6-Month Market Outlook

January 2024 Edition

This past holiday season was a stark reminder of the dire state of the trucking industry. While our predictions for an anemic holiday season were among the most bearish in the industry, we were not expecting to witness one of the weakest holiday seasonalities on record. Yet, despite some moderate rate increases in parts of the country, trucking rates simply could not sustain any significant bounce. The excess of supply weighed on rates, leading to an acceleration of the Q4 trend into 2024: both spot and contract markets show trucking rates largely underperforming historical seasonality, with carriers' margins all but evaporating. January’s storms have kept nominal rates from dropping precipitously at the beginning of the year but, despite every US state being on a weather alert mid-January, trucking rates are failing to build upward momentum.

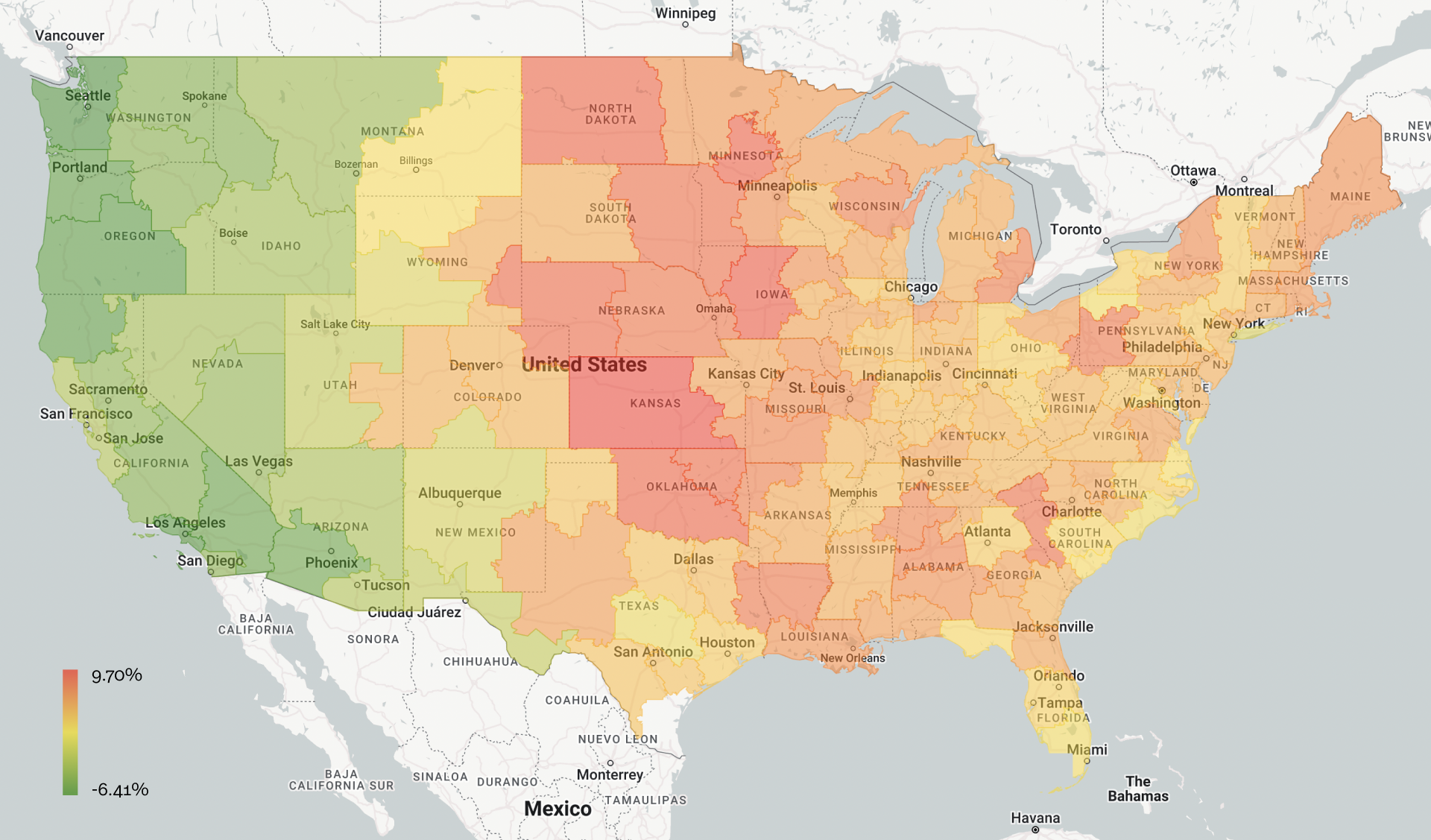

Outbound Rates Heatmap (30-Day Change)

Source: Transfix Internal Data

Note: As of January 15th, 2024

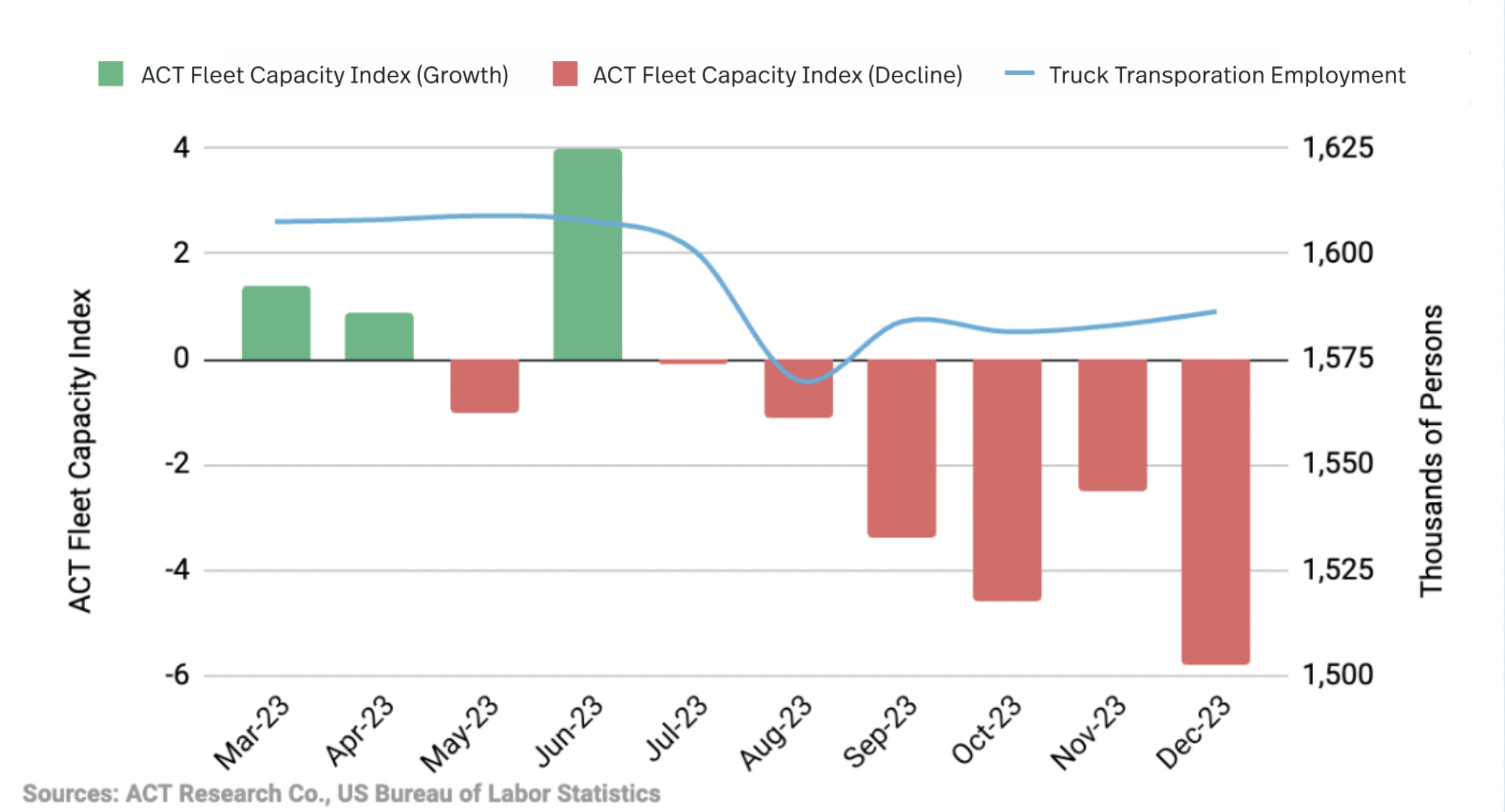

Unsurprisingly, we expect Q1 2024 to be challenging and trucking supply to be the main driver: on one hand, as supply leaving the market accelerates, it will create significant structural challenges, rate and capacity volatility chief among them. Shippers will not only face increased global uncertainty but also great regional dispersion, exposing them to sharp local cost increases despite lower national averages. On the other hand, the faster supply leaves the industry, the faster the industry can bounce from its sharpest recession on record. As such, the weak holiday seasonality might have been the final straw for many smaller Carriers/Brokers, and as the current winter storms only translate into small premiums for both, January is likely to see both trucking Employment and Capacity recede fast. As shown below, this trend has been picking speed since July 2023 and is likely to peak sometime in Q1 2024.

Fleet Capacity vs Truck Transportation Employment

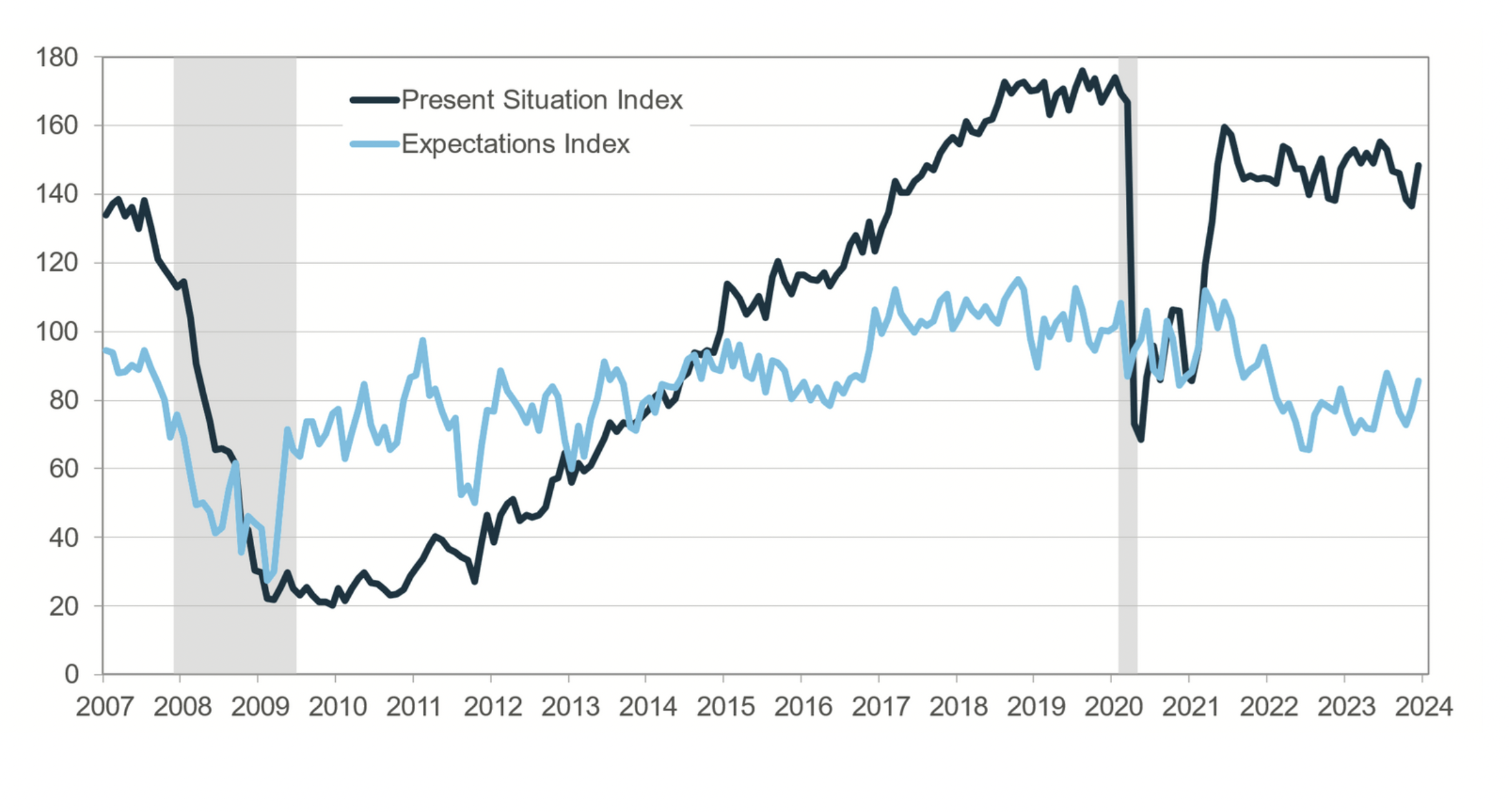

Our call for the Carrier purge acceleration in Q1 2024 is also reinforced by our view that consumer demand is unlikely to pick up significantly at the beginning of 2024. The US Consumer Sentiment data below has certainly shown some improvement for both Present Situation and Expectations in December 2023, but November’s numbers were revised lower and, to quote Dana Peterson, Chief Economist at The Conference Board, as opposed to outright optimistic, the US consumer is merely holding “less pessimistic views of business, labor market, and personal income prospects over the next six months.”

Present Situation and Expectations Index

Sources: The Conference Board, NBER

Sources: The Conference Board, NBER

Note: Shaded areas represent periods of recession

In the absence of a significant pick up in demand, Carriers margins will continue, therefore, to be driven by increasing Operating Costs. To this point, high interest rates, while increasing financing costs for Carriers (trailer financing accounts for over 15% of operating costs), have failed to bring inflation down to the Fed’s targets. December 2023’s CPI increased 0.3% (3.4% annual) while Core prices remained at 3.9%, almost double the Fed’s target. Motor vehicle insurance premiums alone jumped by a record 20.3%, with premiums linearly increasing through 2023 at rates unseen since the 1970s. It is worthwhile pointing out that insurance expenses alone can account for anywhere from 5 to 8% of the operating expense for a Carrier!

While Fuel prices had returned to the bottom of the 2023 range in Q4, Futures prices paint a far less optimistic picture: April’s CME Gasoline Future (RBH4) implies a price increase of 10% over the quarter. Tensions in the Red Sea (where 7 million barrels of crude oil transit daily) are likely to increase the upside pressure. Fuel costs account for close to 25% of operating cost.

All in all, while Carrier costs continue to have upside momentum in an inflationary environment, January's low seasonality will keep rates capped, leading to unbearable pressure on weaker Carriers in Q1 2024.

It remains true that our core assumption (trucking demand is unlikely to pick up before Q2 2024) contrasts with the market consensus, as reflected, for instance, by Morgan Stanley trucking rate predictions. It is, nonetheless, worthwhile pointing out that we were also outliers in January 2023 when we predicted significantly lower rates through the year. We believe our core scenario to be neutral as opposed to pessimistic.

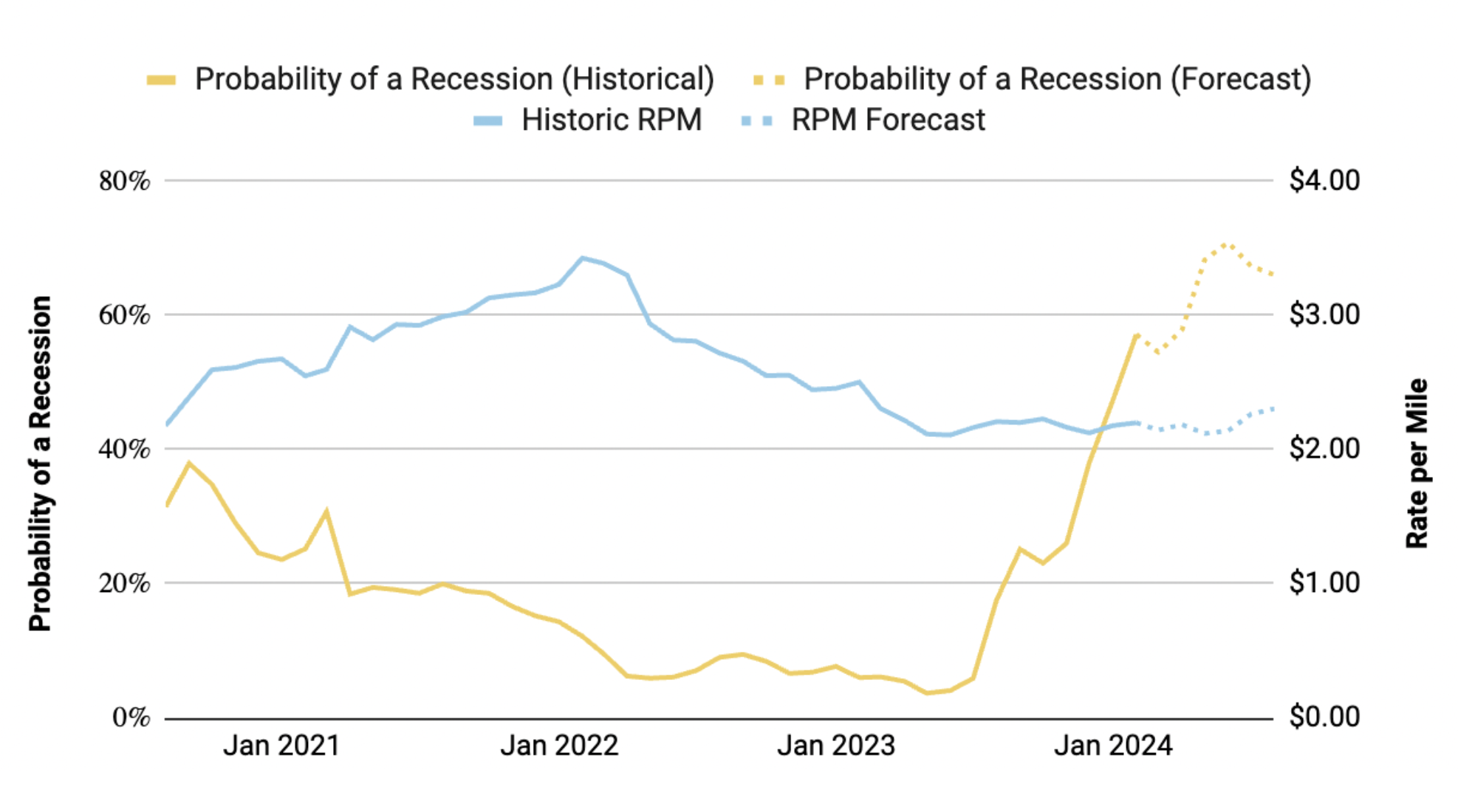

The odds for a US recession have certainly receded in Q4 2023 but remain nonetheless elevated. The New York Fed’s indicator below puts recession odds close to 50%. The initial optimism that led to the drop in recession odds in Q4 2023 was mostly driven by the hope that lower inflation would pave the way for Fed rate cuts, with Goldman Sachs expecting three cuts in quick succession in March, May, and June. Yet, as we have seen, CPI data shows that inflation remains very much an issue.

Probability of a Recession vs RPM

Sources: Federal Reserve, DAT, Transfix Internal Data

Sources: Federal Reserve, DAT, Transfix Internal Data

To sum things up, while we do not discount a minor pick up in trucking demand in Q1 2024, we simply do not believe it will be a primary industry driver. The Carrier purge is and will remain the main driver and, as it accelerates in Q1, will create the foundation for a cycle reversal into Q2 (or H2) 2024.

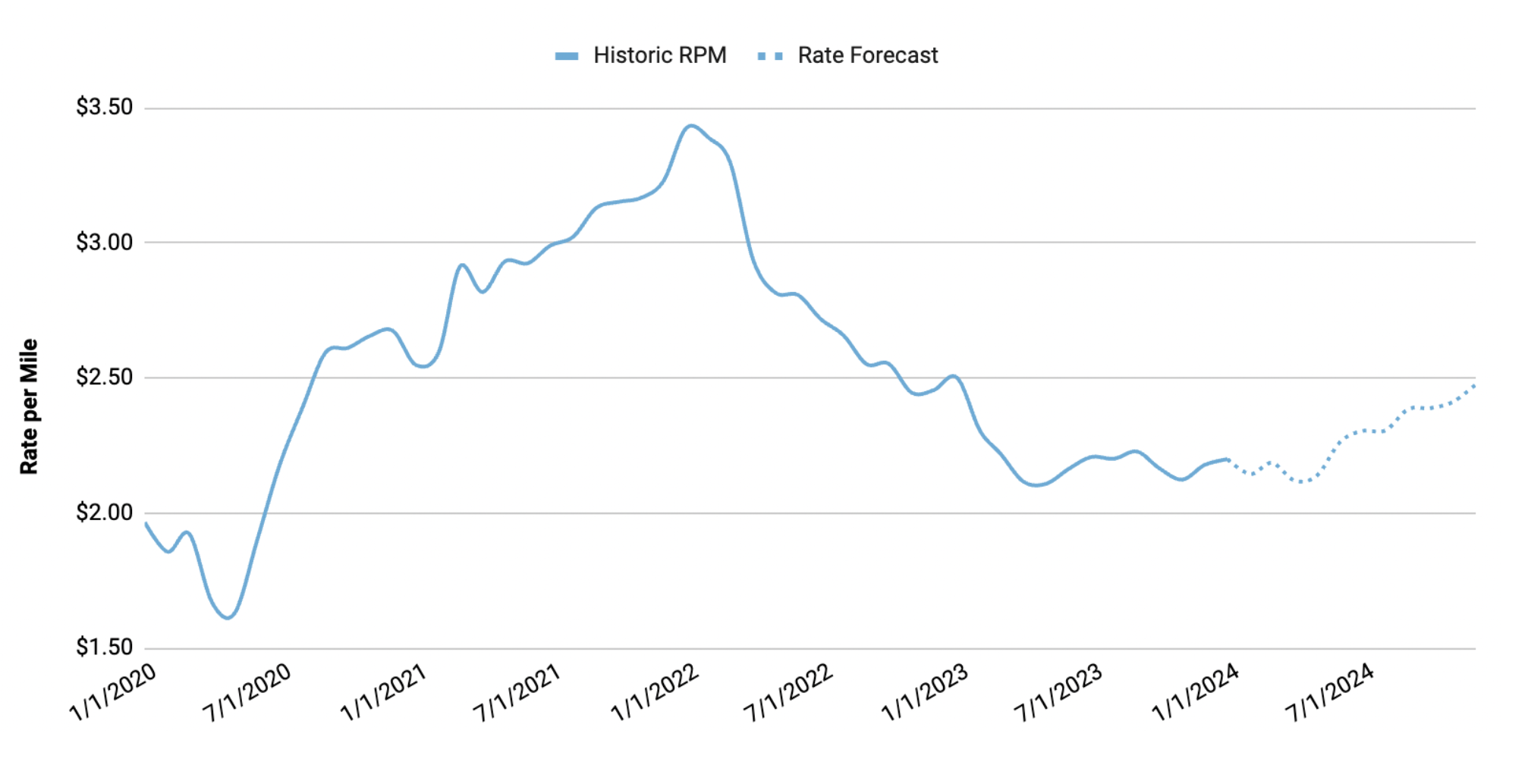

Therefore, while we expect things to get worse before they get better, we are also predicting a sharp trucking rate rally towards the end of Q2 2024, once the Carrier purge will rebalance the market. Equally important, the path ahead will be anything but linear: as the industry will be driven by supply dynamics, the adjustments will create significant disruptions to shippers’ network. Indeed, supply doesn't leave the market uniformly, instead creating pockets of scarcity irrespective of the national aggregate supply levels. As such, low seasonality areas will see supply leave first and, as the seasonal cycle reverses, rates spike exponentially. We strongly encourage Shippers to take advantage of the uncertainty in Q1 2024 to ‘fix’ their rates and create predictability on their networks for the rest of the year.

Accounting for these trends, Transfix's base scenario for June 2024 suggests that trucking rates will marginally increase for an All-in rate of $2.26 ($1.83 per mile for Linehaul alone). The projected range within our confidence interval is $2.10 to $2.48 per mile, to account for the higher likelihood of inflationary pressure for transportation.

Historic Rate Per Mile and Rate Forecast (Jan 2024 - Dec 2024)

Outlook Disclaimer

This document contains materials and information, herein referred to as "Content," intended solely for informational purposes. The Content is broad in scope and should not be interpreted as specific advice of any nature. Transfix, Inc. makes no guarantees about the accuracy or completeness of the Content.

Any mention of or reference to a third party, including through external hyperlinks, is not an endorsement of that party by Transfix, Inc., nor should it be construed as such.

Any reproduction or distribution of the Content is strictly prohibited without the explicit written consent of Transfix, Inc.