6-Month Market Outlook

Oct 2023 Edition

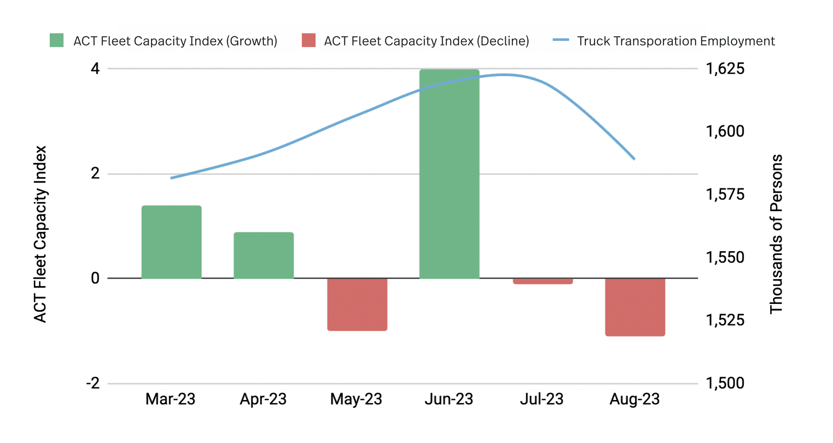

In September, trucking rates remained stagnant or declined across the country, with the exception of the West Coast, and more particularly the Pacific Northwest. Notably, the beginning of October has not seen the traditional spark in rate volatility associated with the start of the holiday peak season: this delay in seasonality suggests the holiday season might be muted by historical standards, keeping trucking rates under pressure as the market remains oversupplied.

Outbound Rates Heat Map (30-Day Change)

Source: Transfix Internal Data

Source: Transfix Internal Data

Note: As of October 15th, 2023

On the surface, little seems to have changed in the trucking industry since mid-September. On one hand, demand might have marginally improved in Q3, as both Scotiabank and UBS point to slightly healthier volumes in Q3 vs Q2. On the other hand, trucking rates have also plateaued in Q3 but not uniformly. While LTL continues to offer a relatively brighter spot for the industry following Yell’s orderly demise, Full Truckload (TL) rates remain stuck in the neutral to negative territory.

Yet, despite relatively stable current conditions, expectations have deteriorated significantly. The pessimism has gathered momentum and is shared by an overwhelming number of industry analysts. Among others, TD Cowen sees low expectations going into Q4 as the TDC Carrier Survey shows that a majority of Carriers do not see a TL rate recovery before Q2 2024. JP Morgan, having downgraded RXO and UW, also sees significant risks to consensus estimates as they table on a ‘lower for longer’ freight rate environment. This view is shared by Citi, which lowered their estimates for Carriers (with the exception of LTL) as capacity is slow to exit the market, keeping the supply and demand unbalanced, and rates under pressure well into 2024.

Additionally, the UAW strike has gathered momentum. As the auto industry moves around $1 trillion worth of products by truck every year and accounts for more than 700k supplier jobs, as the conflict drags on, its impact on the trucking industry will grow exponentially. For the time being the biggest impact has been felt OB Mexico (uptick in reschedules transit time), but we expect to soon see a significant transfer of capacity to Spot markets in the Midwest. As the region has already felt the brunt of the trucking recession for the last 18 months, bankruptcies on the scale of Falcon Transport in 2019 are likely in the cards.

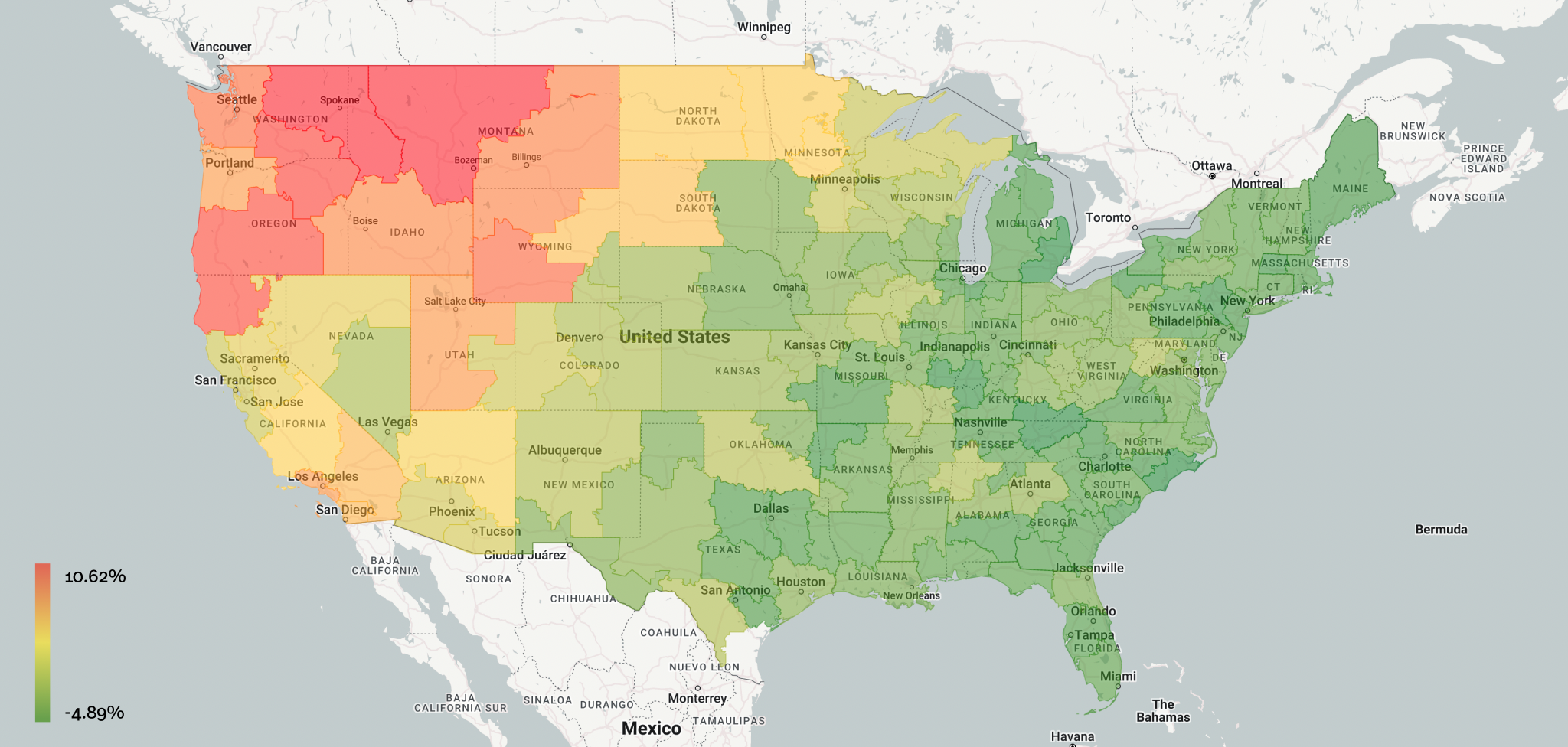

In the meanwhile, the Carrier purge that would rebalance trucking supply and demand and offer a more constructive environment for rates, has barely started. Both Fleet Capacity and Truck Transportation employment (below) have only marginally weakened from record highs. While we continue to expect such a purge in the short term, given the size of the required adjustment, it is unlikely to show an impact before a couple of quarters even in the scenario where it would quickly pick up speed.

Fleet Capacity vs Truck Transportation Employment

Sources: ACT Research Co., US Bureau of Labor Statistics

Note: The ACT For-Hire Trucking Index is based on a survey of carriers measuring degree and directional changes in operational statistics in diffusion indexes (readings > 0 show growth and readings < 0 degradation).

Accounting for these trends, as the industry is likely to remain, at least for the next quarter, in what Morgan Stanley calls a ‘blank space’ between the end of the downcycle and the beginning of the upcycle, based on our internal model, Transfix's base scenario for April 2023 suggests that trucking rates will remain unchanged for an All-in rate of $2.22 ($1.67 per mile for Linehaul alone). The projected range within our confidence interval is $2.11 to $2.38 per mile to account for the potential of higher Fuel prices.

Historic Rate Per Mile and 6-Month Rate Forecast (Oct 2023 - Apr 2024)

-1.png?width=799&height=380&name=Historic%20Rate%20Per%20Mile%20and%206-Month%20Rate%20Forecast%20(Oct%202023%20-%20Apr%202024)-1.png)

Sources: DAT, Transfix Internal Data

Our core scenario also accounts for the deterioration of the macroeconomic environment, which will likely weigh on the trucking industry. The pick up in US inflation (October CPI beat expectations at 4.1%) as Energy prices continue to push higher, combined with the strength of the job market (October Non-farm payrolls soundly beat expectation at 336k vs 170k), means that the Fed is likely to keep rates higher for longer, increasing the odds of an economic recession.

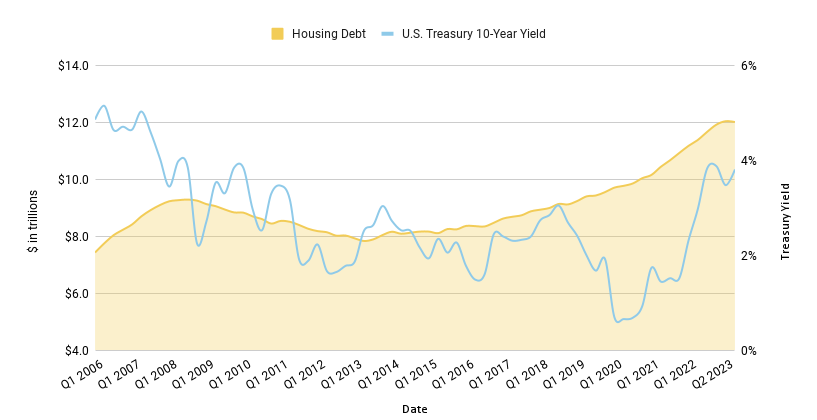

The US consumer, which has been the strongest pillar of growth so far, is also faltering. It has supported the economy at the expense of an exponential increase in debt levels. Consequently, as interest rates have reached new highs, the service of this debt has more than doubled as a percentage of available incomes since 2011 (see below).

US Consumer Debt vs US 10-Year Treasury Yield

Sources: FRED, Federal Reserve Bank of NY

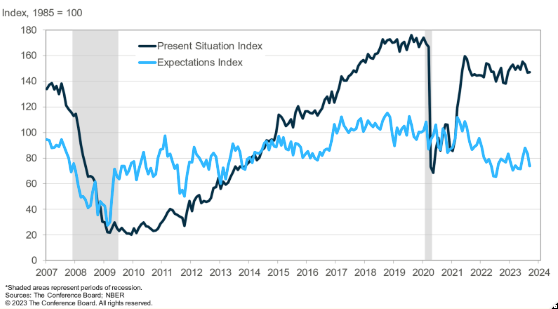

All in all, US Consumer Confidence in October (below) has seen consumers’ expectations plummet. Finally, the prospects of a US government shutdown, likely to translate into a 0.2% GDP loss per week, is equally likely to weigh on Consumer confidence at the worst possible time for the economy, before the holiday peak season. Altogether, these trends will add significant headwinds for Q4 and, as Morgan Stanley reports that most retailers are already sitting on high levels of inventories, it justifies the pessimistic scenarios for the peak holiday season sales and the prospects for a US recession in 2024.

Present Situation and Expectations Index

In summary, while the current trucking industry trends remain stable, the industry, as well as the macroeconomic expectations, are deteriorating. As such, we believe trucking rates will remain in Neutral territory, within a ‘weak’ seasonality pattern similar to 2019, with higher rate volatility and regional rate dislocations.

Outlook Disclaimer

This document contains materials and information, herein referred to as "Content," intended solely for informational purposes. The Content is broad in scope and should not be interpreted as specific advice of any nature. Transfix, Inc. makes no guarantees about the accuracy or completeness of the Content.

Any mention of or reference to a third party, including through external hyperlinks, is not an endorsement of that party by Transfix, Inc., nor should it be construed as such.

Any reproduction or distribution of the Content is strictly prohibited without the explicit written consent of Transfix, Inc.