A Traditional Memorial Day Leading to a Tight-Tight-Tight Summer Season

Memorial Day weekend has shown traditional tight capacity, with many drivers coming off the road for the holiday and those who are still working charging more for their services. National average rates are continuing to rise, volume is showing no signs of slowing, and 1 out of 4 tenders is being rejected — all as we enter some of the industry’s peak months.

“Long weekends always cause issues with truck capacity,” says Justin Maze, Transfix’s senior manager of carrier account management. “We are facing this throughout the country, so expect rates and tender rejections to rise even higher due to the lagging effect of the holiday weekend. Since we’ve been battling a capacity shortage for almost a year now, increases will be exacerbated this year.”

As we noted last week, markets in the South and West are still very tight. Georgia continues to draw attention with skyrocketing rates and volumes, causing rates and rejections to rise in nearby markets, including Florida.

The West Coast is preparing for its highest import levels yet this year. “Peak shipping season is coming soon — and the ‘parking lot’ of container ships stuck at anchor off the coast of California is still there, with Oakland surpassing Los Angeles/Long Beach as the epicenter of congestion,” Greg Miller writes for FreightWaves. And all these imports ultimately will lead to truckload volume, spurring the West Coast market to move upward even faster. Shippers looking for pockets of loose capacity will need to turn to Midwest and Northeast markets.

“One big callout here is the fact that rail volumes remain below average,” Maze says. “This points to the urgency for this freight to get to its destinations and the willingness of shippers to pay record-high rates to move their goods.”

Shippers Conditions Index Marks Lowest Reading on Record

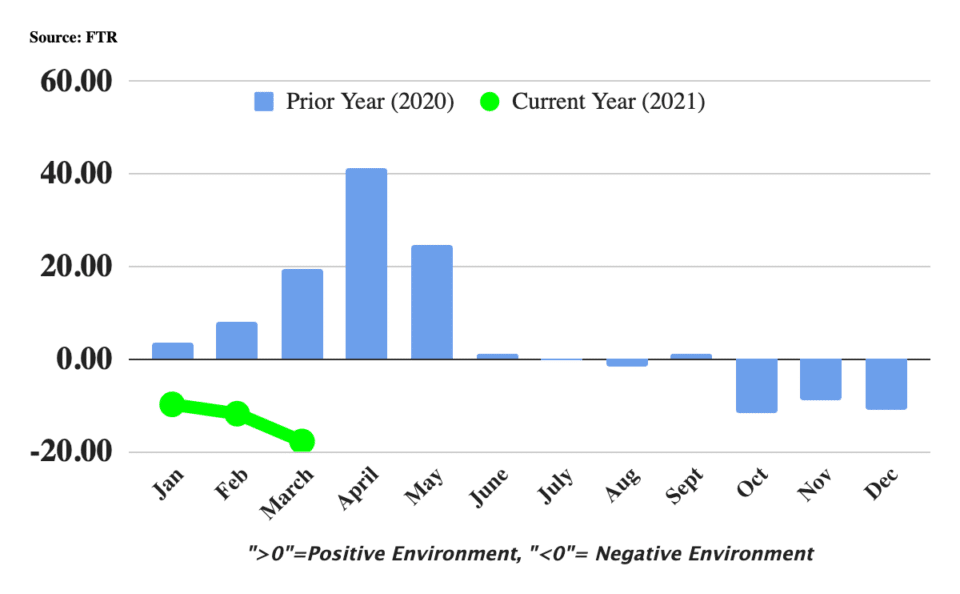

FTR’s Shippers Conditions Index (SCI) for March (the most recent month for which data is available) fell to -17.8, its lowest reading on record. The March reading was more than five points lower than February. This SCI, which represents four major conditions in the U.S. full-load freight market, tracks the conditions that influence shippers’ freight transportation environment. A reading above zero is favorable for shippers; a reading below zero is unfavorable.

According to FTR, conditions are predicted to improve in the coming months, but the SCI will remain negative into 2022.

“While May and June are expected to be the worst months for shippers, as rate increases in truck and rail hit their peak for the year, it is possible that the tight conditions could persist for longer,” says Todd Tranausky, FTR’s vice president of rail and intermodal. “Capacity is expected to remain a constraining factor for transportation through the end of 2021, as truck and rail each struggle to regain employees lost during the pandemic. Strong consumer and industrial demand means freight volumes will remain strong at the same time, setting up a challenging market for shippers over the next few months.”

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.