Q1 2021 Showing Even More Tightness Than 2020

As we drive through the last month of Q1 2021, Transfix is continually assessing what is happening in markets throughout the country using the power of our own data and leveraging our close relationships with carriers. There remains much uncertainty, but one thing will not change: We are always working to keep our customers up to date, as we navigate through yet another year of a fragile and volatile freight market together.

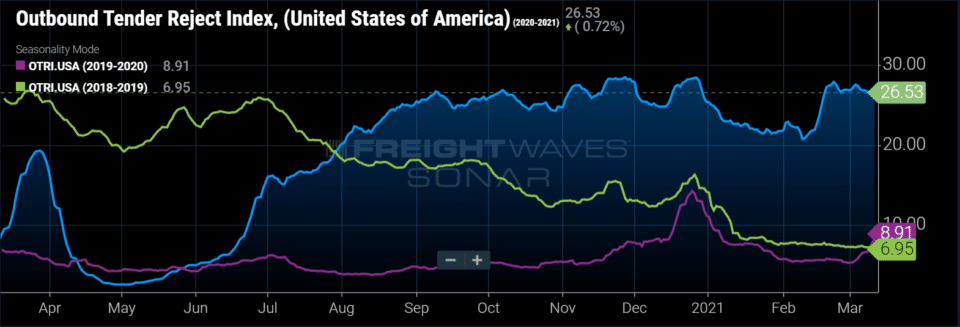

“During the past week, we continued to see tight capacity throughout just about every major market, with some easing in rates and improved routing guides; rates remain at all-time highs — still higher than any point in 2020,” says Justin Maze, Transfix’s senior manager of carrier account management. “Tender rejections are at an extraordinary level with more than 1 of 4 tenders being rejected, thereby disrupting shippers’ routing guides. The spot market continues to be strong and is supporting shippers’ needs. We don’t expect any major changes throughout the remainder of March, pending more weather mishaps.”

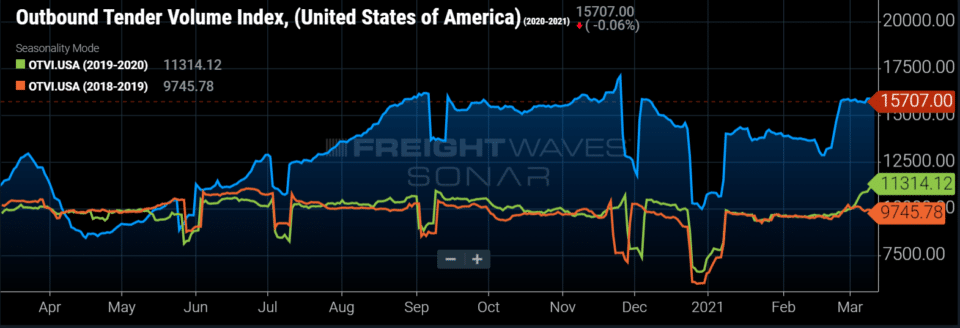

Both the Outbound Tender Volume and Reject indices (OTVI and OTRI) stayed fairly steady at elevated levels this past week. The OTVI is at 15,707; the OTRI is at 26.5%.

“The lasting impact of the winter storms is being felt in the reefer market,” Seth Holm writes for FreightWaves. “Demand for reefer trailers exploded in Texas, with the Reefer Outbound Tender Volume Index for the state increasing over 50% in a 10-day stretch, potentially leaving a vacuum in other parts of the country.

“Over the past three months, growth in outbound reefer tender volumes has outpaced dry van growth, with the disparity accelerating during the storms. As a result of the imbalance, major produce regions like California, North Carolina and Florida have all seen severe reefer capacity shortages over the past two weeks.” With produce season on the near horizon, demand for reefer will only increase.

More Disruptions to Come

Maze points to three major areas that will keep disrupting the freight market during the coming months:

1. Port volumes

We’ve been talking about the backed-up West Coast ports for months now, but even as volume is being rerouted to other ports around the U.S., port volumes are still the talk of the industry.

“Port leadership, industry experts and government officials are becoming increasingly concerned that the huge facilities are likely to remain extremely congested for the next six months,” Dan Ronan writes for Transport Topics. “Factors include a flood of products from Southeast Asian factories, a percentage of longshoremen being off the job because of COVID-19 and a shortage of warehouse space nationwide, especially near ports.”

According to the monthly Global Port Tracker report from the National Retail Federation (NRF) and Hackett Associates, imports at the nation’s largest retail container ports are expected to grow dramatically during the first half of 2021, spurred by increased vaccinations and in-store safety measures.

“NRF is forecasting what could turn out to be record retail sales growth in 2021, and retailers are importing huge amounts of merchandise to meet the demand,” says Jonathan Gold, NRF vice president for supply chain and customs policy. “The supply chain slowdown we usually see after the holiday season never really happened this winter, and imports are already starting to grow again. Consumers haven’t let the pandemic stop them from shopping, and retailers are making sure their customers can find what they want and find it safely.”

2. Stimulus checks

Just as we saw with previous stimulus checks, the coming COVID stimulus checks will have direct impacts on the freight market. This will further buoy the NRF’s projections of increased imports to meet the increased consumer buying sure to come with the new checks. And even more freight will need to be moved.

3. Spot rates overtaking contract rates

Spot rates have started to climb higher than contract rates. This is exactly what we saw in 2020, which turned the industry upside down. “The only cure here is either a huge slowdown in freight volume, which is not coming anytime soon, or repricing contract freight through bids,” Maze says. “I highly suggest shippers react fast here and understand where their partners’ pain points are now before things get any worse.”

Shippers and trucking companies are recovering from the severe weather that broke supply chains in mid-February. “That break sparked a rolling cascade of freight across modes, shooting spot truckload rates skyward,” William B. Cassidy writes for JOC.com. “It’s not clear if those spot rates will descend much before the spring retail and produce seasons.”

“For the remainder of the month, we will continue to see the capacity constraints in most markets throughout the country, but with some slight easing,” Maze says. “Shippers will get some relief on spot rates, though they will most likely still stay above or at the level we saw in 2020. The Southeast will be a region to watch, as the East Coast ports continue to see an increase in volume, and we start preparing for produce season.”

With the uncertainty and volatility surrounding the U.S. economic recovery, shippers need a partner that can help them adapt and excel — no matter the circumstance. Shippers turn to Transfix for our leading technology and reliable carrier network. As volumes drive higher, we are here to help: Learn more about our Core Carrier program and Dynamic Lane Rates. As part of our ongoing market coverage, we’ll continue to provide breaking news, resources and insight into emerging trends and the pandemic’s impact on the transportation industry.