The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | Two Wild Cards to Look Out For

Peak Season Shows Its Cards: No Crystal Ball Necessary

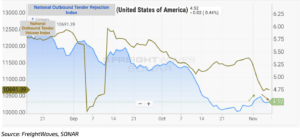

Outside a slight increase in tender rejections, the first week of November brought little to no changes in the truckload market. This minimal increase is likely due to end-of-the-month pressure rolling over into the first days of November. Regardless, the spot market environment did not experience a noticeable shift as rates at a national level remained flat, along with fuel prices.

The approaching holidays will likely prevent spot rates from falling much more and hold them steady through the remainder of 2022. Smaller carriers should plan on seeing rates insignificantly increase as the spot market is unlikely to see much volatility through the holidays if larger carriers continue aggressively going after available spot freight to fill gaps in their networks.

The potential for rail strikes jumped back in our peripheral view last week and could impact freight markets.

Mother nature is pulling one last wild card out of her back pocket. Tropical Storm Nicole will make its way to the East Coast, especially Florida, midweek. Unless Nicole unexpectedly intensifies, we shouldn’t see much of an impact on overall truckload markets.

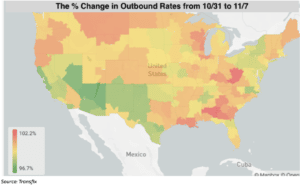

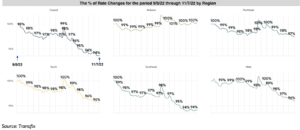

Market Movement: Anticipate Minimal Change

While the Midwest region in general is witnessing a holding pattern in spot rates, some Midwest markets have experienced increases. Primarily markets around the Chicago metro area are experiencing slight tightening. Overall, however, freight originating in the Midwest has seen rates stay flat compared to the average 60 days ago, in which every other region saw rates decline. In the coming weeks, we should anticipate minimal change. I wouldn’t be surprised to see the Northeast tighten slightly and reflect the Midwest, with spot rates remaining flat with some pockets of increases. Still, for the South, Southeast, Coastal, and majority of the West, we will continue to witness a soft market heavily favoring shippers. As we approach the Thanksgiving holiday, keep an eye on the reefer market, as it will likely pick up steam, possibly causing some capacity issues for shippers. For the dry van market, I expect some volatility, due to the shift in facility hours and drivers enjoying the holiday, but nothing that will create significant changes in the overall state of the market. If anything, some carriers may be able to take advantage of higher-than-market rates through the extended holiday weekend.

Contract Market Shows Signs of Decline

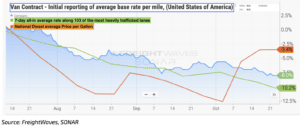

Spot rates throughout the country have been racing to the bottom since March . Still, I believe we are likely close to the bottom, as more carriers are leaving the industry since increased operating costs are not being met with declining rates. Landstar, a juggernaut in the industry, reported a 2.5% decline in owner-operator headcount in Q3, with the expectation for this trend to continue. This is just one of the many recent reference points for a struggling spot market.

While the contract market remains comparatively strong, signs of decline are surfacing. Just as the spot market witnessed significant rate competition, with brokers pricing to win, contract rates will also start to mirror this pattern. The decline has been slow, but I believe we will see momentum through the remainder of 2022, positioning carriers to make difficult decisions in 2023.

Will a Rail Strike Bring on Some Disruption?

As we drive further into Q4, a potential rail strike has again become a concern. As of 11/4, two rail unions have rejected the tentative agreement, and four unions have future dates to vote on accepting or rejecting. A potential strike as early as November 19th could lead to some volatility in the truckload sector.

Carriers, I would not plan on this. I still believe a strike is unlikely as Congress could step in and prevent this from happening. Regardless of what the government does, rail volumes are seeing a muffled peak season. Carriers would welcome more truckload volumes from this disruption. However, the strike’s impact would only be considered significant if the strike period is extended.

Supply Chain Dive tracked the status of the rail talks with each of the twelve unions:

Disclaimer:

All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.