The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | A Snapshot View of 2023 from Justin Maze

Transfix Take Show Notes

Jenni: Well, hello and welcome to an all new episode of the Transfix Take podcast where we are performance driven. Each week we deliver news, insights, and trends for shippers and carriers from our market expert Justin Maze. Maze, it is great to be with you always. We’re just a couple of weeks away from January.

Maze: Hey Jenni, great to be back with you, as well this week as we are coming upon the close of 2022.

Jenni: That’s right and I know everyone is waiting on pins and needles for a rail update.So, what have we got?

Maze: That’s right, Jenni. As of last week, we averted a potential rail strike. The government did step in to act and forced the unions to take the tentatively agreed upon deal from back in September. This is over opposition of the union workers who, unfortunately, did not get the increased PTO that they sought.

Jenni: Which is super unfortunate because sick days should be just a basic human right as it relates to working, specifically in transportation. But what does that mean for the rest of the year, Maze?

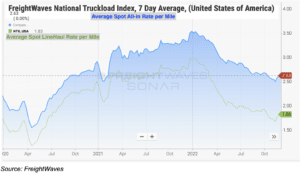

Maze: Well Jenni, now it looks like any potential disruption for the remainder of 2022 is out of the way. We did see, like I said last week, a slight increase in spot rates for the truckload markets. But as of last week, we continue to see these rates decline. I do anticipate that rates will continue to decline through the remainder of this week and most of next week, but as we would expect, rates are likely going to incline going into Christmas week and throughout the remainder of the last week of the year.

Jenni: That’s right. It’s a holiday crunch that we usually see in the last two weeks of December. No surprise there. But what else have we got, Maze?

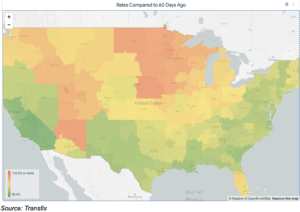

Maze: Last week, we saw rates really see the most impact in the Midwest and to be honest we haven’t seen softening in the Midwest just yet. I do think this week we will see the market start softening as capacity becomes more online, but that continues to be the region for shippers to be on the lookout for. For every other region in the US. It looks like rates are going to be similarly tracking to how they performed through the month of November.

Jenni: And of course for those who need a refresher and, myself included, let’s remind everyone where rates fell in November, especially towards the end.

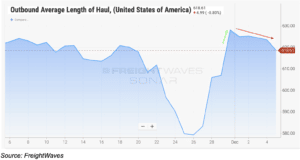

Maze: I think we saw rates increase the week after Thanksgiving due to the end of the month and it seems like looking at the length of haul – the average length of haul got longer, which we usually suspect going into the last week of the month. But I feel as though most retailers probably did one last pushout ahead of Christmas and now we are starting to see that rescind pretty rapidly.

Jenni: Okay, we’ve got some good news for carriers specifically, but let’s talk about which ones and what the news is.

Maze: Exactly! We are still seeing fuel decline. Now, the only caveat there is that this benefits larger carriers more than the smaller carriers that are facing the hard times right now with these lower spot rates. For those smaller carriers that survive off the spot market, they are usually purchasing fuel through the retail system, going to the gas stations, the pumps, rather than these large national carriers who are buying at wholesale. And the gap between retail and wholesale fuel is widening.

Maze: And why is this? It’s because retail fuel generally is slower to come down on a decline, and we are seeing this happen right now, which is going to continue to impact these smaller carriers while they’re still balancing declining overall line haul rates.

Jenni: All right, Maze, so if I could ask you one question about 2022. Where did you think the market ended up being in favor of? I think we all know the answer.

Maze: Well, Jenni, it clearly looks like we are leaving 2022 clearly in favor of a shippers’ market, and for at least Q1 of 2023, it’s going to be very similar. Now, we are facing the holiday week, which will probably bring some pressure to some spot rates as rejections go up, as some drivers decide to go home and take time off for the holidays. And we also see worsening utilization of equipment as different facilities are closed.

Jenni: Well, we’re pulling out our crystal ball at this moment to figure out what exactly will the first half of 2023 look like. Maze, I’m looking to you, and I’m also going to be asking Chris Caplice and Ayeh Bandeh-Ahmadi in another episode to go in a deep dive. But tell me what you think and what you’ve got.

Maze: Well, Jenni, I would say it’s pretty clear that at least for the beginning of 2023, we are going to see extremely soft markets and rates will likely decline to a lower point than we’ve seen in the last several months. If you just look at imports, we are seeing that there’s a 40% decline of manufacturing orders from China that has brought container volume down over 20% between August and November.

Jenni: Well, Maze, keep in mind we are not technically over COVID-19. I know that China has been dealing with a lot of shutdowns throughout the last couple of years, but I think we might actually see those import volumes creep back up to where they were pre-pandemic in 2018.

Maze: Chinese factories are shutting down two weeks earlier than they usually would for the Chinese New Year. So I think that’s a pretty clear indicator that freight volumes are going to continue to be slower going forward for the beginning of 2023. The most important thing for carriers is to make sure that they utilize their equipment to the best of their ability. With line hauls continuing to decline and fuel being very volatile, it is more important now than any time in the last two years to make sure they understand how they’re going to utilize their equipment throughout the week to maximize the miles that they can.

Jenni: So what do you think, Maze? Do you think it’s going to be doom and gloom for the spot market as it relates to carriers or is there just the sparkle of hope going on?

Maze: I am going to stay somewhat optimistic for carriers for the last two weeks of the year and hopefully they are able to put some pressure on shippers to see some increase in spot rates. But as we go into next year, it is more important that carriers continue to change their mentality on the freight markets. Going into next year, relationships are going to be extremely crucial to progress through the beginning of the year. But the second half of 2023 is anyone’s guess because at this point right now, there’s a lot of people out there that are pricing to win freight, not necessarily pricing to move freight. And this could cause that volatile cycle to kick in quicker than we anticipate.

Jenni: Because that means that more freight could be shifted over into the spot market in the second half of 2023, which means that at that point it would be a carrier’s market. But like you said, it’s anyone’s guess. I mean, we’re not really sure. We don’t have the crystal ball to look out that far. But that said, Maze, I’m always grateful for your insights and we’ll see you next week with an all new episode of the Transfix Take podcast. Until then, drive safely.

Disclaimer:

All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.