Spring Brings Slight Slips

Spring has sprung, and with it, tender volumes and rejections have slipped ever so slightly, though both remain at very high levels.

February’s storms caused an already fragile freight market to bend nearly to a breaking point. As Justin Maze, Transfix’s senior manager of carrier account management, predicted in the Feb. 22 Market Update: “This will not have a short-term effect on capacity that will go away as the weather improves. This will leave a lasting effect after the weather clears throughout the country.” And so it has.

“Routing guides were upended, as many major interstates — I-10, I-20, I-40, I-75, I-95, I-24, I-57, I-70 and I-80 — were all shut down for some time,” Seth Holm writes for FreightWaves. “On the retail front, difficulty in sourcing capacity at the beginning of March may have led retailers to accelerate their Q1 order schedule. If that is the case, shippers may have temporarily pulled forward delivery schedules and caused a non-sustainable large surge in tender volumes. It is this high base from which the market is declining.”

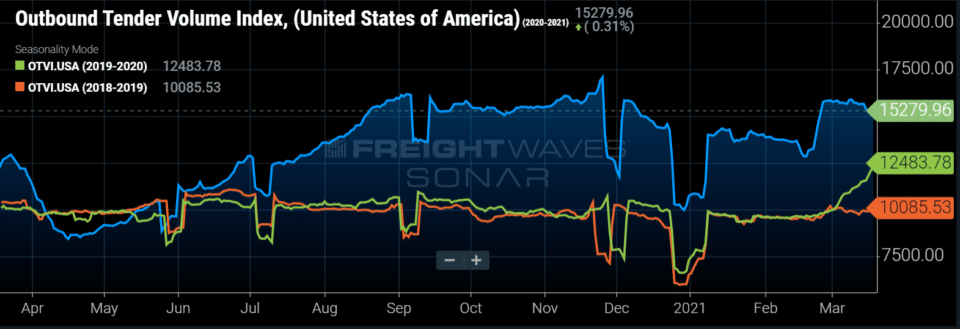

On a national basis, the weekly Outbound Tender Volume Index (OTVI) decreased by 2.7% overall, to 15,280.

“Tender volumes seem to have leveled off with some markets still remaining tight,” says Jonathan Rojas, Transfix’s vice president of carrier operation. “We expect to see the market pick up steam again, as we head into Q2. Key drivers to the market will be stimulus checks driving consumers to buy more products, as well as produce season demand likely being stronger than last year, as more restrictions continue to loosen up for indoor dining and events.”

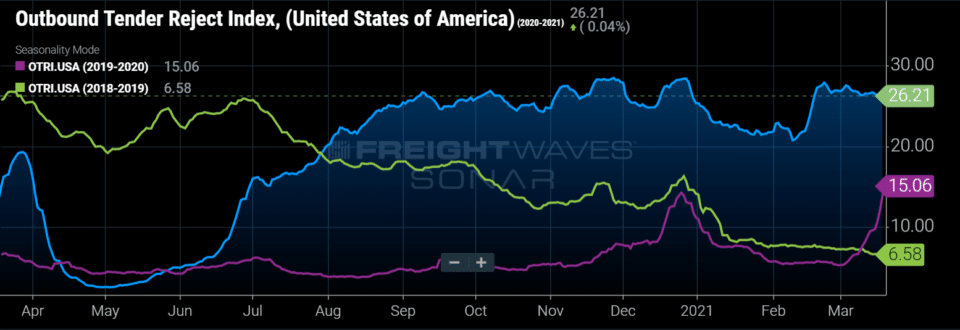

The Outbound Tender Reject Index (OTRI) also fell just a bit from last week’s 26.5%, now sitting at 26.2%. “There was some volatility in major markets this week in both directions,” Holm writes. “Southern markets like Houston and Atlanta have seen a surge in tender rejections over the past 10 days, while Northeastern freight hubs like Harrisburg have seen significant declines.”

Addressing the Driver Shortage

We’re beginning to lose track of how long we’ve been talking about the shortage of truck drivers and its massive impact on the supply chain. According to the Bureau of Labor Statistics, trucking employment is still down 4% from pre-COVID levels, which combines with a 60% increase in freight volume. It’s not a good recipe.

While Class A truck orders in February reached a year-over-year high, there are still fewer people to drive them. So unless volume miraculously starts to drop, the shortage will continue to have a negative effect on capacity.

In an effort to address the issue, two U.S. senators reintroduced the Developing Responsible Individuals for a Vibrant Economy Act, otherwise known as the DRIVE-Safe Act. The act would allow CDL holders under age 21 to haul interstate loads under certain circumstances. There currently is a federal ban on interstate travel for truck drivers under 21.

“The regulation would apply to drivers who have completed, or are participating in, an apprenticeship program, according to the bill text,” S.L. Fuller writes for SupplyChainDive. “Such a program must include a 120-hour probationary period in which the driver proves competency in more basic driving maneuvers, followed by a 280-hour probationary period in which the driver proves competency in more advanced maneuvers.”

Not everyone is on board with the change. Some groups, such as the American Trucking Association (ATA), support the DRIVE-Safe Act, while others, such as the Owner-Operator Independent Drivers Association (OOIDA), oppose it.

“This bill has strong, bipartisan backing because it’s both common sense and pro-safety,” said ATA President and CEO Chris Spear. “It raises the bar for training standards and safety technology far above what is asked of the thousands of under-21 drivers who are already legally driving commercial vehicles in 49 states today. The DRIVE-Safe Act is not a path to allow every young person to drive across state lines, but it envisions creating a safety-centered process for identifying, training and empowering the safest, most responsible 18- to 20-year-olds to more fully participate in our industry. It will create enormous opportunities for countless Americans seeking a high-paying profession without the debt burden that comes with a four-year degree.”

Members of the OOIDA voiced concerns when the bill was first introduced several years ago, citing safety issues and claiming the minimum training standards were “woefully inadequate.”

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.