The Midweek Market Update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | Ep. 68 – Week of September 21

Relief Regarding Rails

This week, most who work across parts of the supply chain can breathe a bit more easily. There is a sense of relief in knowing that no significant disruption will occur due to rail union strikes! Last week, the unions and rail lines came to a tentative agreement. Although no timeline has been provided for final approvals, most view this agreement as a step in the right direction and a relief to shippers of all kinds.

Last September, each week played out like a broken record as we repeatedly reported on spot rates ascending to new record heights.This September, on the other hand, couldn’t be any more different. The truckload market is in the grips of shippers, as spot rates stay stagnant and tender compliance remains at elevated levels. This is cutting off volume that would otherwise be hitting the spot market, which– when viewed through the eyes of a shipper– makes the truckload market stable. Carriers, of course, would view the current market from a different perspective. It has become an unstable market to grow and operate in, given that low rates continue to hamper small to midsize carriers.

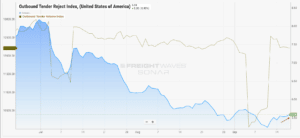

Freight markets observed mixed signals as tender rejections slightly increased through last week, but spot rates remained flat nationally. As carriers celebrated National Truck Driver Appreciation Week, they also continued to benefit from the slow but steady decline in diesel prices that has been underway from August through this third week of September.

Source: FreightWaves, SONAR

Reports By Region

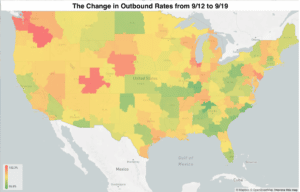

Diving deeper into the state of freight, the Southeastern region continues to loosen as capacity proves to be no issue to shippers. Even as ports along the Southeastern Coast deal with high volumes of imports and ongoing issues (a lack of chassis and overabundance of empty containers), truckload markets have no particular issues and spot rates are still witnessing slim declines. As we mentioned last week, the Pacific Northwest continues to tighten as produce volumes pick up. Shippers in that area should expect this to continue through the next few months, whereas carriers should start attempting to pull the rates in their direction.

The Midwest region has started to see signs of tightening as spot rates have started to pressure in recent weeks– especially around the major markets in the Chicago metro area, an important rail hub. Even as fears of rail union strikes and their potential impacts to the West coast loomed over the industry last week, California did not experience any noticeable impacts. Still, freight heading into the Golden State is experiencing the most volatility (by comparison, at least) as rates continue to increase slightly, regardless of the origin.

Source: Transfix

Is Long Haul Volume on the Comeback?

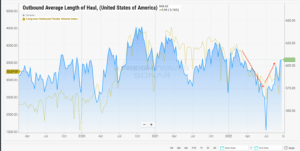

This week, the trend that catches my eye is something we’ve been seeing since the beginning of September: an increase in longer haul volume, which is a factor that pushes “average length of haul” numbers higher. As most already know, a change to the length of haul is one way to disrupt capacity without an increase in overall volume; longer lengths of haul will tie up capacity for a more extended period. Throughout the pandemic, we saw the average length of haul grow as disruptions added urgency. This caused freight to be moved across a greater length of haul and get to the final destination more quickly.

Since March– when the “cliff fall” of spot rates started– we have also witnessed a longer-haul freight decline, as shippers no longer had the urgency to move inventory along to the final destinations. Instead, we’ve seen that freight moved to nearby warehousing markets, which is part of a spike in warehousing demand. So far this month, we have seen the national average length of haul increase, which could pressure capacity in different markets. It’s too early to declare this a market-changing trend, but it’s certainly an area to keep an eye on as we move into Q4.

Source: FreightWaves, SONAR

Coming Next Week

In our next Market Update, we’ll take a closer look at the ports and what is happening as imports slow. Imports continue to show a significant shift to the East Coast, one that has created bottlenecks similar to those we saw last year on the West Coast. Join us next week as we take a closer look at the ways this congestion may impact the truckload sector.

Disclaimer:

All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.