Thankful for Truck Drivers and a Break on Fuel for the Holidays

Welcome to the week of November 22nd edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

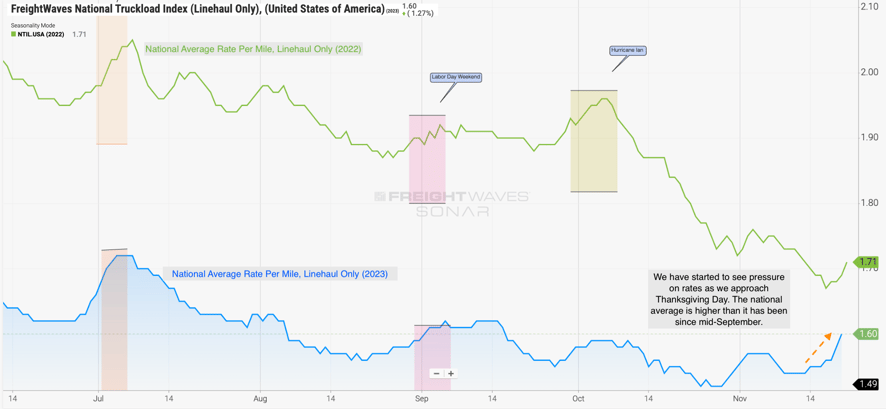

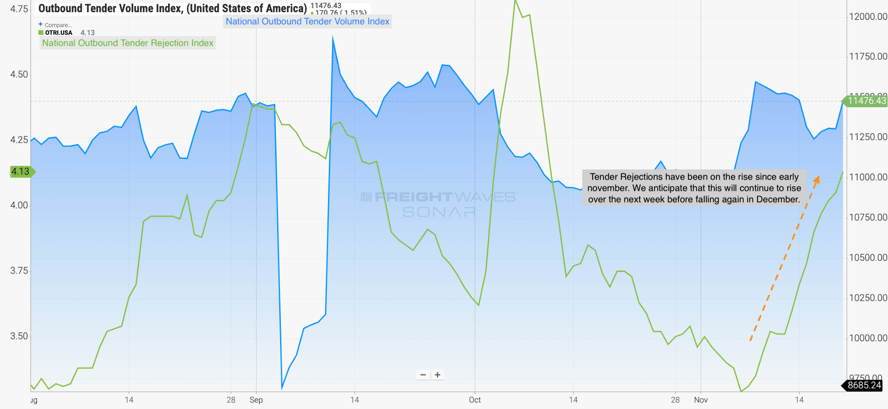

Navigating Hangover Freight and Volatility: Hangover freight, stemming from facilities closed on Thanksgiving and Friday, is pushing volume to the following Monday. Anticipate a spike in rates early next week due to this backlog. Meanwhile, Maze predicts an overall increase in rates as we approach the end of the month, a time when hangover freight coincides with heightened demand. Currently, the National Average Rate Per Mile sits at $1.60, a slight increase from last week. Reefer freight markets are tightening, with a national outbound tender rejection rate surpassing 10%.

Source: Freightwaves

Source: Freightwaves

Black Friday Traffic Jams: Navigating the Congestion: Did you know that Black Friday induces 41% more traffic jams than a typical Friday? The surge in Black Friday traffic poses challenges for truck drivers, causing significant delays, especially in major metropolitan areas. As consumers rush to stores for sales, truckers navigating through traffic jams experience 20% longer delays. With Black Friday just a few days away, drivers must prepare for heightened congestion and shippers should prepare for potential delays.

Regional Roadmap: Where the Rubber Meets the Road

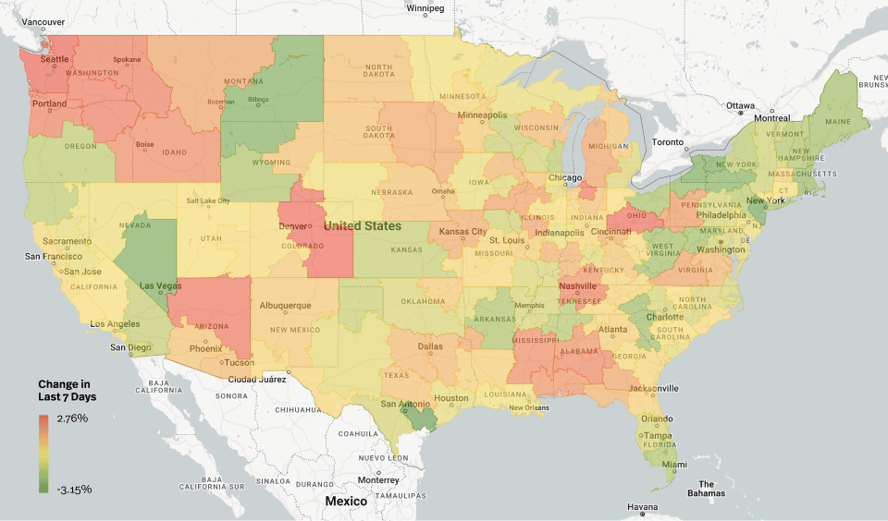

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

Source: Transfix Internal Data

West Coast: A Haven for Carriers: The West Coast remains optimistic for carriers, witnessing a surge in rates. Freight originating from Washington, Montana, and Idaho continues to drive this increase. Although southern California experienced a slight decline, expect a shift as longer hauls pick up during the holiday weekend.

Midwest: A Slight Uptick with Reefer Freight Spotlight: The Midwest saw a slight uptick in average rates, with Wisconsin, the top cranberry supplier, contributing to reefer freight tightening. As hangover freight and the end-of-month demand kick in, anticipate the Midwest to pick up steam.

Fun Fact: Wisconsin is the number one supplier in the US of cranberries. There has been a significant shipment of cranberries out of Wisconsin in preparation for the Thanksgiving holiday.

Northeast: Tightening Trend with Pittsburgh Leading the Way: The Northeast experienced an overall decrease in rates, except for Pittsburgh, where a 1% increase indicates potential tightening spreading from the Midwest. While not as pronounced as other regions, modest tightening is expected in the Northeast.

Coastal Region: Long Hauls Drive Decrease: The Coastal Region witnessed an overall rate decline due to lower rates on longer hauls. However, local freight in the Virginia area saw a 2% increase. Expect a temporary decrease until the pressure on the spot market drives rates up across the country.

Southeast: Florida Stays Loose; Other States Experience Tightening: Mississippi, Tennessee, and Alabama saw tightening as capacity diminished, while Florida remains a loose state. Georgia, especially Atlanta, experienced a slim rate increase, providing a telling sign for the week.

South: Relatively Flat Rates with a Market-Dependent Landscape: The South witnessed relatively flat rates, with minimal week-over-week changes. Texas remains market-dependent, and overall reactions to Thanksgiving are expected to be limited.

On the Horizon: What Lies Ahead in the Trucking Terrain

Fuel Costs and Holiday Optimism: Maze notes an optimistic outlook for the November holiday season, backed by increasing consumer consumption and a potential record number of sales. The cost of diesel in California dropping below $5 for the first time since July is a positive sign for carriers on the West Coast. However, the duration of this trend remains uncertain.

Next Show Preview: December Trends and 2024 Anticipation: In our next episode, we'll review how the markets played out during Thanksgiving week, discuss expectations for the month of December, and explore trends shaping up for 2024. Maze anticipates a market decline before the Christmas and New Year's holidays, providing carriers an opportunity to gauge the industry's direction going into the new year.

Have a Happy Thanksgiving and remember - drive safely!

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.