After months of political back and forth, the $1.2 trillion bipartisan Infrastructure Investment and Jobs Act (the “Bill”) is now law. Despite the Bill not being an overnight fix for today’s supply chain issues, one of its intents is to provide for short- and long-term projects that will positively impact the domestic and international flow of goods.

Investing in infrastructure is critical to fixing many of the issues we’re seeing today and we are hopeful that the new bill lays the foundation for building a stronger, more resilient supply chain. Of course, it remains to be seen how the Bill’s funds will be allocated or in the end used, but we are optimistic that it will, among other things, ultimately have a positive impact on the infrastructure necessary for ground transportation.

According to the ATA, freight bottlenecks and their corresponding traffic congestion cost the U.S. 1.2 billion hours of lost productivity annually. For context, that’s on par with 425,533 commercial truck drivers remaining idle for an entire year. All these wasted hours and fuel add up, totaling to $74.1 billion in extra operational costs every year. They also produce an additional 67 million metric tons of CO2 emissions from trucks.

Still, these changes can make a significant difference as we look to the future. That’s why we’re examining their impact and sharing our outlook of what you can expect during and beyond this unprecedented shipping season.

The Infrastructure Bill’s Major Ground Transportation Spending Initiatives

The Bill includes funding initiatives aimed at improving roads, bridges, tunnels that over time should positively impact freight transportation, including $37 billion for bridges alone. Like any transportation bill, ultimately a safe and well-constructed national road system can be expected to positively impact travel time for the motor carriers and other commercial users of the system.

The American Trucking Associations (ATA) rightly points out that the investment is comparatively substantial. Slightly more than one-third of the $1.2 trillion is allocated for surface transportation programs over the next five years. Roughly $347 billion of that portion is devoted to highways, marking a 38% increase from the baseline levels in 2015’s FAST Act, the previous highway reauthorization bill.

The economic toll of overdue bridge and road repairs exact on trucking is staggering. One yard of cracked steel required closing an I-40 bridge between May 11 to July 31, 2021, costing the U.S. trucking industry approximately $200 million in delays and re-routing by some estimates.

Yet, unfortunately, none of the Bill’s programs will provide timely relief to port congestion.

The Current State of the LA and Long Beach Port Affairs

The chassis shortage underlying much of the port congestion persists without a clear and quick total solution, though many port warehouses and freight forwarders are offering transfer services which is a positive move. In another potentially helpful move, the City of Long Beach is temporarily allowing container yards to stack more ocean containers on their lots. Port rail services continue to have capacity issues, while the port’s container pick-up and delivery appointment systems continue to be somewhat unreliable causing delays for freight transported by truck.

Even when goods begin to move, a question remains where will they go. Much of Southern California’s commercial warehousing space is presently taxed, be it public or private, and off-pier container yards are similarly crowded. While the aforementioned switch-over programs can have an impact, logisticians agree that more creative solutions are needed.

The government moved for the implementation of programs to impose excess dwell fees on containers left nine or more days that move by truck and six days or more for those scheduled for transport via rail. While aimed at the pier operators, they have simply been funneled through the ocean carriers to unsuspecting shippers. All the while not having the ability to affect any systemic improvements.

Even when goods begin to move, a question remains where will they go. Much of Southern California’s commercial warehousing space is presently taxed, be it public or private, and off-pier container yards are similarly crowded. While the aforementioned switch-over programs can have an impact, logisticians agree that more creative solutions are needed.

The Near-Term Reality, and the Rising Rates Shippers Face

A trend towards higher long-haul truckload freight rates during the holidays is expected to occur this year outside of the port drayage fleets.

The issue is so much bigger than not having enough drivers. The inefficient use of trucks is contributing to a massive capacity issue, not to mention environmental issues across the domestic truckload transportation ecosystem.

With demand for drivers in this segment of the trucking business expected to increase, 3PLs seeking to utilize largely the same independent drivers are, in essence, in bidding wars, and carriers see high turnover as drivers seek the highest remuneration and, in turn, drivers freight rates up. This once again highlights the need to make long-haul truck driving a more attractive career, and increase the pool of potential drivers.

Dr. David Correll of the MIT Center for Transportation & Logistics FreightLab has challenged how the industry and media overemphasize the driver shortage in the current trucking climate. He has pointed out that, “We see drivers getting around six and a half to seven hours driving a day on average when … a driver could drive 11. I don’t understand how something can be both scarce and underutilized at the same time. If we are so short on drivers, why aren’t drivers getting all the miles they want to carry the loads?”

The answer to Dr. Correll’s question is complicated, with answers ranging from poor training, lack of parking and the many unpaid hours drivers are forced to work on tasks other than driving. Operational changes are long overdue, both to enable long-haul drivers to spend more time on the job driving, and to treat them with the respect they deserve.

From our viewpoint, the issue is so much bigger than not having enough drivers. The inefficient use of trucks is contributing to a massive capacity issue, not to mention environmental issues across the domestic truckload transportation ecosystem. Additionally, there are a plethora of working conditions that we must work to solve for – from wait times to independent carrier compensation. We need to make truck driving a more appealing career.

The Processes and Technology Shippers Can Leverage to Weather Today’s Volatility

There is one advantage shippers can tap into now that doesn’t require ports to clear, governments to act, warehouses to expand hours and capacity, or drivers to join the labor pool: Technology.

So how can shippers stretch their dollars and find reliable capacity in today’s environment?

First, let’s face the facts, it’s a carrier market. You must prove your company is worthy of a carrier’s business, not the other way around. That starts with regularly communicating to brokers and carriers, and being flexible in your terms.

Every detail matters, meaning you must plan ahead if you intend to negotiate a peak season price. And during those negotiations, be creative with your rate structures. The shippers that are easiest to do business with will earn carriers.

Of course, every reputable shipper will exemplify these behaviors. But you can still differentiate your operation. There is one advantage shippers can tap into now that doesn’t require ports to clear, governments to act, warehouses to expand hours and capacity, or drivers to join the labor pool: Technology.

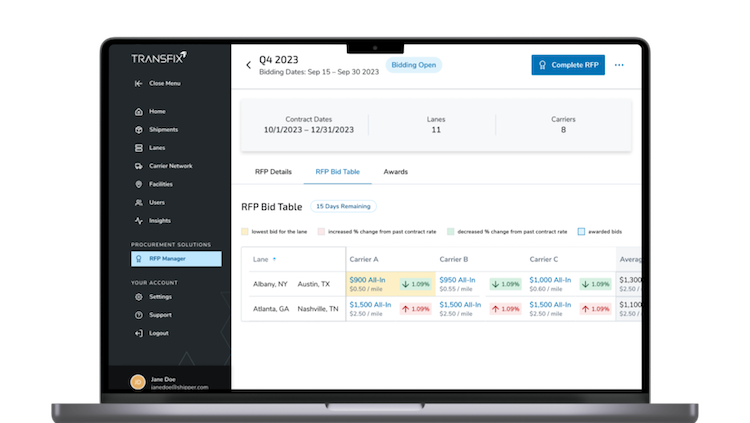

Specifically, AI and automation have reinvented numerous industries, yet transportation and logistics lag woefully behind. This freight tech can empower you to obtain the best spot rates by harnessing reliable past data into sophisticated algorithms that predict quotes with the most accuracy in far less time. It can also match shippers with carriers that serve their preferred lanes, cargo, regions, etc. with far less paperwork and chance for manual error. This process also accommodates mini-bidding and RFPs.

The right tech provides not only real-time tracking but also facility details, showing you problem areas to fix. These actions translate to reduced detentions and dwell times.

But technology itself is merely half the answer. Finding a strategic digital freight partner that knows the technology as well as the carriers is vital.

Achieving meaningful results with facilities data requires context from experts who speak regularly with shippers. For example, in 2020 when shippers across the board struggled to find quotes for cross-country, Transfix’s deep relationships with thousands of carriers matched shippers with the cross-country capacity they needed.

The combination of people and tech is crucial as large and enterprise shippers seek to obtain the trucking capacity they need to handle surging demand. At times, small and mid-sized shippers can’t compete. They can, however, rely on a strategic freight partner that’s built a relationship-based carrier network eager to do business with them.

Part of that trust is technology that works every time. The other portion is something carriers know all too well: Even the best freight tech requires people who understand its limitations. For instance, Q1 2022 is expected to defy typical trends with strong shipping traffic. Brokerages that rely solely on technology will struggle as past data and unsophisticated algorithms will project unrealistic rates and capacity. But experienced digital freight partners understand how to lean on relationships during disruptions.

Transportation experts know how their carriers work in ways technology doesn’t capture. Over the past 18 months, we’ve witnessed carriers make moves in all directions, from intra-state to long haul and expanding to neighboring states. Understanding carriers’ operational shifts help us find opportunities with shippers who once would have been off the table.

Expanding Tech and Partnerships to Prepare for the Inevitable New Normal

One of our long-time CPG clients experienced this firsthand. Over the last two years, our network became one of their top carriers for volume. During early COVID supply chain disruptions, we partnered with the client to create novel solutions, such as pop-up drop fleets to help them gain efficiency at their overwhelmed facilities.

The pandemic will, we sincerely hope, eventually subside. But certain elements of consumer and societal behaviors will not.

Recent U.S. Department of Commerce figures indicates that consumer eCommerce use rose 34.2% year over year. For comparison, 2019 growth stood at 15.8%, and 2018 clocked in at 14.3%. We’re facing long-term changes in purchasing that our existing system for moving goods isn’t built for.

As supply chain executives and governments worldwide pivot to resilience, the framework for lean logistics may not completely return to pre-COVID practices.

Long term, a mass overhaul of all legacy systems is unavoidable. Shippers and carriers alike have a massive opportunity to transform this sector.

To reach this point will take time and a strategic partner that’s there as much for fulfilling your carrier needs as helping plan your long-term transportation is key. The more widespread adoption of technology, such as Transfix’s, will help to increase supply chain efficiency. As more players adopt improvements, we should see a cascading network effect.

Reliable, accurate data will fuel this transformation. What starts with finding rates and capacity evolves into identifying and mitigating inefficiencies across your facilities and operations. These changes reduce costs and keep your best carriers happy.

Once more, it’s not just finding a partner with a large network of carriers. It’s choosing a partner who has deep, meaningful relationships with those carriers. At Transfix, our thousands of carriers aren’t mere entries in a database. Our relationships give us the ability to quickly flex up as demand increases.

One of our long-time CPG clients experienced this firsthand. Over the last two years, our network became one of their top carriers for volume. During early COVID supply chain disruptions, we partnered with the client to create novel solutions, such as pop-up drop fleets to help them gain efficiency at their overwhelmed facilities. And this is just one example of many customizable solutions we can provide depending on the unique needs of the shipper.

Transfix pioneered the use of technology in transportation and logistics eight years ago. Our technology and people have emerged as a clear leader to provide spot support for shippers, along with pricing and capacity for shipments anywhere in the lower 48.

We’re here to partner with you through the chaos of peak season and the upcoming overhaul in how our entire industry will do business.

![[Webinar Recap] The Market Rebalance is Coming: Critical Strategies to Fortify Your Carrier Network](https://transfix.io/hubfs/Transfix_February2023/images/truckcarrier.jpg)