The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | Is Produce Season Having a Slow Start?

Jenni: Hello and welcome to a brand new episode of the Transfix Take podcast, where we are performance driven. It’s the week of March 22, and we are bringing you news, insights, and trends for shippers and carriers from our market expert, Justin Maze. Maze, we’re finally in spring.

Maze: Hey, Jenni! Great to be back with you this week. I cannot be happier that we are now driving through spring.

Jenni: Yeah, seriously. I’m hoping we can put all of that weird weather behind us. But Maze, my question to you is, are we springing forward into good news? What have you got this week?

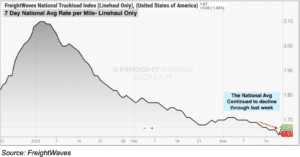

Maze: Well, Jenni, I’m going to sound like a broken record, and I’m going to repeat what I’ve said the last couple of weeks. From a national view, we are continuing to see a slight decline in freight market rates, with tender rejections remaining somewhat stagnant. We are approaching the end of Q1 and the end of March, so we may see some pressure in the next week and a half. However, I don’t really think it’s going to be noticeable based on where we are with capacity.

Jenni: You know what, Maze, that may change. We are going to keep a close eye on this potential storm that is predicted to bring a significant amount of rainfall to California in the middle of this week. The Sierra Nevada area is still dealing with that heavy snow that they received this weekend. That said, this could also impact California’s produce season, which is slated to start around the beginning of April, which is just a couple of weeks away. Maze, what are you thinking on produce season right now?

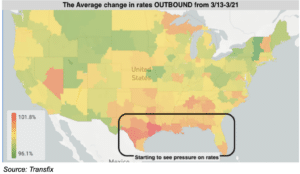

Maze: Well, Jenni, I definitely do think that over the next three to four weeks, we will start to be able to gauge how impactful produce season will be. Many industry experts are already speculating that produce season will be weaker due to the storms out West. But we are already starting to see signs of the produce season kicking in and bringing volatility into the South and Southeastern markets. It’s definitely something we’re going to keep a pulse on and report back during our next episode.

Jenni: Okay, Maze, now we’ve gotten weather out of the way. Another important factor today: rates. Where are we?

Maze: That’s right, Jenni. We are still seeing rates see a slight decline nationally. They started last week at $1.67 per mile. They’re now down to $1.63 as of this past Friday.

Jenni: Where do we stand this week?

Maze: I think we’re going to continue to see that modest decline in specific regions that I keep calling out: the West Coast, Midwest, and Northeast. But we are going to start seeing the rates increase. We saw it last week in different markets throughout the South and Southeast. This does definitely have to play into produce season. Now, nationally, tender rejections are right around that 3.6% mark and have been for about two and a half weeks. When you dive into the numbers a little more, you start seeing why I keep calling out produce season, because tender rejections are actually ticking upward in the South and Southeast, but continue to fall pretty rapidly out West due to the surge caused by the bad weather. We are starting to see the Northeast and Midwest open up, more so the Northeast as tender rejections have come down quite a bit along with rates. I do believe in the coming two to three weeks, the rates out in the Midwest and tender rejections will both decline as we see the opposite effect in the South and Southeast.

Jenni: This is gearing up to be a really interesting and unpredictable produce season. I mean, what’s new in the supply chain? Right? And that could impact the carriers, which is interesting as well.

Maze: That’s exactly right, Jenni. A lot of these carriers, especially smaller and mid-sized carriers, are really hoping for a strong produce season to kick some pressure around. Because ultimately, if we do not see some volatility or pressure hit the spot market from produce season, the next opportunity that carriers will have to put pressure on the spot market is DOT week, and that’s not until mid-May.

Jenni: That’s right. This year it is Tuesday, May 16, until the evening of Thursday, May 18. And what usually happens is carriers stay off the road, tender rejections increase, and the capacity gets tighter, and that could be the market swing that carriers are looking for. But we won’t know until we get there. Maze, you know what it’s time for: the regional breakdown. Why don’t we get started in the Northeast?

Maze: Over the past week, capacity in the Northeast has seen continued loosening in spite of the winter weather. This week, I do believe it’s going to continue down that path. We’re going to see tender rejections continue to decline along with spot rates. When you double click into the Harrisburg, Pennsylvania market, which is one of the largest outbound markets by volume, you see that there’s a sizable deduction in the amount of freight that was moved out of that market last week, which will bring overall softness to the entire Northeast.

Jenni: All right. What’s going on over in the Midwest?

Maze: Very similar. This week’s weather looks clear, and although rates have not declined as much as I would have anticipated during the last two weeks, I do believe this week we’re going to see the decline and spot rates pick up speed, as capacity loosens. Along with this, tender rejections will start seeing a mild decrease as well.

Jenni: So that’ll be an interesting market for carriers, but why don’t we move on over to the Coastal region?

Maze: This region showed a lot of loosening capacity last week. Rates declined faster than we saw in the previous couple of weeks – a trend that will continue this week. Freight out of the Coastal region going down to the Southeast is going to heavily favor shippers.

Jenni: How about the opposite side, the Southeast?

Maze: This is a region that we continue to keep an eye on as produce season usually sparks volatility in the Southeast first.

Jenni: What are we looking at this season, Maze?

Maze: I will call out the Atlanta market, which is one of the largest, if not the largest outbound market by volume. Atlanta saw a slim decrease in overall volume outbound. But again, Atlanta is not where we’re keeping an eye on to watch for volatility – that’s going to be Florida, and markets in the Southern part of Florida are continuing to see a little more tightness, but nothing too alarming yet.

Jenni: I would say we still have until maybe mid-May, because a lot of the crops that come from there – strawberries, oranges, tomatoes, etc. – aren’t really in season, so to speak, until spring or summertime. But what about the South, Maze?

Maze: This is the other region that we really need to keep a close eye on because we are seeing a little more of a volatility along the border due to produce markets, most likely. Now Dallas is also showing the same trend as the Harrisburg, Pennsylvania market with a pretty measurable decline in outbound volume last week.

Jenni: That makes tons of sense. But why don’t we wrap up this breakdown with the West coast?

Maze: The West Coast again is going to be going through some pretty significant weather over the next couple of days, but ultimately I do not think that we need to be too alarmed when it comes to capacity within the West Coast. We continue to see rates drop pretty fast after a couple of weeks of inclement weather. I will note though, that the Los Angeles and Ontario markets, which are some of the larger markets in the country for outbound volume, saw an increase last week. This isn’t a trend with multiple weeks behind it, but it is something to keep an eye on. I do not believe it’s going to continue, to be quite honest, Jenni.

Jenni: This is going to be a really interesting couple of weeks. Maze, do you have any advice for our shippers that are listening to the show?

Maze: Freight going into the South and Southeast right now is where shippers should be looking to drive down rates. These are favorable lanes for carriers because they know if they go down South and Southeast, they’re going to get higher rates leaving.

Jenni: It looks like we’re obviously seeing an overall decline in rates across the board, Maze. I guess my crystal ball question to you is how much lower can we possibly go? I know that we addressed this question a couple of weeks ago, but I really need to know now.

Maze: I do believe again that we are near a bottom in the Southeast and South due to the volatility that produce season usually brings. But the big factor there will be how much volume comes from produce this year.

Jenni: There’s a lot to look out for over the next couple of weeks into Q2. I’m really hoping for some type of volatility and a really strong produce season as we haven’t seen one in a while. That said, we will see you next week with an all new episode of the Transfix Take Podcast.

Until then, drive safely.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. Or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. Nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon as such. All views and opinions are subject to change.