A New Year for Trucking is Off to a Rocky Start

Welcome to the week of January 3rd edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Listen to the Transfix Take Podcast here:

Industry Insights: Unpacking the Road Ahead

In the last edition of the Transfix Take for 2023, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

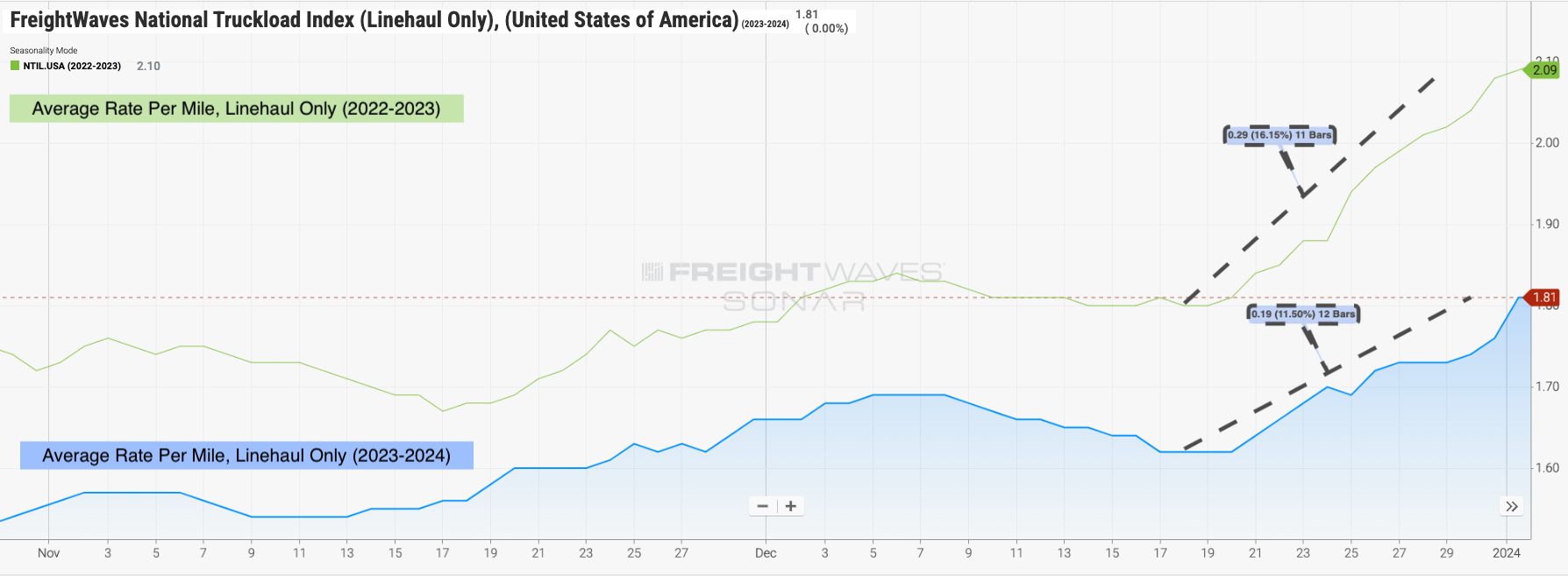

National Average Rate per Mile and Tender Rejections: As we step into 2024, the national average rate per mile and tender rejections have set the stage for the year. From December 18th to January 2nd, rates increased by 11% (linehaul), a bit shy of the 15% surge seen last year during the same period. Notably, tender rejections rose above 5% for the first time since January 2023, marking a significant shift in market dynamics. Carriers, however, didn't find the holiday season as lucrative as anticipated, with fuel costs showing an unexpected increase after weeks of decline from October.

Source: Freightwaves

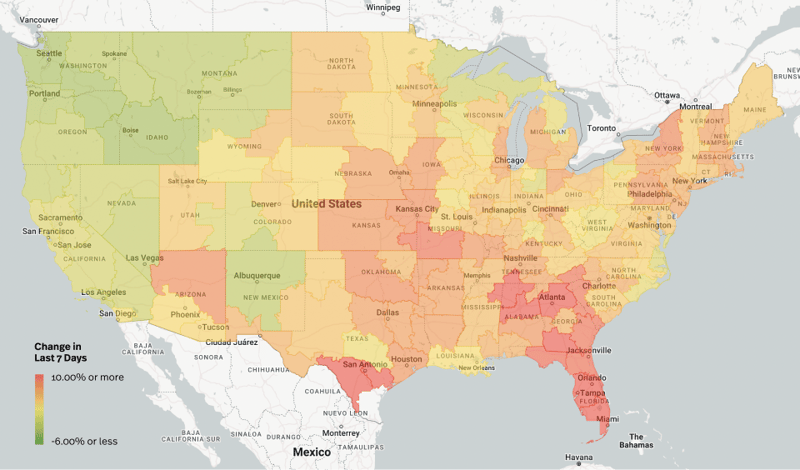

Source: Freightwaves

The Great Carrier Purge: Maze's insights into the Great Carrier Purge suggest that while more carriers might exit the market throughout January, the real impact on rates might not materialize until the end of Q2 or the beginning of the second half of the year. The contract and spot rate difference remains significant, indicating that the market reset may take some time.

Suez Canal and Red Sea: The maritime front has seen a rocky start in 2024, with trouble brewing in both the Suez Canal and the Red Sea. While the impact on maritime rates is expected, the overall effect on U.S. truckload freight markets may depend on geopolitical developments. If capacity remains loose, the immediate impact might be limited.

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

Source: Transfix Internal Data

Source: Transfix Internal Data

The Northeast: The Northeast saw an average increase of about 4% on freight originating in the region. Snowstorms are anticipated in parts of the Northeast, potentially impacting freight markets and leading to increased rates.

West Coast: The West Coast surprised by not experiencing issues with imports. Average rates out of the West Coast remained nearly unchanged over the past two weeks, with pockets of tightening in states like Arizona and Utah but cooling down in California and the Pacific Northwest. Overall, the West Coast did not see any positive impacts on rates, indicating loose capacity.

The Midwest: This region experienced some tightening, primarily driven by market dynamics. A winter weather storm last week marked the first significant snowfall of the year. Although the largest volume freight market, Chicago, saw tender rejections rise over 6%, most Midwest markets witnessed rate increases ranging from 2% to 5% over the last two weeks.

Coastal Region: Parallel to the Midwest, the Coastal region has seen pockets of tightening, with an overall rate increase of about 2% to 5%. Looking ahead, we anticipate the Coastal region to lose the gains experienced over the last two weeks, unlike the Midwest and Northeast, which are expected to retain their improvements due to winter weather conditions.

The Southeast & The South: The Southeast and South regions surprised us, deviating from the national average trend. Carriers in the Southeast wielded the most leverage over the last two weeks, with rates increasing by approximately 7%, and the South following closely with just under 6%. While these regions typically don't exhibit significant increases during the Christmas and New Year's holidays, the recent surge was unexpected. However, we predict that these gains will recede rapidly over the next two to three weeks, as these regions lack the seasonality strength seen in the Midwest, Northeast, and usually the West Coast during this time of the year.

It's worth noting that specific markets within these regions experienced higher rate increases. For example, the Laredo market in the South saw a remarkable 10% increase in average rates for freight originating there over the last seven days.

On the Horizon: What Lies Ahead in the Trucking Terrain

Looking ahead, Maze predicts a significant fall in rates throughout January, surpassing the declines seen last year this time. The West Coast, despite expectations, remains stable, and potential snowstorms in the Northeast could lead to increased rates. The impact of the Great Carrier Purge may not be felt until later in the year, emphasizing the importance of shippers' decisions during the ongoing RFP season.

We’ll make sure to fact-check these predictions at the end of January but until then - stay tuned for more insights and updates in our next newsletter. Drive safely!

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.