Q2 Opens With Capacity Being Stretched, Reefer Rejections Soaring

Q2 is off and running, with a tight freight market, high volume and barely increasing available capacity. Tender volumes are 12%–15% above pre-pandemic levels, and there is virtually no increase in overall truck capacity.

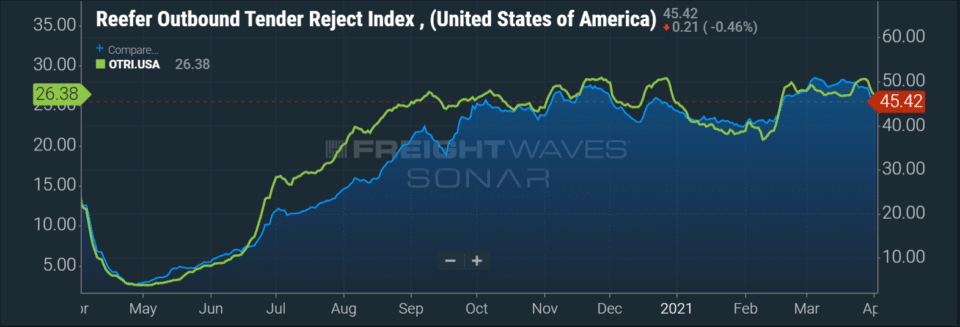

As the volatile transportation market continues, the beginning of produce season could wreak havoc on the reefer segment. Reefer tender rejections continue to hold above 45% — just down from the all-time high in the weeks after the winter storms — and show no signs they will drop.

“Reefer capacity could cause major pain points throughout the market, as produce freight gains momentum through Q2, and we start to see tender rejections make slight increases in produce markets, such as Florida and Texas,” says Justin Maze, Transfix’s senior manager of carrier account management. “It’s extremely important for shippers to solve for reefer capacity now.

“As consumers continue to eat more at home, this also translates into more reefer capacity needs. When you buy groceries on your own, $100 gets you much more than spending $100 at a restaurant. This translates into more groceries being bought by consumers, which translates into more freight taking space on trailers.”

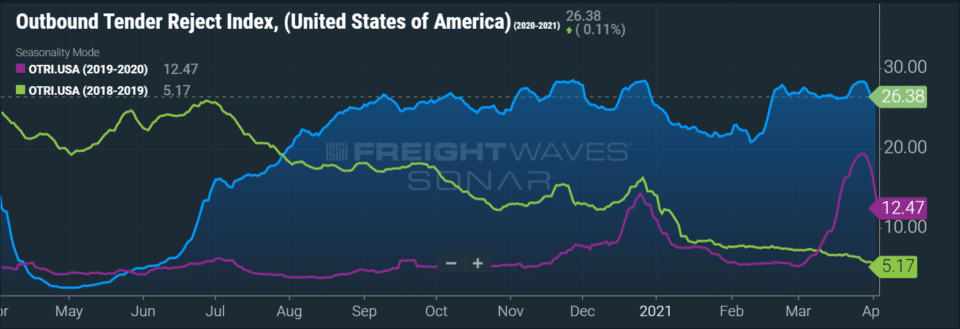

The U.S. aggregate Outbound Tender Reject Index (OTRI) peaked at 28.3% on March 28; it currently sits at 26.4%.

“It seems that the surge in tender rejections was mostly volume-driven as shippers sought out last-minute shipments,” Seth Holm writes for FreightWaves. “The retreat this week is unsurprising, but what happens over the next few weeks will be telling for the summer season. Produce season is just beginning, and reefer capacity has rarely been tighter.

“Higher freight demand is likely in the coming months, and there are no immediate signs of capacity relief visible. The port congestion has prompted retailers to seek alternative routes, which will benefit East Coast ports, but with carriers optimized for L.A./Long Beach, it may create lasting volatility.”

Dry van volumes and rates have shown some relief as we start the quarter, Maze reports, but these rates will most likely have slight rises throughout April in most major markets — especially those that sit in produce areas.

“We continue to see explosive growth in imports on both coasts, which could bring further displacement of capacity in the near future,” he says. “Shippers are leaning on over-the-road transportation, which can offer quicker service than rail. They need to ensure they can stock their shelves, as inventory levels continue to be at extreme lows. Using more truck capacity for longer hauls, as we saw in the second half of 2020, crunches capacity even more, as individual trucks are tied up with their loads for more time.”

Manufacturing Up Again in March, Pushes Transport Capacity

With manufacturing ending Q1 on an upswing, retailers and shippers are looking for more transportation capacity, which is very hard to find. The Institute for Supply Management Manufacturing Purchasing Managers’ Index (PMI) reached 64.7% in March, up 3.9 points from February. Additionally, IHS Markit’s U.S. Manufacturing PMI for March reached its second highest point in the survey’s 14-year history, a reading of 59.1. A reading of 50 or higher indicates growth on both indices.

According to Chris Williamson, chief business economist at IHS Markit: “March saw manufacturers struggle to cope with surging inflows of new orders. Although output continued to rise at a solid pace, capacity is being severely strained by the combination of soaring demand and supply chain disruptions: Supply chain delays and backlogs of uncompleted orders are growing at rates unprecedented in the survey’s 14-year history, meaning inventories of finished goods are falling at a steep rate.” Despite production reportedly being constrained by supply shortages, the report showed the steepest rise in new orders since June 2014.

“As they increase their output, U.S. manufacturers will compete for the same trailer and container space now claimed by consumer retail shippers, both LTL and truckload,” William Cassidy writes for JOC.com. “Those shippers are rushing merchandise from Asia to the U.S. to prevent stock outages amid low inventories.

“Rising industrial demand also generates more demand for U.S. imports headed to manufacturers rather than consumers. Port congestion, especially in Southern California, has delayed those shipments, and those delays stoke demand for even more shipments down the road.”

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.