Regional Gains and Losses Make For An Even Split

Welcome to the week of March 20th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the logistics horizon.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

Chicago Lanes Bring Driver Risk and Delays: Last week's persistent winter weather, including ongoing snowstorms in the first days of spring, posed challenges for drivers, particularly along critical lanes like Denver to Chicago and Kansas City to Chicago. Here are the top 5 powered by WeatherOptics:

- Chicago to Denver (worst for drivers with a 10/10 risk score)

- Kansas City to Chicago (worst of the 5 with 66% maximum shipment delay)

- Chicago to Detroit

- Minneapolis to Chicago

- Columbus to Rochester

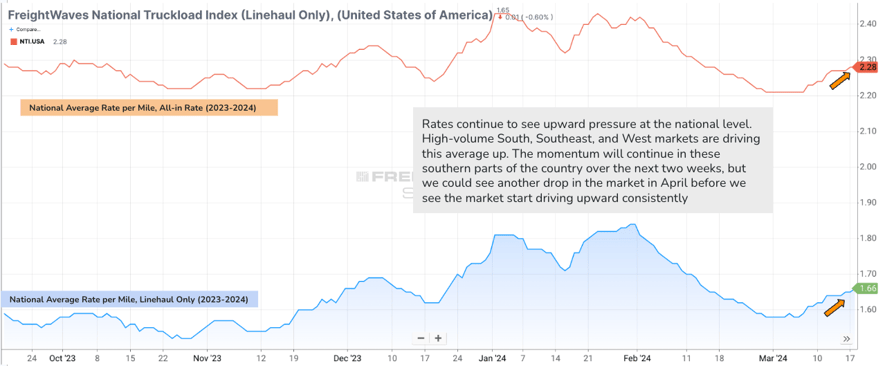

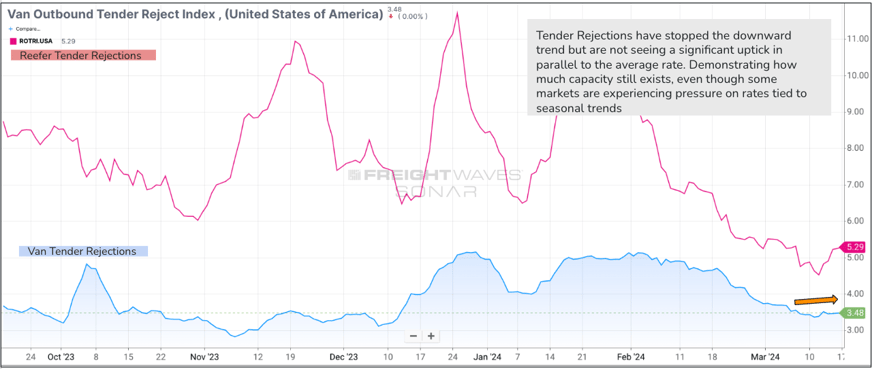

A More Resilient Freight Market Rebounds: Despite these obstacles, the broader freight market remains resilient. The national average rate per mile has surged to $1.66, showing a notable uptick from previous weeks, while tender rejections have plateaued around 3.5%. Keep an eye on March's volume trends as they could impact spot market dynamics in the near future.

Source: Freightwaves

Source: Freightwaves

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

.png?width=872&height=512&name=Map%20chart%20-weekly%20market%20update24-0313%20(1).png) Source: Transfix Internal Data

Source: Transfix Internal Data

South: In the South, rates are on the rise, reflecting a 1.15% increase and signaling growing momentum. Early indications of produce season are visible along the borders of Texas, Arizona, and California, where increased truckload volume from Mexican imports is contributing to the upward trend.

Southeast: The Southeast continues to experience tightening, particularly in vibrant markets like Miami. Long-haul and cross-country freight are reaping significant gains, driven by heightened produce volume. As a result, rates from hotter markets to the South and Midwest are seeing an upward trajectory.

West Coast: Across the West Coast, markets such as Phoenix, Ontario, and Los Angeles are witnessing a resurgence in momentum following recent storms. This trend is expected to persist for the next week, fueled by a surge in imports from Mexico.

Coastal Region: While southern markets like Charleston and Greenville are showing signs of tightening, northern counterparts such as Baltimore and Alexandria are experiencing softening rates. Overall, the coastal region maintains relative stability amidst these divergent trends.

Northeast: In the Northeast, rates continue to decline, marking a 7% overall decrease. Expectations suggest continued downward pressure until a bottoming-out period in the coming weeks or months.

Midwest: The Midwest has seen a nearly 8% dip in rates over the past 30 days, with further decline anticipated, particularly for lanes heading toward the West and South. These trends highlight the intricate dynamics shaping regional freight markets across the country.

The Road Ahead: What to Expect As We Drive Out of March

As we progress through March, signs of market pressure are becoming increasingly apparent. This momentum is expected to persist over the next two to three weeks as we approach the end of Q1. However, as we transition into Q2, a slight downward pressure on rates is anticipated at the national level. Nevertheless, this dip is projected to be temporary, with rates gearing up once again as we enter the middle of produce season.

If you want to get into the specifics of what the next 6-months will bring, Jenni Ruiz will be hosting a webinar with Transfix’s Chief Economist, Paul Poziiumschi, next Wednesday at 2 PM Eastern Standard Time to go over all the details you need to know to stay ahead of the curve. Reserve your seat here.

Join us next week for an all-new episode as we close out the month of March. Until then, drive safely.

To make sure you never miss an episode of the Transfix Take podcast, subscribe on Spotify or Apple Music.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.