Tight Markets, Rising Rates as Produce Season Arrives

As we enter the second full week in April, we are starting to see some market movements comparable to past years, while others are trending off the usual path. Capacity issues in produce markets in the Southeast and South are driving up rates, and states such as Florida and Georgia are only getting tighter.

“Currently, Southeast tender rejections for dry van remain the highest in the country, holding steadily at more than 30%,” says Justin Maze, Transfix’s senior manager of carrier account management. “Produce season traditionally starts to cause rising rates in these markets beginning in early to mid-April.”

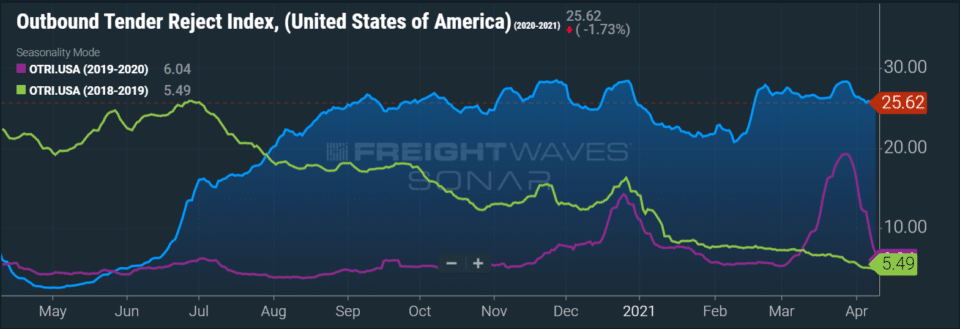

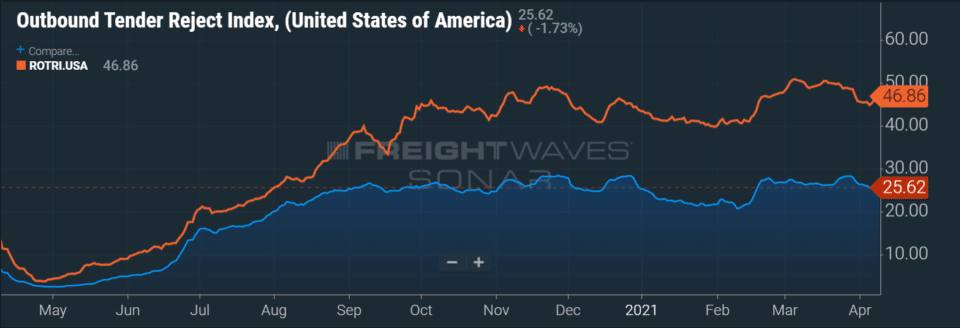

The U.S. aggregate Outbound Tender Reject Index (OTRI) peaked at 28.3% on March 28, and it currently sits at a still-elevated 25.6%. As we reported last week, reefer rejections are sky-high. The Reefer Outbound Tender Reject Index (ROTRI) is at nearly 47%, which means nearly half of all electronically tendered contract reefer loads are being rejected.

Rates in major freight markets on the West Coast are rising, as well, with more capacity issues. Ports all over the country continue to get clobbered with imports (see below), and we are seeing this turn into over-the-road volume, as many retailers struggle with extremely low inventory levels. We continue to watch for any possible Suez Canal impacts to the East Coast markets, especially New York, New Jersey and Savannah.

Paul Bingham, director of transportation consulting at IHS Markit Economics, told Transport Topics that the Suez situation will have a long effect on truckers: “The repercussions for the truckers are going to last longer. They’re already scheduled out — say, a month — to have that vessel come back to Asia, load again, come back to the U.S. again. Well, that vessel is going to stay late. It’s not going to be able to fully catch up to that quickly. And it may be a period of maybe a few months.”

“In the coming weeks, we will continue to see the Southeast and South markets deal with major capacity constraints that will keep driving up rates,” Maze says. “On the flip side, the Midwest and Northeast markets have started to show signs of stabilizing, with rates holding steady and some even declining going into hot markets. Nationwide, we continue to see increases in load-to-truck ratios, which translates into capacity issues and rising rates.”

Are You Ready for Blitz Week?

We are watching closely: With such a tight market throughout the country, and tender rejection almost normalizing at more than 20%, even a small impact on supply or demand can have an exacerbated effect. One such impact is DOT Blitz Week, which was canceled last year, and is now scheduled for May 4–6. This 3-day safety blitz usually causes a pretty significant market disruption.

“With a market already at its breaking point, we could see this event have a much larger impact during that time period and for some time going forward,” Maze says. “Remember the February storms that disrupted the entire country’s trucking capacity? We continue to see higher rates from that event. Shippers need to plan ahead for DOT Blitz Week, as many drivers shut down their trucks for this event.”

Retail Imports Expected to Hit All-Time High This Week, Soar Through Summer

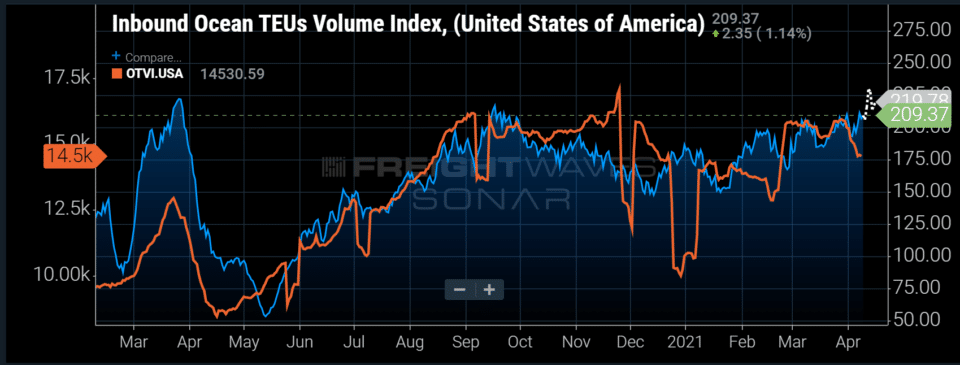

The Inbound Ocean TEU Volume Index (IOTI), which measures maritime bookings for twenty-foot equivalent units (TEU) for U.S. imports, is expected to hit an all-time high this week.

“With imports being tied more closely than ever to surface freight volumes and transportation demand, this could be a signal of an extremely active summer for domestic surface transportation providers,” Zach Strickland writes for FreightWaves. “Whereas the connection between truckload and import volumes has not always been this close, the urgency of the past year has closed the gap between the time the freight is on the ship to the time it moves on a truck.”

Last summer started the surge of imports to retail container ports. According to the National Retail Federation and Hackett Associates’ monthly Global Port Tracker report, that surge is now expected to continue at least through the end of summer 2021.

“We’ve never seen imports at this high a level for such an extended period of time,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “Records have been broken multiple times, and near-record numbers are happening almost every month. Between federal stimulus checks and money saved by staying home for the better part of a year, consumers have money in their pockets, and they’re spending it with retailers as fast as retailers can stock their shelves.”

Under the current forecast, volume is expected to remain at or above 2 million TEU for 11 out of 13 months by this August. Before 2020, monthly imports had reached 2 million TEU only once, in October 2018.

Ports do seem to be catching up with the surge, however. We’ve reported in recent months about upwards of 30 cargo ships waiting to enter the ports of Los Angeles and Long Beach; only 17 ships were waiting in recent days.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.