6-Month Market Outlook

Aug 2023 Edition

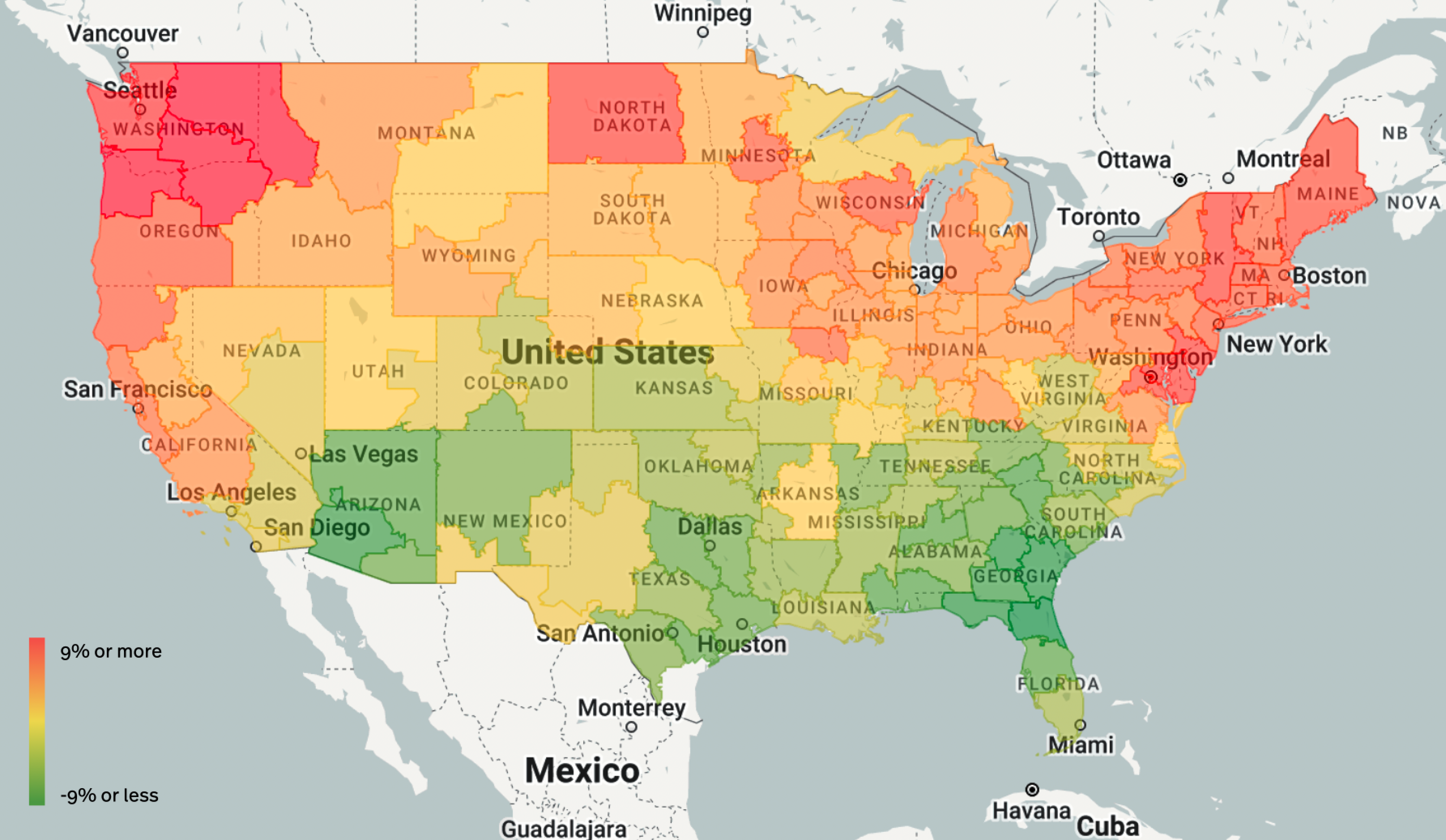

July saw a marginal decline in national trucking rates as the produce season was drawing to an end, reversing the rate bounce in June. The first half of August accelerated the downward trend (heatmap below), with the correction gathering some momentum before the Labor Day weekend, when seasonality supports rates.

Outbound Rates Heatmap (30-Day Change)

Source: Transfix Internal Data

Note: As of Aug 15, 2023

While national average Spot rates in mid-August are flirting with April’s lows, at a more granular level, we continue to see significant market dislocations, with the South and Southeast remaining on a downward trend while the Pacific Northwest rates staying very resilient. The Northeast and Midwest are also starting to tighten, and the seasonal trend is likely to accelerate into the fall.

Going forward, the industry continues to face significant downwinds but we are also seeing a few clear green shoots for the first time in over one year:

Goldman Sachs pointed out that, for the first time since March 2021, freight trucking lost 2,800 drivers in June 2023. This is a relatively small adjustment compared to the increase of 20,200 drivers since June last year, especially considering that load availability has decreased by 20% since June 2022. Yet, as previously stated, a reduction in capacity is, in our view, the best predictor for spot rate normalization. and, as such, should July confirm this trend, we are likely to see trucking rates bounce within a quarter or two.

Bank of America’s bi-weekly Truckload Demand indicator at the end of July also offered some hope for the future: it has increased 10% sequentially (to 55) for the first time in 72 weeks, to the largest level since June 2022! While BoA states that dry van Spot Linehaul average rates dropped from $1.42 per mile in June to $1.27 in July (vs May’s low of $1.25), and the overall index remains well under the all-time average level (60), industry positive outlooks bounced from 27% to 35%. This trend is also confirmed by Morgan Stanley’s TLSS indicator, which outperformed for the first time this year, primarily driven by the 3-month forward rate sentiment. In short, while the industry remains in crisis, to quote Churchill: “Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”

Financial markets are certainly pricing the end of the tunnel, as transportation stocks outperformed the S&P 500 by 3% in July, and 17% over the year, even though this is mostly driven by LTL carriers as opposed to TL carriers.

Our 6-month forecast below has therefore adjusted to account for these encouraging trends. Based on our internal model, Transfix's base scenario for February 2023 suggests that trucking rates will marginally increase by approximately 2.5% from the end of July to the end of Jan 2024, for an All-in of $2.26 per mile. The projected range within our confidence interval is $2.15 to $2.48 per mile ($1.65 to $1.98 per mile for linehaul rates, plus $0.50 per mile for fuel charges). It is important to realize that a significant increase in the All-in rate against last month is due to the spike in fuel prices, adding 7 cents per mile.

.png?width=805&height=460&name=Screen%20Shot%202023-08-14%20at%203.39.35%20PM%20(2).png)

At the same time, the national average is hiding significant dispersion between regions. Below we highlight the difference in our prediction between the Midwest and the South over the next 6 months.

.png?width=805&height=460&name=Screen%20Shot%202023-08-14%20at%203.35.41%20PM%20(2).png)

Beyond sectoral trends, the overall macroeconomic environment has also offered some green shoots. US Inflation remained on a downside trend in July, with the headline at 3.2% and Core inflation falling to 4.7%. Yet, while the Fed is likely to pause hiking rates for now, with inflation well over the 2% target, financial conditions across the economy will remain tight. The job market remains resilient but continues to cool down, while the manufacturing sector continues to contract, albeit at a slower rate in July: US Manufacturing PMI bounced to 46.4, yet remaining in contraction territory for the 9th consecutive month. Reflecting the slight improvement in the short-term global outlook, the likelihood of a US recession, based on the Estrella and Mishkin model for the New York Fed, has now marginally dropped from 67.31% to 66.01%.

.png?width=805&height=460&name=Screen%20Shot%202023-08-14%20at%203.37.17%20PM%20(2).png)

In summary, while we are encouraged by the green shoots, both macroeconomic and industry-specific, it is too early to announce a long-term change in trend for either capacity or trucking rates. As macroeconomic trends remain soft, an acceleration of the trucking industry supply consolidation remains the most likely outcome: while June has shown the first signs of capacity normalization, a lot more has to happen before supply and demand converge. While we see rates benefiting from seasonal trends into the year-end, bar a collapse in trucking capacity, we continue to see little impetus for a strong rate rally before Q1 2024. In the meantime, we anticipate an increase in rate volatility and regional rate dislocations.

Outlook Disclaimer

This document contains materials and information, herein referred to as "Content," intended solely for informational purposes. The Content is broad in scope and should not be interpreted as specific advice of any nature. Transfix, Inc. makes no guarantees about the accuracy or completeness of the Content.

Any mention of or reference to a third party, including through external hyperlinks, is not an endorsement of that party by Transfix, Inc., nor should it be construed as such.

Any reproduction or distribution of the Content is strictly prohibited without the explicit written consent of Transfix, Inc.