After the Storms, Freight Finding New Footing

Have you been experiencing some déjà vu during the past 10 days? The aftermath of the winter storms affecting most of the nation drove rates and tender rejections up at a similar speed to what we saw a year ago, as the pandemic unfolded last March. The polar vortex had a rippling effect across supply chains, with markets well outside the storm areas dealing with large impacts to supply and demand.

“Carrier capacity was displaced, as connecting freight was canceled, and shippers needed to start moving freight out of different markets that were less affected by the storm in order to get it to its destination,” says Justin Maze, Transfix’s senior manager of carrier account management. “You can spot this in Los Angeles, where market volume jumped 15%. Shippers need to move more freight from here because other facilities are closed.”

As we noted last week, the impacts of such storms last much longer than the weather itself. With supply as fragile as it is, events have a domino effect across the country. As March arrives, we have seen a nonseasonal trend with rates already being pushed upward. And with capacity still displaced, it could take another week or so for rates to settle.

Volumes, Rejections Bounce Upward

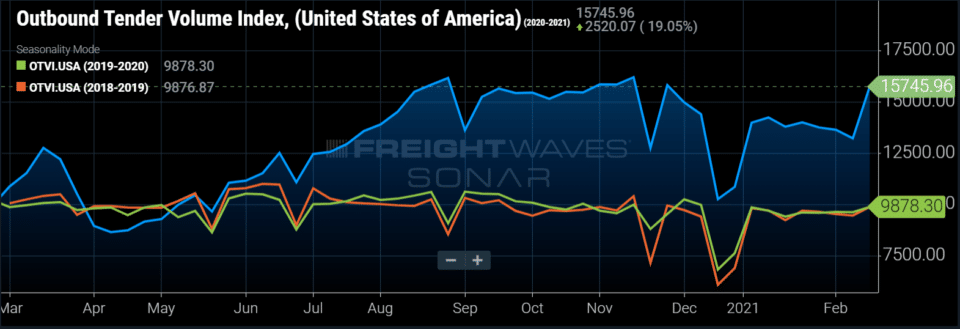

The Outbound Tender Volume Index (OTVI) “fell ~6% last week, as snow and ice blasted all but six states, but volumes roared back more than 20% this week off the bottom,” Seth Holm writes for FreightWaves. “Some of this can be attributed to normal seasonality — freight volumes have risen in the last week of February/first week of March each of the past three years.

“Consumers continue to spend heavily on goods, which drives freight and depletes already diminished inventories. Even if consumer spending diverged from its current upward trajectory (which most see as unlikely given the additional stimulus, accelerating vaccine rollout and strong consumer balance sheets), the heavy inventory restocking ahead might be sufficient to keep freight flowing at elevated levels.” The OTVI sits at 15,746.

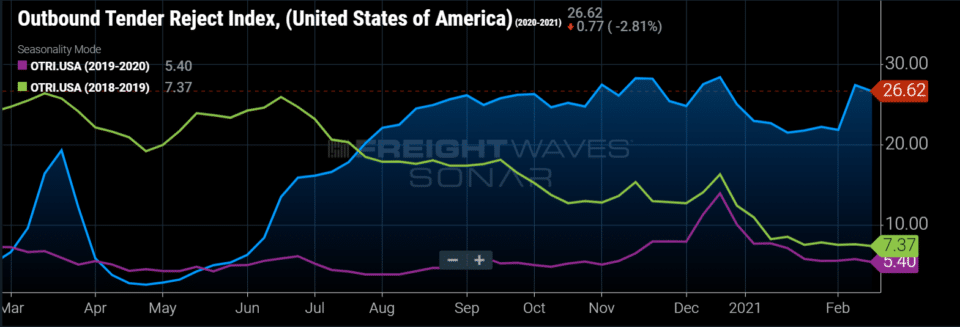

Tender rejections are back at near all-time highs, with the Outbound Tender Reject Index (OTRI), a measure of relative capacity, at 26.62%.

“Given the elevated rejection rates and tight capacity to begin the year, in what is traditionally, seasonally the softest time for truckload freight, any catalyst to keep drivers off the road can be amplified,” Holm writes. “Over the past week, reefer rejections increased by 178 bps and currently sit at 47.3%, over 3,500 bps higher than year-ago levels. As the produce season is set to take off in the upcoming months, the pressure to secure reefer capacity that is already being felt could become more problematic as networks work to catch up.”

The freight world shows no sign of slowing any time soon. “Our carrier partners remain bullish on what the next few months will bring in terms of freight demand,” Maze says. “At Transfix, we are ready for when the fragile supply breaks, with solutions tailored to shippers’ needs.”

EIA: Diesel Prices Increase for 16th Consecutive Week

Fuel prices continue to be a strong talking point, as they have been increasing for weeks, almost putting us back to rates we saw early last year, Maze says.

Indeed, according to Logistics Management, the Department of Energy’s Energy Information Administration (EIA) reported that the national diesel average has been increasing for 16 consecutive weeks. “With a 9.7-cent increase, the national average came in at $2.973 per gallon, outpacing the 7.5-cent increase, to $2.876 per gallon, for the week of Feb. 15. … Prior to the week of Feb. 8, the most recent high, for a weekly national average, was from the week of March 9, 2020, when it came in at $2.814, right before the COVID-19 pandemic took hold.”

Tranfix Announces New TMS Partners

Transfix announced new TMS integration partnerships with logistics market leaders, including FreightPOP, project44, Recon Logistics, SwanLeap and UROUTE.

These partnerships further strengthen Transfix’s ability to customize freight solutions for shippers of all sizes through technology integrations that deliver increased efficiency and decreased costs through automation — whether via partner integrations, EDI integrations or its proprietary TrueView TMS software built for small and mid-size shippers.

Users of FreightPOP, project44, Recon Logistics, SwanLeap and UROUTE can now enhance their operations with fully automated access to Transfix’s instant pricing capabilities, guaranteed capacity and reliable carrier network, all within their existing TMS. Through the API integrations, shippers can accelerate complex, time-consuming workflows, and gain visibility and access to fair market rates and capacity in real time.

“By partnering with some of the most innovative logistics software companies, Transfix empowers shippers to execute freight most cost-effectively within the platforms they already use every day, offering yet another way for brands to more intelligently move freight,” says Jason Langhoff, head of partners

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.