasting effect after the weather clears throughout the country.”

Seth Holm of FreightWaves concurs: “If this would have occurred at a time when capacity was plentiful and carriers’ assets underutilized, networks could be shifted much easier to absorb the disruption. But with an already tight market and a meaningful percentage of drivers sidelined, freight will pile up and create a backlog of pent-up demand. Therefore, it may take weeks for already strained carriers to accommodate this freight.”

Freight is stuck in markets that are shut down or from where drivers can’t leave. Freight continues to be rejected, as carriers stay off the road nationwide, leading to a pile-up at DCs and warehouses. The national average for the Outbound Tender Reject Index (OTRI) rose more than 5 percentage points, from 21% to 26.3%, week-over-week.

“Capacity is not shifting around the country as it should be,” Maze says. “For example, the carrier that was supposed to pick up a load in Dallas and deliver it to Atlanta was not able to operate, so now there is one fewer truck in the Atlanta market to reload.”

Weather has also temporarily shut down some rail lines, which could have a lasting effect on long hauls. Many large retail and CPG shippers are shifting rail volume to the OTR spot market.

“For the coming week, we will continue to see tight markets throughout the country, especially in areas that have been shut down,” Maze says. “The Northeast and Midwest have been dealing with winter storms for weeks now, but we should see a slight decline in tender rejections and spot rates, as carriers get back to normal operations, and capacity restructures itself in key markets. Regions such as the South and Southeast could see longer-lasting effects on capacity, as they struggle to dig out of weather situations for which they were not prepared.”

West Coast Ports Overflowing

We’ve been reporting for weeks about the overwhelming congestion at the ports of Los Angeles and Long Beach. As COVID-19 continues to fuel both Americans’ elevated buying of goods and a labor shortage at the ports, there’s no sign of the situation abating. Currently, 85% percent of ships are going into anchorage while waiting for terminal space, and the wait time at anchorage is up to 8 days, up from 2.5 days in November 2020.

“All indications point toward a strong flow of imports over the next few months, as consumers continue an unprecedented buying surge, which began last summer,” said Port of Los Angeles Director Gene Seroka. He also said the port currently has enough volume in the anchorage for a month’s worth of work, and with more vessels arriving, they need to “meter the cargo,” or the port could continue to have ships at anchor well into the summer of 2021, reports The Maritime Executive.

The Port of LA is projecting a 34% year-over-year increase in volume for February to 730,000 TEU, and an increase in month-over-month volume is projected in early forecasts for March. Media outlets are reporting the Port of LA has begun diverting ships to other West Coast ports, including the Port of Oakland.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.