Yet Another Winter Storm to Damper Deliveries

Welcome to the week of February 14th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the logistics horizon.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

Massive Snowstorm Wrecks Valentine’s Day: This week's weather has thrown a wrench into the freight markets, particularly in the Northeast, where a significant snowstorm has caused disruptions. With over 28 of the top 53 lanes experiencing severe weather delays, including key routes like Buffalo to Boston and Cleveland to New York City, the average maximum shipment delay sits around 60%. Overnight, on Tuesday, there was a 6+ hour snowfall with totals projected between 8-12” or more and it's affecting just Northwest of I-95 and along I-80. Peak snowfall is predicted to be just over Central and Northeast Pennsylvania, the Hudson Valley, and interior Southern England. While this storm is localized to the Northeast, it's expected to impact tender rejections, especially in the region. These insights are powered by WeatherOptics.

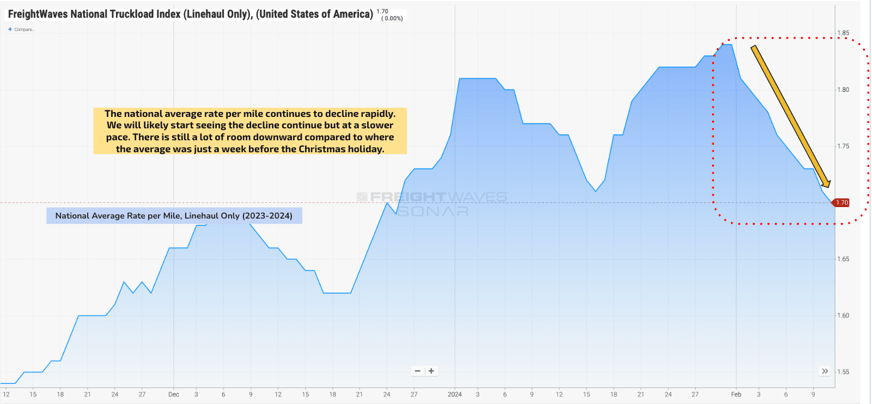

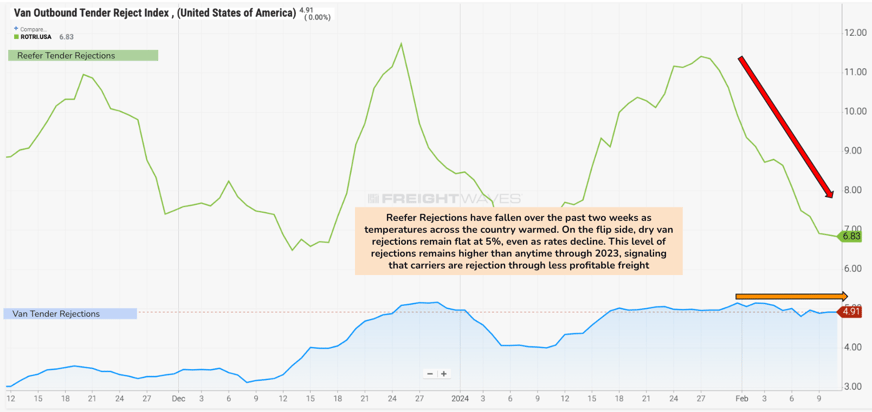

A Temporary Slowdown For Losses In Rates While Rejections May Spike: Justin notes that while this may slow down the decline in national average rates, which currently sits at $1.70/per mile, due to localized pressure, tender rejections are likely to increase in the Northeast. Dry van tender rejections have remained flat at around 5% nationwide, while reefers have seen a nearly 7% decline, albeit less impactful than in January. Despite the weather's influence, the downward trend in rates is expected to persist, and likely at a slower pace due to the recent loosening of markets.

Source: Freightwaves

Source: Freightwaves

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

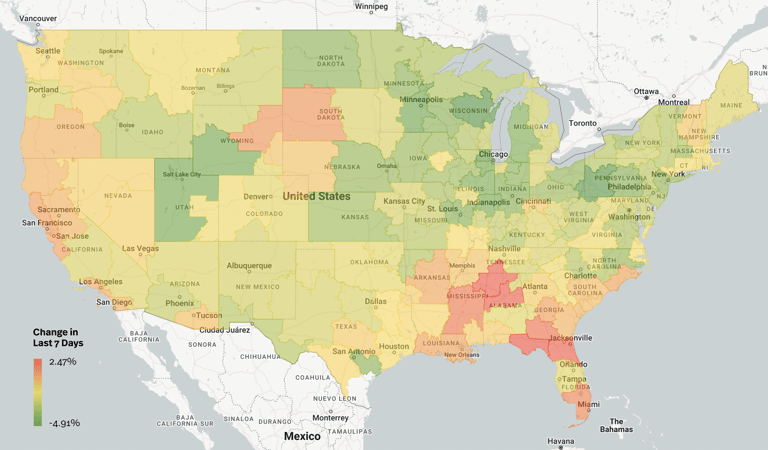

Source: Transfix Internal Data

Source: Transfix Internal Data

Northeast: The snowstorm has hit the Northeast hard, causing late deliveries and increased difficulty in moving freight within the region. Major markets like Harrisburg, Elizabeth, and Allentown saw decreases of over 2.5% in the past week, indicating a challenging environment for carriers to maintain rates.

Midwest: While the Midwest remains unaffected by winter weather, rates continue to decline, presenting an opportunity for carriers to seek better conditions away from the impacted Northeast. Carriers shipping out of Harrisburg, Pennsylvania, going into major freight Midwest markets like Juliette, Chicago, could gain some leeway to escape weather conditions.

Southeast: Valentine's Day-related outbound freight has tightened the Southeast market slightly, but capacity is expected to loosen in the coming weeks, leading to a decline in rates. Rates; however, in this region are still up just over 1.5% over the last 7 days.

South: Strikes in Mexico haven't yet impacted US freight markets, but rates in the South have seen rapid declines, except for New Orleans, where rates have increased due to unique market dynamics influenced by freight coming in from Houston and Dallas.

Coastal Region: While snowfall in the Northeast may affect freight movement along the I-95 corridor, rates in the coastal region are expected to continue falling, especially with short and mid-hauls with over 2% drops over the last seven days. Expect these conditions to potentially tighten through the weekend to make up for lost capacity.

West Coast: Rates on the West Coast have been steadily declining, with long-haul rates dropping nearly 4% in the past week. With excess capacity and ongoing downward pressure on rates, the outlook remains challenging for carriers, especially those long-haul cross-country drivers. This is also a market to keep a close eye on as we get closer to produce season.

On the Horizon: What to Expect On Next Week's Episode

Next week we take a deep dive into carrier exits from the industry and their potential impact on market dynamics through the first half of the year. As the market anticipates a turn, understanding the trends in carrier exits will be crucial for predicting when this shift might occur. Additionally, ongoing weather patterns and their influence on freight movement will continue to be monitored closely as the industry navigates through the remainder of winter.

Join us next week for an all-new episode where we hope the roads get clearer. Until then, drive safely.

To make sure you never miss an episode of the Transfix Take podcast, subscribe on Spotify or Apple Music.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.