The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | Ep. 73 – Week of November 2

Larger Carriers Feel Impacts of Soft Market

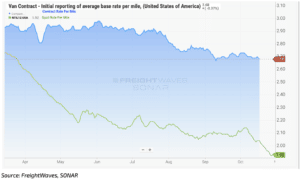

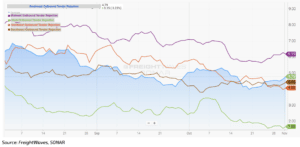

One month into the 2022 peak season, truckload markets continue to soften, as spot rates decline and carriers accept nearly all freight offered to them via contract. To make matters even more challenging, fuel costs increased through October and will likely be elevated for the coming months. Contract freight is also experiencing a drop but remains more lucrative and hasn’t experienced the level of decline that’s occurring in the spot market. The softening market is no longer only impacting small and midsize carriers. Last week, multiple large carriers reported earnings, and the message seemed the same for all. Many trucking executives are expecting tough times in the near future.

Holidays Won’t Pressurize Spot Rates

I believe we are nearing the bottom as spot rates continue to decline. With rising fuel costs hitting smaller carriers hard, it’s likely that many are already operating close to breaking even and potentially taking a loss. Volatility around the holidays puts pressure on spot rates, which could help keep some drivers on the road. However, with a muffled peak season, even the holidays likely won’t pressurize spot rates. With large national fleets relying on spot freight to connect and fill their networks, it’s likely they are able to move spot freight at a loss just to keep their network running properly, which has allowed spot rates to get as low as they are, squeezing smaller carriers out of the industry. They are simply eating everything that’s left.

Carriers: Leave a Market with More Freight Than You Came With

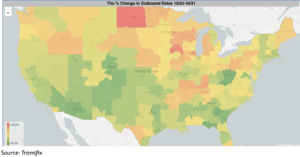

As we start shifting gears into winter, the Midwest and Northeast show signs of seasonality, as rates remain flat or increase in some markets. These increases are minimal, however, compared to the decline the rest of the country is still experiencing. The Midwest region has the highest tender rejection rate, slightly above 6%, while the West is below 2%. California’s import volume continues to lag and trucking spot rates are still falling, regardless of the upcoming holiday season that traditionally fuels the spot market in Southern California through Q4. This could change as threats of rail union strikes are on the horizon again. Regardless, in order to keep the wheels turning, carriers need to plan their connecting loads carefully. It is even more important in light of the current freight environment, for carriers to plan their connecting loads and routes carefully trying to deliver to a market that will have them leaving with a variety of loads.

Rail Strike Update

The industry may have assumed we avoided a strike on the rails, but we have yet to be in the clear. For truck drivers, a strike could put some pressure on truckload spot rates. As of last week two unions have rejected the tentative offer and are back at the table to negotiate. However, as unions are resisting to budge on their terms, a strike is possible in November.

Winter (and Fuel) Forecast

Fuel prices have been a mainstay in the news as they impact all consumers, but truck drivers are especially feeling the pain of diesel’s spiking cost, as fuel is one of the highest operating costs for a carrier. As we close out 2022, we could see new record-high fuel prices as the perfect storm is brewing. As we turn into the colder months, diesel reserves for the months of October are expected to be at the lowest levels since 1951, making supply an issue. The potential railroad strike is another ingredient that would contribute to a tough winter, as more fuel would be forced to move on trucks, therefore increasing cost and the chance of a bottleneck. These issues will continue being top of mind for carriers, as they navigate a very tough market, but all consumers could feel the potential impact.

Disclaimer:

All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.