The Calm Before the DOT Storm

Welcome to the week of April 18th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the logistics horizon.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

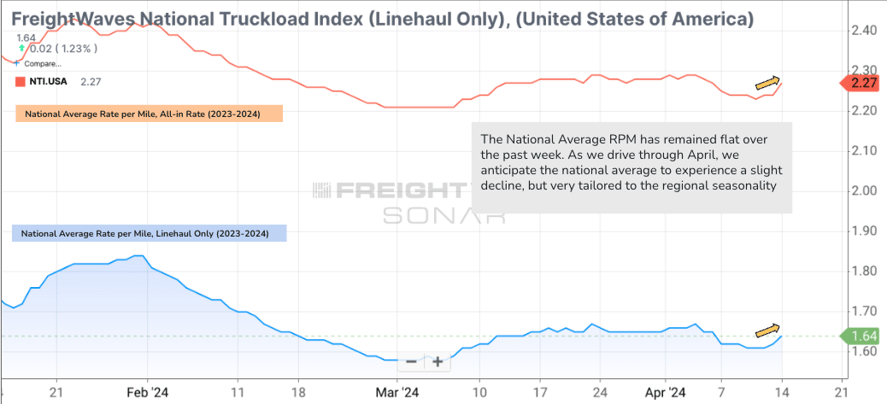

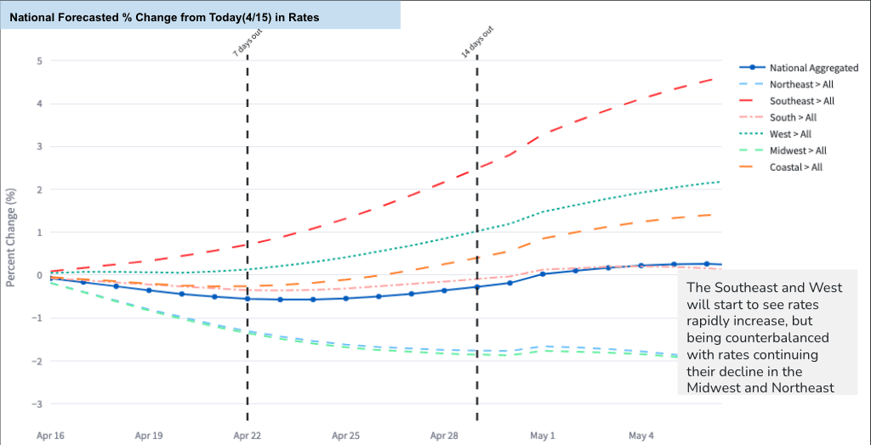

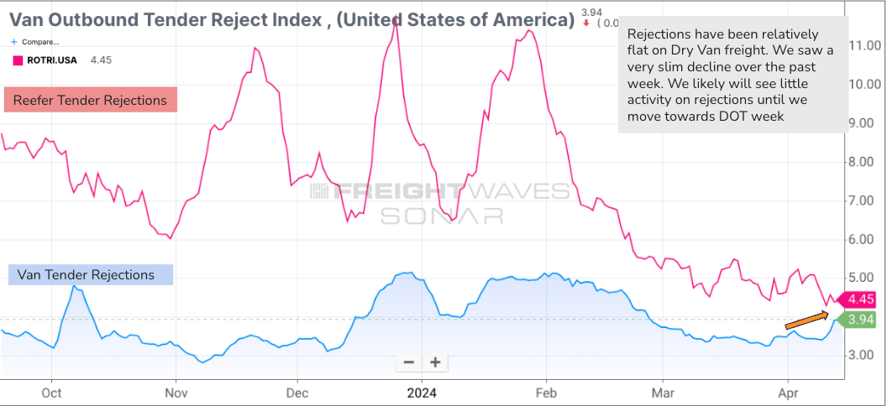

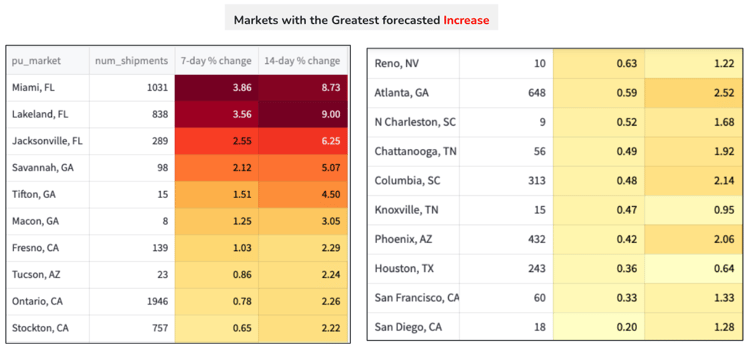

Rate and Tender Gains and Losses Across the Country: Over the last seven days, both the national average rate per mile and tender rejection index have increased. The tender rejection index rose from 3.5% to almost 4%, while the average rate per mile reached approximately $1.64.In the upcoming week, expect the Southeast and Coastal regions to experience the greatest gains due to gearing up for produce season. Conversely, anticipate declines in the Northeast and Midwest as freight volume increases in the Southeast.

Source: Freightwaves

Source: Transfix Internal Data

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

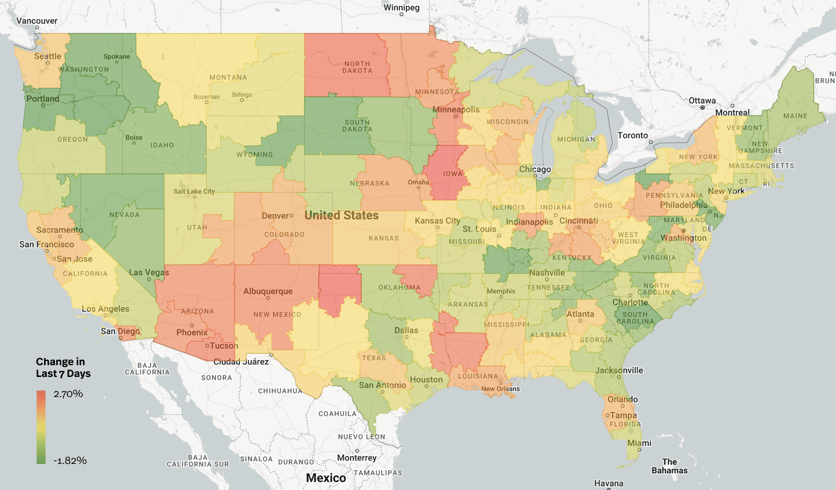

Source: Transfix Internal Data

Source: Transfix Internal Data

Midwest: In the last seven days, the Midwest saw a modest 0.18% rate increase, primarily influenced by rural markets. However, this upward trend may not be sustainable, with expectations of potential declines in the coming week. Volume destinations, particularly whether freight stays within the Midwest or moves to the Northeast, will play a crucial role in determining rate fluctuations.

Northeast: Continuing its trend of decline, the Northeast remains relatively stagnant with no significant breakout markets anticipated. Weather impacts are minimal, and while certain markets in Pennsylvania show slight tightening, overall rates are expected to continue their downward trajectory.

Coastal Region: Experiencing a notable 0.77% rate fall in the last seven days, the coastal region is expected to remain relatively flat with a slight decline. This trend is contingent upon freight destinations, with rates rapidly declining for shipments heading south or staying within the coastal area, while tightening is observed for lanes going to the Northeast or Midwest.

West Coast: With an impressive nearly 2% overall rate increase over the last 30 days, the West Coast stands out, driven by markets like Los Angeles and Ontario. California, Nevada, Arizona, and parts of New Mexico are particularly tight, resulting in increased rates across the entire region. Longer lengths of hauls contribute to this tightening, and as spring and summer progress, further increases in rate are anticipated.

South: Despite weather interruptions, the South experienced a commendable 2% rate increase over the last 30 and 60 days, especially in cross-country runs. However, a decline is expected in the next week as the market recovers from storms in the Gulf states. Freight destinations will continue to influence rate fluctuations, particularly for shipments heading to the Midwest or West Coast.

Southeast: With markets like Miami showing promise, especially as produce season approaches, the Southeast is poised for increased rates in outbound lanes. The anticipation of a strong produce season may lead to skyrocketing rates for lanes heading to the Northeast and Midwest, while rates plummet for inbound lanes. The impact of weather over the past six months on produce season remains uncertain, but heightened seasonality in rates is expected throughout the country.

Source: Transfix Internal Data

The Road Ahead: AB5 is Back on the California Map

The ongoing battle around AB5 in California continues, with recent appeals from industry associations like the California Trucking Association and OOIDA. While the outcome remains uncertain, the impact on the trucking industry, especially rates, could be significant. Carriers are already adapting their operations in anticipation of potential changes, but if AB5 were to go into effect, it could exacerbate operational challenges, especially for smaller carriers and owner-operators.

Overall, the industry is navigating fluctuations in rates and capacity, with close attention to regulatory developments like AB5 and seasonal shifts impacting different regions.

Join us next week for an all-new episode of the Transfix Take Podcast. Until then, drive safely.

To make sure you never miss an episode of the Transfix Take podcast, subscribe on Spotify or Apple Music.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.