Rate Declines Surpass 11% - But Will That Dive Continue?

Welcome to the week of February 28th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the logistics horizon.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

Top 5 Worst Weather Lanes: This week's top 5 worst weather lanes, as powered by WeatherOptics, include:

- San Francisco to Salt Lake City

- Sacramento to Seattle

- Seattle to Spokane

- Minneapolis to Chicago

- Portland to Salt Lake City

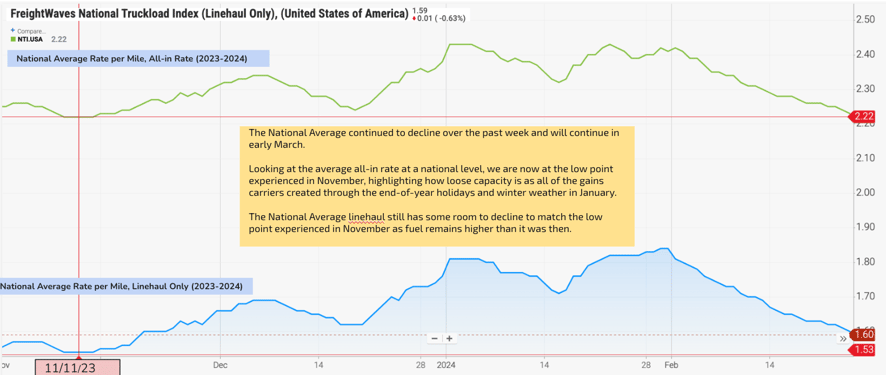

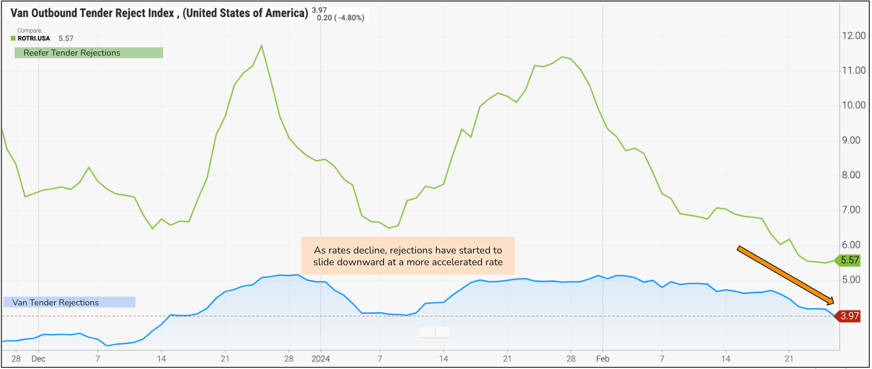

February’s Last Fight: The national average rate per mile has declined, currently standing about eight cents per mile higher than November 2023 levels at $1.60. However, all-in rates have hit the lowest point since November. Tender rejections have dipped below 4%, indicating a market nearing stabilization but raising questions about potential shifts in March.

Source: Freightwaves

Source: Freightwaves

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

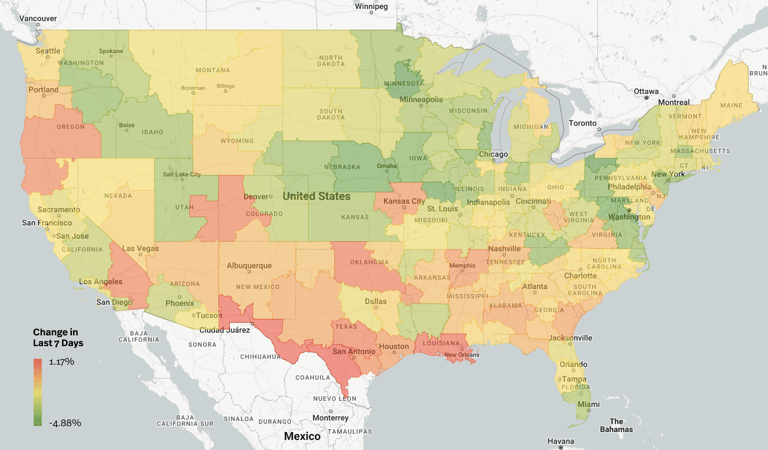

Source: Transfix Internal Data

Source: Transfix Internal Data

South: The Southern region shows signs of tightening, particularly in border markets, influenced by seasonal patterns. Momentum in smaller markets like Austin, Texas, suggests an impending seasonal change, likely impacting average rates potentially through mid-March.

Midwest: Rates in the Midwest continue to decline, reflecting a broader trend over the past 60 days with the highest drop of 2.37% across all regions. Although weather-related disruptions near Chicago may seem temporary, the region is expected to witness further rate decreases in the foreseeable future.

Coastal Region: Despite recent resilience, the coastal region experiences a decline, notably in the long-haul Atlantic corridor. This trend is expected to persist, paralleling the Southeast's downward trajectory. Rates are declining in this region by around 2% for both mid and long hauls.

Southeast: Post-Valentine's Day stability in the Southeast masks declines in markets like Chattanooga and Knoxville. The proximity to larger markets contributes to a broader decline in Tennessee, with seasonal changes anticipated in the coming weeks.

Northeast: Capacity loosens in the Northeast, impacting delivery schedules for retailers. Tender rejections remain low across all regions, suggesting further rate declines in the Northeast as it approaches its market bottom.

West Coast: The West Coast witnessed a steady decline in rates with a total 8% decrease over the last 60 days, although the pace begins to slow. Import demand remains insufficient to drive significant rate changes, with market conditions expected to stabilize as weather disruptions subside although it’s a normal seasonality trend for this region to continue its weakening through the first half of Q1.

The Crystal Ball Review

Here’s what the crystal ball reviewed at the top of the month:

- National rates were predicted to decline by approximately 4%, with tender rejections gradually decreasing towards the 4% mark by month-end.

- Maze expected reefer rejections to level out and decline, particularly in the Midwest and Southwest regions, thanks to warmer temperatures.

.png?width=1521&height=656&name=Screenshot%202024-02-27%20at%2010.12.20%20AM%20(1).png)

Source: Freightwaves

Looking ahead, March predictions will be discussed in the next episode of the Transfix Take podcast, as the market navigates continued volatility and potential shifts in demand and capacity. Until then, drive safely!

To make sure you never miss an episode of the Transfix Take podcast, subscribe on Spotify or Apple Music.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.