Winter Storm Heather Continues to Pummel Every Region

Welcome to the week of January 17th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

Winter Storm Heather Wreaks Havoc on National Freight Markets: We’re experiencing profound impacts of the ongoing winter weather across the United States, from freezing temperatures in the Midwest to snowfall in the Northeast. Regions such as Wisconsin, Michigan, and parts of New York are grappling with record-breaking snowfall, leading to school closures and hazardous road conditions. The South is also experiencing frigid Arctic air, affecting states such as Texas, Tennessee, and Georgia. Texas, including Houston and Dallas, is grappling with freezing temperatures and precipitation, extending to the southernmost parts and impacting freight operations. Tennessee, especially Nashville, is experiencing snowfall, with the disruption expected to spread across the Southeast.

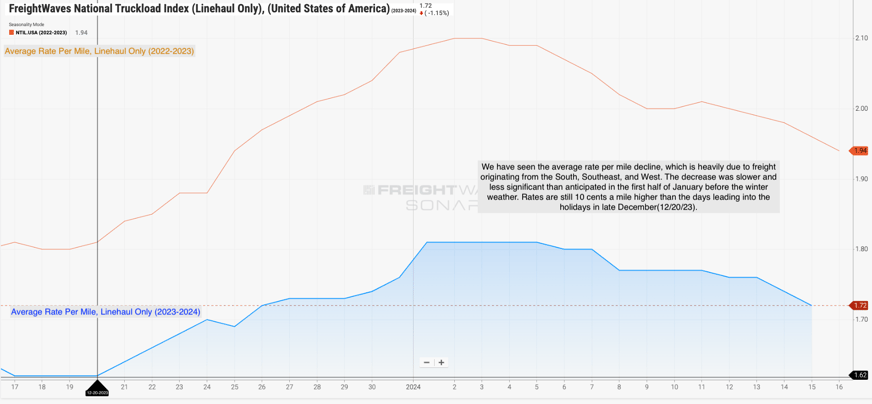

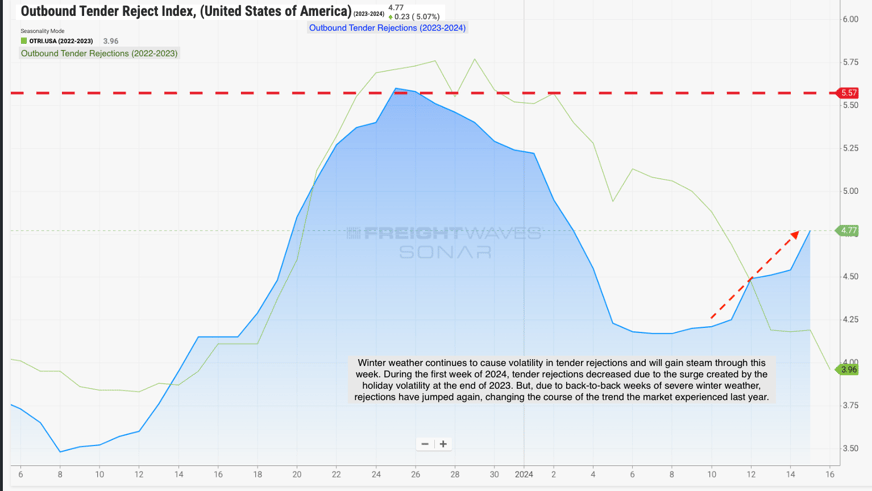

National Average Rate per Mile and Tender Rejections: The winter weather has had a direct impact on the National Average Rate Per Mile, with last week's closing out at $1.72 per mile. This week, a limited decline is expected as the winter weather extends to Southern states. Year-over-year, tender rejections have increased by one percentage point from approximately 4% in 2023 to almost 5% in 2024, reflecting the upward trend attributed to weather-related disruptions. Further increases in tender rejections are anticipated as the winter weather persists.

Source: Freightwaves

Source: Freightwaves

Fast Freight Facts:

- Snow and ice contribute to approximately 500 fatal truck crashes annually in the US.

- Over 14,000 injuries per year result from truck accidents involving adverse weather conditions.

- 23% of trucking industry costs are attributed to winter weather.

- 50% of annual trucking delays are caused by snow and ice.

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

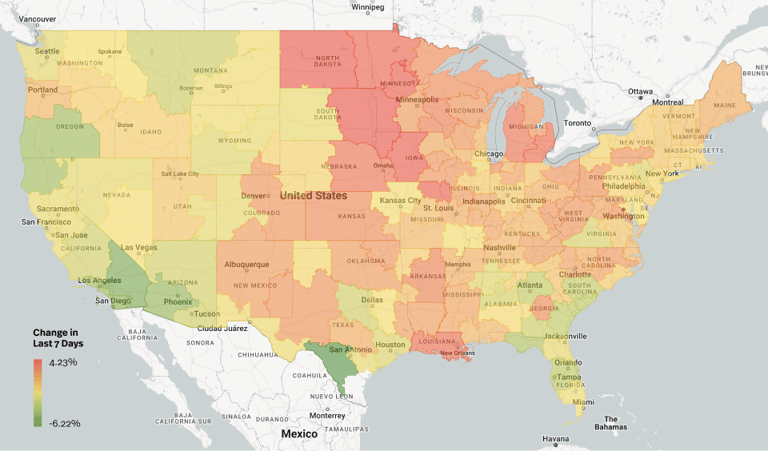

Source: Transfix Internal Data

Source: Transfix Internal Data

The Northeast: The ongoing snowfall in the Northeast, particularly in upstate New York, has slightly increased rates. Freight is staying within the region, leading to higher rates per mile for carriers.

The Midwest: The Midwest continues to face challenges with snow, high winds, and cold temperatures. This has caused increased pressure on rates and capacity, with carriers reluctant to operate in hazardous conditions.

Coastal Region: The Coastal Region experienced mixed conditions, with tightening in North Carolina and easing in parts of South Carolina. Anticipation of continued volatility is expected to impact the entire Coastal region due to weather.

West Coast: The West Coast continued to be the least desirable market for carriers as it’s witnessing a slowing decline in the Pacific Northwest due to winter storms, while Southern California is experiencing a decline in outbound rates. The rise in imports may impact West Coast truckload markets in the coming weeks.

The Southeast & The South: The South and Southeast are grappling with frigid Arctic air, impacting states such as Texas, Tennessee, and Georgia. Volatility is expected with upward pressure on rates in these regions. Winter weather disruptions are causing challenges in supply chain operations throughout the Southeast.

On the Horizon: What Lies Ahead in the Trucking Terrain

West Coast Volume Uptick: Looking ahead, we explore the rising imports on the West Coast, particularly in Southern California. The potential impacts on truckload markets downstream are being closely monitored. The Wall Street Journal reported that Southern California ports today are handling about 36% of US containerized imports, up 33% from last year. Maze notes that while he doesn’t think we’ll see impacts on the West Coast truckload markets for a few more weeks, it will have impacts downstream leading to what we think could be a tighter first half of 2024 should carrier exits continue to increase as predicted.

The Big Freight Question: We’re seeing similar weather patterns to 2021 when we had the deep freeze in the South and saw rates and the freight market spike and stay there. If this winter weather mess continues, we need to ask ourselves ‘Where do rates go from here?’ If this weather continues for another week or so it could be enough of a pendulum swing to determine the state of the market for H1.

Join us next week for an all-new episode where we hope the weather isn’t top of mind. Until then, drive safely.

To make sure you never miss an episode of the Transfix Take podcast, subscribe on Spotify or Apple Music.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.