6-Month Market Outlook

Nov 2023 Edition

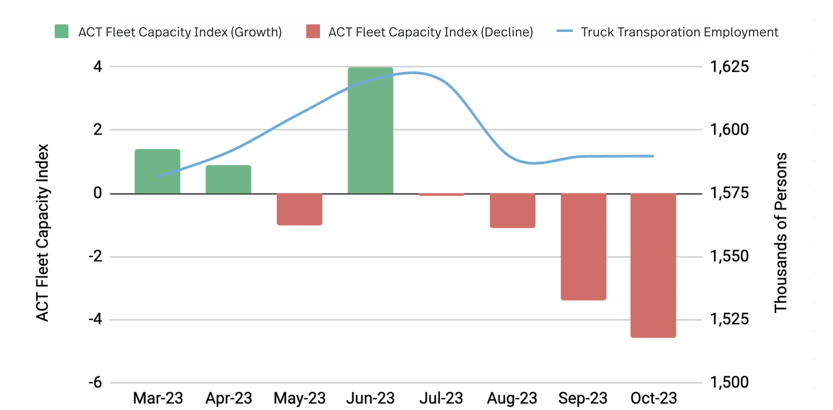

In October, national average trucking rates declined by as much as 3%. While we had expected rates to marginally soften, the size of the correction as well as the extent to which the market weakness spread indiscriminately across all regions, are definitely challenging our previous view that rates had plateaued.

While there was a bounce in trucking rates starting in the third week of November, as forecasted in line with typical year-end seasonality, in light of the recent market move, we have revised the holiday season rate bounce lower and reduced the forecasted impact on short hauls. In short, our already low expectations for the holiday season just got marginally lower. We expect the seasonal bounce in rates to be focused on long haul, reefer, and outbound of the West region. As for the rest of the freight categories, we expect weak seasonality, at best in line with 2019.

Outbound Rates Heat Map (30-Day Change)

Source: Transfix Internal Data

Source: Transfix Internal Data

Note: As of November 15th, 2023

Last month, we pointed to the discrepancy between marginally better Q3 conditions in the trucking industry and the much bleaker expectations for the end of the year from shippers and carriers alike. Some of the negative expectations that surfaced in September and October have already been realized, as the rate drops reflect the loss of confidence in the industry’s future.

The freight environment certainly remains challenging. The Cass Freight Shipment index was down a sobering 4.7% in October alone. Q3 earnings for the Transportation and Logistics sector were weak, with October and November following a similar trend, as retailers prioritize price instead of volumes. Moreover, Goldman Sachs estimates that the number of long haul TL drivers remains 5% above pre-pandemic highs at 554,000 in November, keeping the industry oversupplied and prices subdued.

Yet, as Jefferies notes, the Q3 earnings were very much in line with expectations, the most noteworthy aspect being the lack of negative surprises. Deutsche Bank, while acknowledging that an industry recovery is unlikely before the end of Q1 2024, also doesn't expect meaningful revisions to the EPS, while CIBC’s analysis states that the freight cycle has found a trough and there are encouraging data points, most notably a significant improvement in Volumes across Q3 (up 8% YoY according to Goldman’s November’s data).

In short, the well-advertised trucking recession might have run (most) of its course. While the economy at large might face renewed headwinds, including a recession, it is worth noting that trucking is more than 18 months ahead of the economic cycle due to the brutal post-Covid adjustment. As such, while demand might continue to remain subdued due to economic weakness, the supply side is already rebalancing the industry. The ‘Great Carrier purge’ has already started.

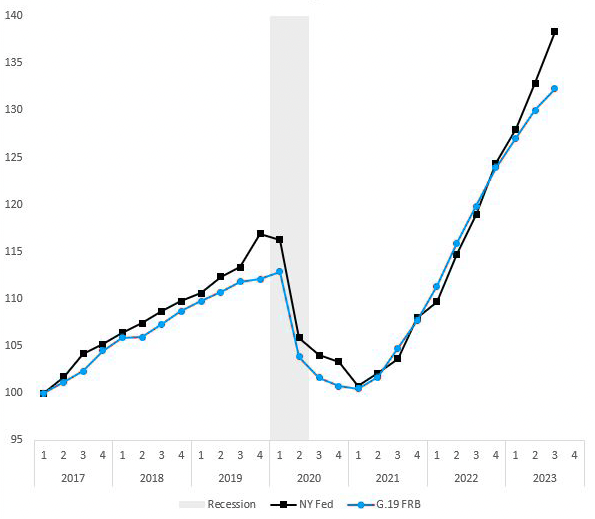

The recent Carrier and Broker public failures, Convoy being the most visible one, are just the tip of the iceberg. Aggressive growth strategies during COVID times, often based on financial leverage, including asset-backed lending, have accelerated the risk of insolvency as margins have been shrinking and costs escalating. We are currently witnessing a reprice of industry risk, starting with factoring companies which have accumulated significant losses from the recent brokerage failures. Unsurprisingly, as access to financing is becoming more difficult, in addition to being more expensive due to the persistence of high interest rates, the most fragile sector of our industry, the small trucking companies, are facing significant headwinds. The bad news is that, our industry being one of the most fragmented and dominated by small players, this sector accounts for the overwhelming majority of trucking capacity. The ongoing Carrier and Broker purge is doomed to accelerate as many small players, facing overwhelming financial pressures, are leaving the industry at the same time. Several indicators are already pointing in this direction: Class 8 trucks net order were down 14% in October and 25% YoY following a similar trend to Employment and Fleet Capacity (shown below). Therefore, we see significant potential for fast supply destruction culminating early in 2024, leading to higher trucking rates, possibly earlier than Q2 2024.

Fleet Capacity vs Truck Transportation Employment

Sources: ACT Research Co., US Bureau of Labor Statistics

Note: The ACT For-Hire Trucking Index is based on a survey of carriers measuring degree and directional changes in operational statistics in diffusion indexes (readings > 0 show growth and readings < 0 degradation).

Forward-looking financial markets are also betting on the industry’s likely rebound within a couple of quarters. Wolfe’s Freight Transport Index bounced back 6.6% in the second week of November and is, as of November 15th, up 13.8% YTD, outperforming the S&P 500 (+13.5%). As FT has lagged against the index, we agree with Baird’s sentiment that, given the depressed valuation levels, the industry is currently offering significant opportunities.

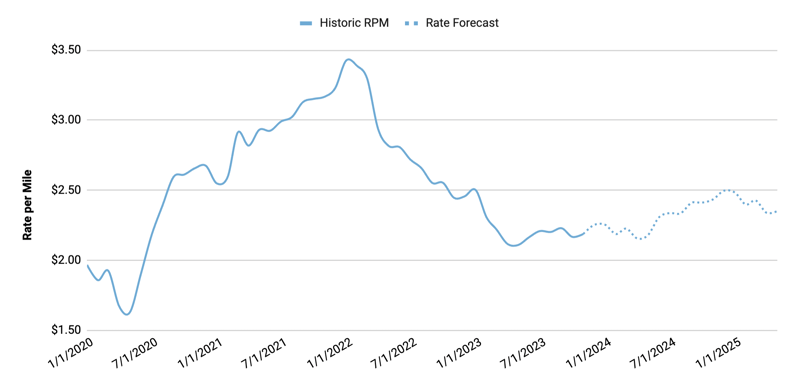

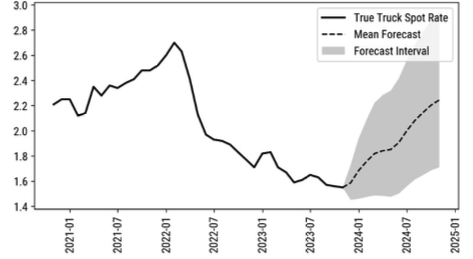

Accounting for these trends, Transfix's base scenario for April 2024 suggests that trucking rates will remain unchanged for an All-in rate of $2.16 ($1.59 per mile for Linehaul alone). The projected range within our confidence interval is $2.06 to $2.38 per mile, to account for the higher likelihood of inflationary pressure for transportation.

Historic Rate Per Mile and 6-Month Rate Forecast (Nov 2023 - Apr 2024)

Sources: DAT, Transfix Internal Data

It is worthwhile mentioning that several competing models are converging in pointing in the same direction. Morgan Stanley’s forecast below expects Linehaul rates to bounce more than 20% in the next 6 months and continue to rally for the rest of the year:

Forecast as of end of October 2023

Source: Morgan Stanley Research

While we do not share the same assumptions, we acknowledge that the market momentum has now shifted, not only making a substantial rate rally likely but also, given the ongoing reduction in supply, possibly steeper than our main scenario.

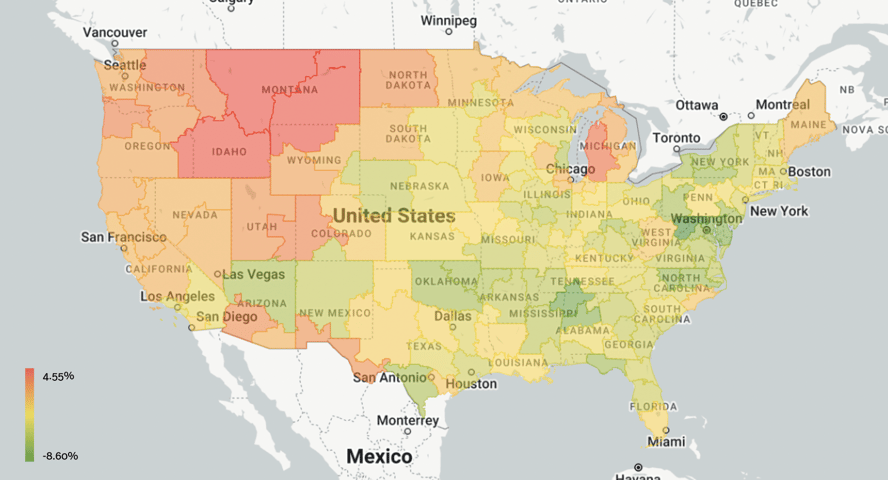

Indeed, our core scenario accounts for some deterioration of the macroeconomic environment, which would likely weigh on trucking demand. Here again, the current conditions are rather positive: inflation somewhat moderated in October, as the Core CPI in November dropped to 4% and the Q3 GDP surprised on the upside (4.9%); the job market remains resilient even though it started showing some moderation and volatility (increasing less than expected in October by 150k after a surprising gain of 297k in September). Markets are now discounting further Fed rate hikes and implicitly price a rate cut in June 2024, which will loosen the financial pressure on the economy. On balance, the odds for a US recession have diminished. Nonetheless, the US consumer, which has been the strongest pillar for growth so far, is also starting to falter, under the weight of both inflation, still double the Fed’s target, and the cost of servicing debt (below) that is growing.

Measures of consumer credit card debt (indexes, 100 = Q1 2017)

Sources: FRED, Jason Miller

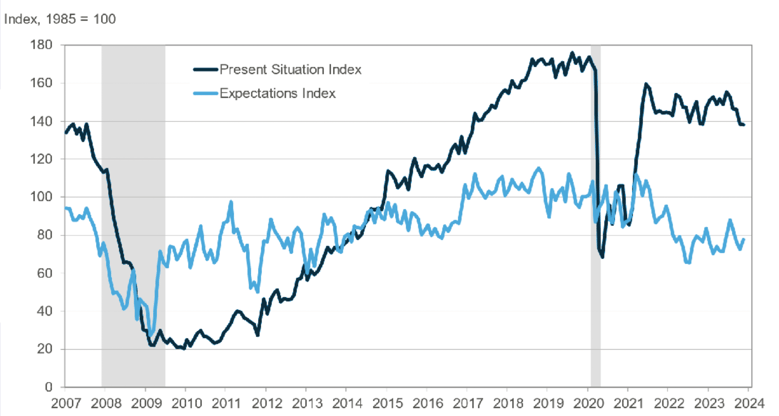

Unsurprisingly, Consumer Confidence in October (below) has continued to plummet, with current conditions now converging towards last month’s low expectations.

Present Situation and Expectations Index

Source: The Conference Board, NBER

NOTE: Shaded areas represent periods of recession

Nonetheless, should the US avoid a recession, and to a bigger extent continue to grow at a healthy rate, the trucking demand that we forecast roughly flat could be a game changer. Combined with the ongoing reduction of trucking supply, it could lead to a rate bounce towards the top of our confidence rate (close to Morgan Stanley’s).

In summary, while the trucking industry continues to surprise on the downside, even accounting for potential deteriorating macroeconomic expectations leading to a reduction in consumer-driven trucking demand, we expect the current supply destruction to rebalance the market within a couple of quarters. As such, we estimate that the main risk is for moderately inflationary trucking rates in 2024.

Outlook Disclaimer

This document contains materials and information, herein referred to as "Content," intended solely for informational purposes. The Content is broad in scope and should not be interpreted as specific advice of any nature. Transfix, Inc. makes no guarantees about the accuracy or completeness of the Content.

Any mention of or reference to a third party, including through external hyperlinks, is not an endorsement of that party by Transfix, Inc., nor should it be construed as such.

Any reproduction or distribution of the Content is strictly prohibited without the explicit written consent of Transfix, Inc.