Transfix Take Podcast | Ep. 55 – Week of June 15

Spot Market Cools to Early-May Levels

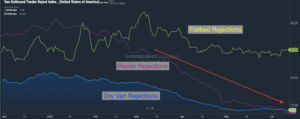

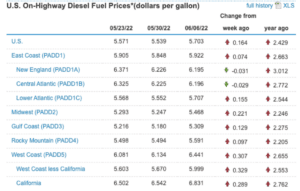

Carriers steering their way through the week struggled to keep momentum from the active spot market spurred by Memorial Day. While national spot rates ticked slightly upward, this was mainly due to new record-high diesel costs – with a national average of $5.70 per gallon. Tender rejections started to slide down again to below 8.5%, similar to rejection rates at the beginning of May.

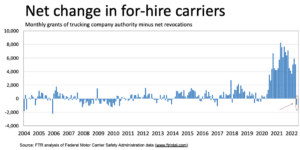

Shippers with temperature-sensitive goods continue to enjoy the available capacity brought by weak refrigerated volumes. Demand for reefer carriers is lower than it has been in the past two years with tender rejections lower than 8%. This all comes on the heels of newly released FMCSA numbers showing a negative net change in for-hire carriers.

Regional & Port Pulse Check

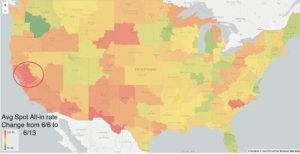

Looking at specific regions, the spot market hasn’t seen notable shifts over the past few weeks. Two exceptions are Southern Florida, where produce season is cooling down, and the West Coast where rates are continuously making slight gains.

Markets with ports of entry, whether ocean or land, continue to be tight, especially along the East Coast, Gulf Coast, and Southern border. The meaning of tight capacity, however, differs from how we expressed it over the past two years. The version of tight capacity in these port-adjacent markets isn’t placing pressure on spot rates. The largest weekly change in spot rates was only a 2.5% increase in the Stockton, CA market.

Source: Transfix & DAT

Contract Freight Here for the Win

Contract acceptance remains steady, with less than 9% getting rejected. This scenario is quite the shift from what shippers experienced nearly two years ago when rejection rates sat above 20%. The volume of accepted contract freight remains high and well-above pre-pandemic levels. Contract compliance and increased contract rates have led to the spot recession that carriers are seeing. Alongside that pain point lives other factors like fewer bottlenecks in the supply chain, which creates greater efficiency. The length of haul decrease we are witnessing means drivers are being utilized for more volume.

Keep a Vigilant Eye on Three Things

Fuel

It is no secret that fuel has been a large factor in transportation costs, and last week we saw diesel prices jump to another record with a 16-cent week-over-week increase. Carriers on the West Coast and in the Northeast are facing the highest diesel costs.

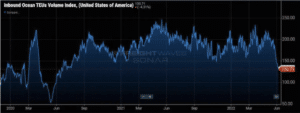

Imports

Import volumes are another frequent debate topic. Some say imports are falling off a cliff and projecting gloom, while others argue that they remain strong and are simply normalizing. Inbound container volumes into the U.S. have dropped over 36% since May 24. Volumes now approach similar levels to pre-pandemic. This is following months of records set at numerous U.S. ports of shippers pulling in more freight to rebuild inventory.

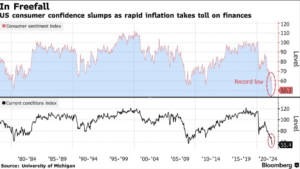

Consumer Spending

Consumer spending drives demand in truckload volumes. Today, however, consumers are navigating high inflation, which will be a leading indicator to future volumes. University of Michigan’s Consumer Sentiment Index continues to drop, hitting the lowest levels recorded. Combine this data point with the personal savings index, which we pointed out last week, as it hit the lowest levels we haven’t seen since the Great Recession.

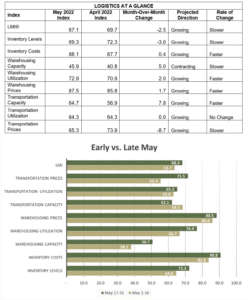

What are Folks on the Front Lines Feeling?

The Logistics Managers’ Index shows exactly what we see in the data. For truck transportation, capacity is easing, and rates are moving more in favor of shippers. Inventory levels continue to grow, but costs grow even faster with inflationary pressures. Warehousing, as I mentioned weeks ago, is something to keep an eye on, and the LMI confirms that it remains a pain point with tightening capacity and surging prices.

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.