Transfix’s Data Solutions suite is designed for brokers of all sizes, and uses cutting-edge algorithms and advanced analytics to distill massive data sets into actionable insights. Leveraging proprietary AI and machine learning models, Transfix’s data science and predictive analytics platform is poised to transform how brokers operate by increasing win rates, improving operational efficiency, and ultimately increasing profit margins.

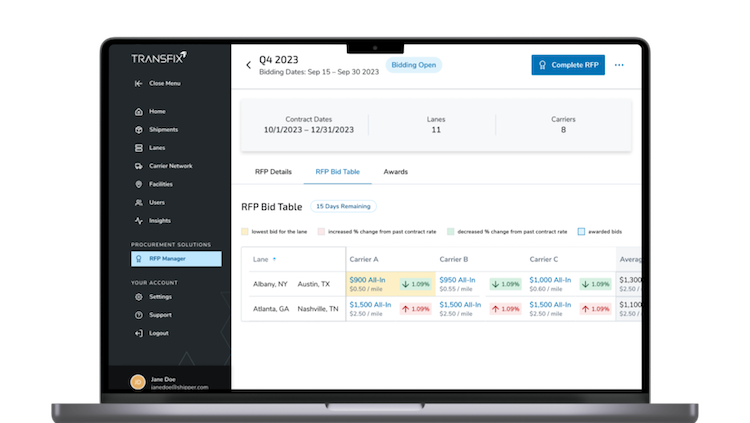

At the heart of the new offering is a comprehensive Custom Cost Modeling tool, which provides in-depth market rate forecasts and insights, enabling brokers to make smarter, data-driven pricing decisions. This proprietary algorithm integrates millions of data points, offering a more precise and realistic view of how market conditions will impact a specific broker. With a seamless data upload—whether it’s RFPs or specific lanes—brokers can instantly begin analyzing and improving their operations using an intuitive, standardized template. Users receive automatic alerts and can easily access reports that track status, view detailed analytics, and retrieve historical data.

Transfix partners with brokers to turn hindsight into foresight to help them optimize freight decisions and gain a competitive edge in the market. Here’s an in-depth look at our Custom Cost Modeling tool:

- Forecasting Intelligence: Utilize Daily Forecasts (45 days ahead) and Advanced Forecasts (1-18 months ahead) to support pricing spot and contract freight, as well as portfolio management and broker load prioritization.

- Historical Cost Predictions: Utilize historical buying performance data to enhance cost forecasting when contracting freight. By analyzing past transactions and market trends, you can identify patterns that lead to more accurate predictions. This approach allows for better budgeting, improved negotiations with carriers, and strategic decision-making, ultimately reducing financial risks and optimizing freight costs.

- Reporting & Analytics: Gain insights on lane desirability, network alignment, revenue projections, and risk factors like seasonality and volatility. Users can also view portfolio distributions, cash flow impacts, and lane performance as well as risk compared to averages.

“The impact on users will be immediate, but what makes this solution truly powerful is that it will continue to evolve, learning from customer-specific strengths and challenges, and identifying new opportunities for added profitability over time,” says Jonathan Salama, Transfix Co-founder and CEO.

Transfix Data Process and Philosophy

By leveraging predictive modeling, our Data Solutions offering tailors insights to industry-specific trends and in-house capabilities, allowing brokers to stay ahead of the curve.