Transfix Take Podcast | Ep. 58 – Week of July 7

All Eyes on California Owner Operators Facing AB5

Assembly Bill 5 (AB5) – a law that will significantly restrict the business autonomy of independent contractors in California – is about to take effect, much to the chagrin of California Trucking Association’s desperate attempts to appeal it.

The news has been populating industry headlines for under a week, so let’s take a step back and understand what’s coming down the road for approximately 70,000 owner operators in California.

What is AB5?

The law, originally intended for gig workers like car services and food delivery, eventually started to impact the trucking industry. To protect independent contractors whose employers were avoiding the extension of benefits, AB5 extends employee classification status to gig workers, which for the trucking sector, includes owner-operators. The law makes it extremely difficult for businesses operating within California to operate with independent operators that are leased on. Once an independent contractor is an employee under this law, it prohibits them from forming contracts with whomever they please. When companies are forced to reclassify their owner-operators as employees, operating costs will spike, and it’s possible that labor – and therefore capacity – will disperse.

While multiple outlets are reporting that ~70,000 independent contractor drivers live and work in California, it’s likely a much smaller portion of owner-operators that are actually leased on. There are a subset of owner operators that have their own motor carrier number (MC) and move freight for brokers who will not be impacted by the AB5 law.

Obviously, countless companies that depend on leased on owner operators may move their operations outside of California, but this process requires proof of residency in another state – a process that requires the kind of time that most owner operators don’t have in the current market.

Maze’s Crystal Ball: AB5 Edition

How much negative impact will this law have on capacity? I believe this will mainly affect two trucking sectors, over-the-road (OTR) and drayage. Drayage carriers will likely turn to unions, while OTR drivers will test various solutions and business models. Solutions some may consider:

- Closing down their business

- Shifting to the employer-employee model

- Create a second separate business as a brokerage

California trucking markets may get tougher to navigate in the coming months as the industry absorbs the impact and creates solutions. We are likely to see tightening markets in the state, on top of the seasonal tightness it’s already experiencing. But, very soon we will understand the true impact for drayage and over-the-road drivers.

The crystal ball for the year’s second half was becoming clear until recent weeks with AB5, stalled labor union agreements and continued bottlenecks on the rail. Nevertheless, we could see the market tighten as we navigate seasonality and the disruption from these bottlenecks. Next week, we dive into the union negotiations along with the impacts of rail congestion.

Spot Rates Remain Stubborn in Tight Markets

Unfortunately for carriers, the threat of a holiday weekend, paired with the end of the month and quarter, did not bring the anticipated fireworks to the spot market. Shippers didn’t have to break a sweat locating capacity heading into the holiday weekend. This holiday weekend could have been one of the last opportunities for carriers to try and take back some pricing power as we head into a slower freight period and a questionable second half of year.

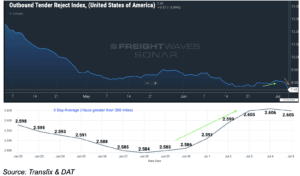

While the spot markets felt some pressure over the holiday weekend, it wasn’t much more than a sparkler. The national outbound tender rejection rate rose slightly over 8%, just enough to push the average spot rate up by more than 1%. However, the pressure was short-lived as tender rejections dropped quickly as we turned into the week.

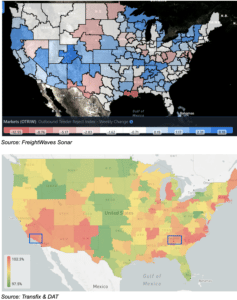

As we settle into the week, most market conditions have not changed from the week before. Atlanta and Ontario, CA continue to be tighter markets with rising rates as shippers face some capacity issues, giving carriers some opportunity in the highest volume truckload markets in the country. Still, even in these tight markets, spot rates hardly budge, regardless of tender rejections increasing.

Below you can see that even markets neighboring Southern California and Atlanta, GA are experiencing increased rejection rates – a domino effect of the larger markets pulling in their capacity. The same tune rings true for spot rates in these surrounding regions, they’re not budging much. The Ontario, CA market has only witnessed a 2% increase in spot rates from 14 days ago, and Atlanta, GA, comes in even lower at just over 1%.

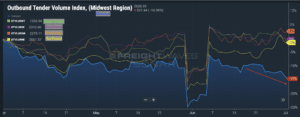

Beach Season Has Arrived, but Shippers’ Paradise is the Midwest

The beaches along both coastlines have reached their busiest season, and the further we get into summer, truck capacity is and will be tighter compared to most other markets. Import volumes also remain strong for the time being. However, moving further inland, the same cannot be said. Midwestern trucking markets continue to loosen. Last week, the Midwest experienced declining volume heading into the end of the month and the quarter. At the same time, all other regions saw volume increase heading into the holiday weekend. The Midwest continues to be a shipper’s paradise, beating both coastlines.

The movement of freight is changing in every mode, as shippers do their best to keep up with record demand while fighting congestion at multiple points throughout the supply chain. Shippers who think forward, use data and think outside the proverbial box on solutions, while partnering with companies such as Transfix, will come out of this ongoing freight rally in a better position and well ahead of competitors. The one huge win through this pandemic has been speeding up the digital transformation of the transportation industry.

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.

Disclaimer: All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.