Whether or not transportation leaders are new to the nuances of full truckload freight procurement, the advances in technology and shifts in the market make it so there’s always something to learn about the RFP process, and contracted and spot freight, and the sometimes blurry lines between the two.

Here’s how the traditional RFP process usually works:

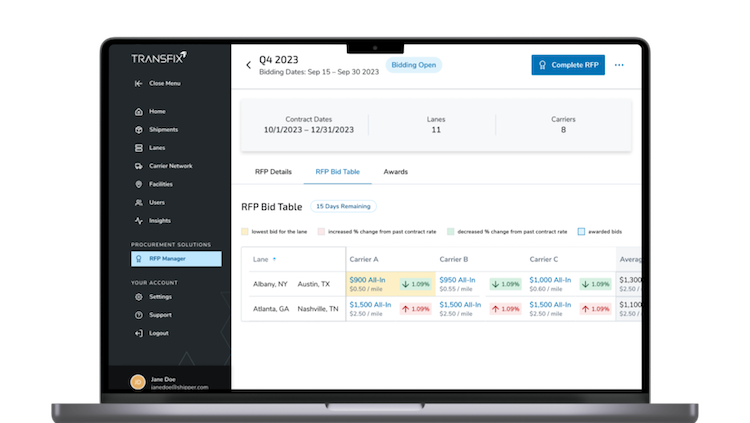

The RFP, or Request for Proposal, also sometimes called a Request for Quote or RFQ, is a historically annual documented bidding process that helps shippers find suitable transportation providers to meet their freight transportation needs. While the primary purpose of the RFP process is to level the playing field for transportation providers who are asked to submit rates and capabilities for a shipper's lanes, the RFP is also a tool for budgeting and ensuring consistent available capacity that meets corporate mandates.

Again, historically, Q4 to Q1 each year, shippers invite choice carriers to bid on their freight lanes, but before those bids can occur, the shipper must outline business goals, distribution needs, pain points, and technology and insurance requirements, among other criteria. The invited brokers, freight forwarders, and carriers then respond to those requests and submit bids. Shippers review the bids and award lanes to the service providers who best align with their priorities. Considering the time rebidding can require via email and spreadsheets or other platforms, the end-to-end process can take up to several months for the shipper to complete.

Due in part to the pandemic-spurred consumer and market shifts, more annual contracts are being shortened to monthly or quarterly mini bids in order to better track the market. The shorter bids may be the singular way freight is awarded to service providers, or they can be used as an adjunct to annual bids.

This article is not meant to be a comprehensive how-to for all shippers, since we realize how wildly different various industries and commodities approach procurement. However, in recent conversations with transportation managers, we observed the need for a guide to answer foundational questions as they approach the RFP season and look closely at their growth strategy. After all, transportation leaders navigating freight pricing often feel at the whim of market volatility, fuel costs, and other complex and shifting variables.

Step 1: Evaluate Your Transportation Needs

Three Reasons Shippers Utilize the Spot Market for Truckload Capacity

Spot freight pricing provides a more real-time, ad hoc pricing option for shippers, as the rates can fluctuate daily according to market. Unlike contract freight, which often is executed via an agreed-upon price that may be above or below current market value, shippers will pay a premium for spot rates during tight markets. Alternatively, during markets in which trucking capacity is more abundant, they will find lower prices than the current contract rates.

Whether working through a freight broker, load board, or asset carrier, shippers can procure a one-time shipping agreement at the time of need to move at the market rate. Shippers tend to leverage spot pricing for three reasons.

- Their transportation needs are minimal, inconsistent, and difficult to forecast.

- They have volume beyond their contract agreements. Let’s say the summer’s temperatures were higher than anticipated, so a water bottle distributor ends up shipping more loads than expected. Those extra loads could be procured from the spot market.

- Their contracted carriers have rejected loads. During markets of high consumer demand and tight trucking capacity – like the pandemic pressurized market that lasted from mid-2020 to mid-2022 – carriers may reject contracted freight for more lucrative rates on the spot market if the shipper will not pay the higher rate. Where this occurs, the shipper then must find new carriers in their base or on the spot market generally at a higher market price than what was secured during the RFP process. The opposite is also true.

The spot market certainly has its benefits, but for those shippers looking to scale with a growing number of lanes across a more complex geographic network, it’s likely time to consider more strategic procurement options.

Want to Nurture Relationships with Carriers? Let’s Talk RFPs.

According to recent data from the ATA, nearly 70% of freight movements are executed through RFPs. While the spot market might offer short-term solutions, investing in relationships with carriers through contracts will increase the likelihood that those same carriers will uphold contract agreements when the market turns in their favor and give some rate/capacity certainty.

Also, stronger carrier relationships means more consistent service levels and potentially higher percentages for on time pick-up and delivery, which many shippers deem more valuable than getting the lowest price.

Savvy shippers use a mix of spot and contract to get the best of both worlds.

Step 2: Set Your Procurement Priorities

Before setting up an RFP, shippers need to understand and identify their priorities and requirements for service providers. Answering these questions will help them in this process:

- What are their commodities’ special needs, e.g. specialized equipment?

- What kind of market seasonality does their commodity experience?

- What is their price versus service criteria?

- How important is predictability in service and/or price?

- Do they have technology requirements for their carriers (EDI/API)?

- What are their insurance and security requirements?

- Do they have any corporate compliance initiatives to consider, e.g. diversity, sustainability, liability?

Step 3: Think Beyond an Annual Pricing Strategy

In this inherently cyclical industry (see the four year history of contract rates below), the market of trucking capacity will inevitably tighten and loosen, and rates will increase and decrease.

Source: FreightWaves

Where and when possible, shippers who have depended heavily on the spot market should consider building longer-term relationships with strategic carriers to assure capacity and service through contracts..

Hot Take: Shippers will have a better chance of creating a strategic carrier relationship if they don't try and lock in 12 month contract rates, but instead work in shorter time frames.

In order for the relationship between shippers and carriers to be mutually beneficial, both shippers and carriers have to think beyond the status quo. Maintaining a rate for an entire year is simply no longer realistic for most businesses and commodities at the whim of shifting consumer demand and other external factors.

In our next Procurement Help Desk installment, we’ll dig deeper on RFP frequency and introduce alternatives to the annual cycle like dynamic pricing and quarterly bids.

Until then, to learn more about the RFP process and how Transfix uses technology and long-term expertise to promote ease, accuracy, and lasting carrier relationships, click here.