Hectic March at High Levels

Freight markets started to drive in reverse through the month of February, but we’re now parked back into a hectic March market. Last week, we saw the domino effect of a massive weather event that broke the fragile supply, as demand continued to strengthen.

“Tender volumes and rejections took a steep drive upward, landing in similar spots as they were in during peak holidays, such as Thanksgiving and Christmas,” says Justin Maze, Transfix’s senior manager of carrier account management. Rates shattered previous records, crossing over a national average of $3.30 a mile, according to Truckstop’s 7-day average.

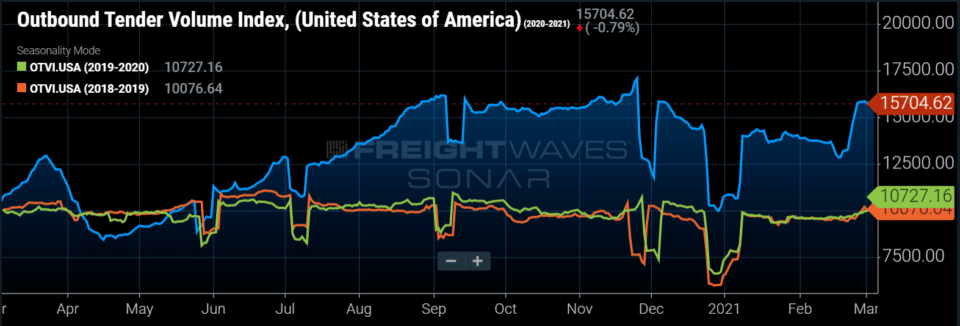

Following the winter-storm disruptions, freight tender volumes moved horizontally this past week. The Outbound Tender Volume Index (OTVI) is up ~16% YoY when adjusting for the high level of rejected tenders, sitting at 15,705.

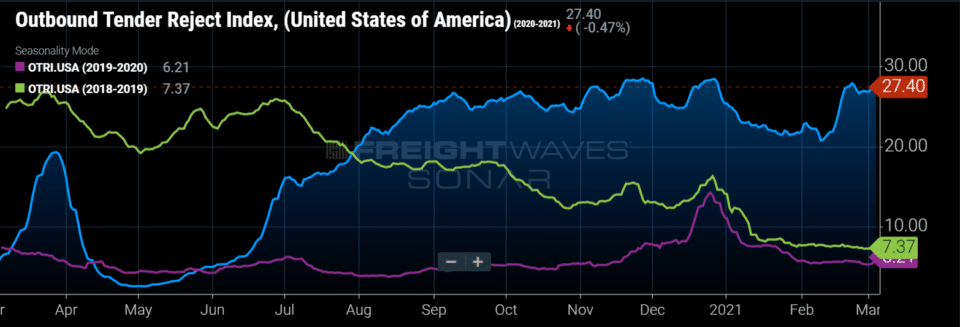

The Outbound Tender Reject Index (OTRI) also moved horizontally this past week, stabilizing at a very high level above 27%. “I believe we are near the natural ceiling for tender rejections, and this is evidenced by surging spot rates,” Seth Holm writes for FreightWaves.

“Trend lines lead me to believe we could see the spot market continuing its strength for months to come, as the displaced and fragile supply tries to keep up with shippers’ needs,” Maze says. “This week, we will continue to see tight markets throughout the country. There will likely be some softening in rates, but they won’t go back to where they were prior to the storms. We could see rates continue to rise through the rest of March.”

Feb. 1–Feb. 15 saw more than a 33% incline in spot requests from shippers throughout the country. The Midwest continues to be the tightest region, with the Rust Belt also showing an extreme capacity crunch. Markets in the Southeast and coastal regions are starting to see capacity constraints, as well, which will only get worse.

“During the next few months, we could experience a market similar to 2018, pushing more freight into the spot market and keeping rates high, at least until capacity comes back online,” Maze says. “Unfortunately for shippers, we are only seeing supply-to-demand continue to decline. Even with record truck orders, there still are not enough drivers entering the industry to drive them. With driving schools and DMVs having been closed for months, many potential drivers have headed to the construction industry, which is also booming.”

What to do When Your Freight Doesn’t “Fit”

Shippers in the U.S. should brace for months of tight truck capacity and higher rates in both the truckload and less-than-truckload (LTL) markets, speakers confirmed during a panel on the 2021 trucking outlook at the JOC’s TPM21 conference.

Panelists said “carriers will award capacity to shippers whose freight ‘fits’ their network — i.e., the right shipments in the right lanes and at the right price and margin,” William B. Cassidy writes for JOC.com. “Companies that fail to understand motor carriers’ need for in-network freight and delay truck drivers will see transportation spend rise as fast as the freight piling up on their docks, speakers said. In other words, importers and exporters struggling to get better control of their landside trucking costs need to forget about promising trucking companies volume and offer freight that fits carrier networks.”

“The truck capacity crunch, which research by Michigan State University shows is deeper than that of 2018, is hitting shippers and importers as they struggle to rebuild inventories drawn down last year,” Cassidy writes.

None of this is good news for shippers. “As we saw in 2020, guaranteeing capacity for freight that falls outside of routing guides is extremely tough and can lead to crushing transportation costs for any size shipper,” Maze says.

Rest assured, though, there is assistance available to help shippers of all sizes navigate the treacherous — and potentially expensive — waters ahead. Transfix provides end-to-end solutions to help alleviate the pricing pain brought by a prolonged tight market.

“We use dynamic solutions when pricing to help shippers through the RFP process,” Maze says. “We use real-time data to reimagine their RFP to provide not only solutions that involve Transfix, but also solutions they should be thinking about when moving freight with anyone. We work with shippers to make their networks more cost-efficient, and we also provide a world-class solution for shippers when they need to move freight on the spot market. Our dynamic pricing solutions and concepts cater to specific shippers’ needs, and when combined with our cutting-edge capabilities, they make Transfix the ideal shipping partner in these turbulent times.”

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. We are here to help you navigate the tight market: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.