Transfix Take Podcast | Ep. 57 – Week of June 30

Triple Threat for Tighter Capacity: July Fourth Weekend, End of Month, & End of Quarter

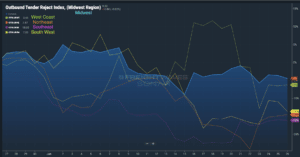

As we travel further into summer, markets continue to cool. However, some opportunities are arising for carriers to put more pressure on spot rates. Not only is July Fourth fast approaching, but so is the end of the month and second quarter. These three factors combined cause tender rejections typically to spike, since some drivers take capacity off the road. Larger carriers in particular are more likely to take time off over the holiday. At the same time, however, shippers will be pushing more volume into the truckload market in an effort to maximize revenue for the month and quarter.

Carriers, take advantage, especially if you’re forgoing the BBQs and working through the weekend. There’s usually opportunity in the spot market around long holiday weekends, so leverage rates in your favor.

Shippers, don’t worry about this ruining any weekend BBQ plans. As seen on the SONAR charts below, tender rejections, volume, and spot rates have all fallen in the past 30 days. The market is clearly continuing to soften, so we do not expect any dramatic shift, just a slight increase in spot volume and rates, similar to what we saw Memorial day weekend.

How Typical is This Year’s July Fourth?

I’d like to call out that tender rejections still are not seeing an impact from the upcoming weekend like we traditionally do by this period. Still, shippers should expect rates to rise on Wednesday and get more expensive as we enter the weekend. Added pressure on longer-haul freight at the end of the week should be expected as drivers aim to get home throughout the week and stay local until the weekend. Long haul freight could keep capacity tight, since facilities may be closed on Monday.

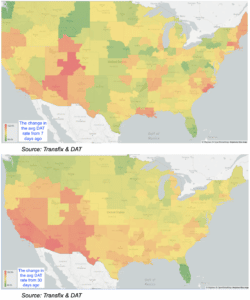

As mentioned earlier, this could be the last opportunity in the near future to put pressure on shippers. In the heat map below, it’s clear that capacity is easing in the East and starting to impose pressure on the West.

Carriers Get Lucky in Two Major Markets

Even as shippers continue to have control over capacity in just about every market and the national average spot rate dropped again last week, carriers still have the potential to put pressure on spot rates in the two largest markets by volume, along with markets lining the Mexico/U.S. border.

Those two markets are Ontario, California, and

Atlanta, Georgia. In fact, the Ontario market continues to tighten slightly week-over-week, and last week it took back the top spot for outbound volume after the Atlanta market held it for most of the past six months.

What’s TighteningCapacity Out West?

I would love to say what’s causing this shift in the market is new, but it’s actually more of the same. Imports are certainly slowing, but issues surrounding rail congestion, such as chassis shortages, are now making over-the-road trucking a more attractive option for some shippers. Where are the chassis?

We have more in the network than last year, but they are not being unloaded and returned promptly. We have seen it in the headlines, and now you are seeing what happens when shippers have more inventory on hand than they would like. They need somewhere to store this inventory, and managing the flow of placement becomes difficult and time-consuming, resulting in freight sitting in containers for a longer period of time.

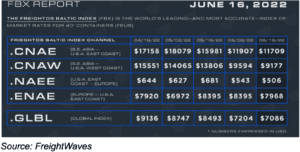

Trucking No Longer Only Sector with Easing Rates

Maritime rates have been on the slide downwards over the past few weeks. The Southeast Asia to the US West Coast route has seen a significant drop in rates of 41% since April 18th. Incoming import volumes are also weakening as ports work through the backlog. The Ports of Savannah and Houston are experiencing congestion at anchorage, but the rest of the US ports have been able to work through the backlog of vessels.

The Ocean Shipping Reform Act of 2022 (OSRA-22): What’s at Stake?

This bill gives maritime regulators greater oversight over container storage fees and the ability to monitor whether ocean carriers are adhering to soon-to-be revised rules on loading exports.

The purpose of the bill is to ease current supply chain challenges by expanding the authority of the Federal Maritime Commision. The hope of the bill is to prioritize U.S. exports and make the maritime sector more efficient. The true impact won’t be known until we understand how the FMCSA plans to enforce it along with what steps they take to make changes. This bill comes after the hectic 18 months in which supply chains faced multiple challenges.

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.