The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | Are We Driving Into a Normal 2023?

Transfix Take Show Notes

Jenni: Hello and welcome to an all new episode of the Transfix Take podcast, where we are performance driven. Each week we deliver news, insights, and trends for shippers and carriers from our market expert, Justin Maze. Maze, it’s the last show of the year. It is great to be with you.

Maze: Hey, Jenni, great to be back with you as well this week as we start turning the corner out of 2022 and beginning our drive through 2023.

Jenni: That’s right, Maze. And now I hope you had a great weekend, but I don’t know about you, it’s starting to feel really cold in the way that it should feel in December.

Maze: Hope you had a great weekend as well. And you’re spot on. The weather outside is starting to feel a lot more like the winter holidays with snow hitting coast to coast this week. And we’re going to get into how this could play into the freight market through the next two weeks as we finish off 2022.

Jenni: All right, well, then let’s get right into the markets, shall we?

Maze: Well, Jenni, before we jump into the freight markets, I would like to bring some awareness to some great news as we roll out of 2022, and that is the Truck Parking Safety Improvement Act, which has bipartisan support. This is a bill that would invest hundreds of millions of federal dollars into truck parking.

Jenni: So interesting. I was just talking to my friends over at Real Women in Trucking, and that was the one thing that they all synchronously called out as their 2023 big bet. Very cool.

Maze: As we both know, Jenni, there is definitely a shortage, and it’s only worsened over the past few years, of parking spots for truck drivers. As truck drivers have one of the most important jobs to keep this economy rolling, it is extremely important that we continue to push for truck driver safety out in the roadways. So I am happy to see this come into fruition.

Jenni: As am I. I really could not have foreseen a much better time. You know, I pass by a lot of empty lots in the New York City tri-state area and I know that we can put good use to that.

Maze: Let’s take one last look at the freight markets before we take the exit to 2023.

Jenni: Well, despite some relatively uneventful weeks prior to December, it looks like there’s some volatility.

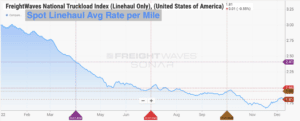

Maze: That’s right, Jenni. We’re still seeing some volatility out there. Last week we mentioned how the Thanksgiving holiday and the end of the month brought higher spot rates throughout the country, though tender rejections remain low. But this week we will continue to experience some volatility in the Midwest and Pacific Northwest. Over the last week, we saw national rates decline, but are still above the spot rates we saw prior to the holiday. This week, keep an eye out in the Midwest and Pacific Northwest, because not only is there a winter storm stretching coast to coast, but these two regions have been pretty stubborn. Take the Midwest for example. Midwest spot rates are higher now than they were throughout the month of November by about 2.5%. So do not expect too much change in the spot market conditions in the Midwest and Pacific Northwest until January.

Source: FreightWaves

Jenni: So, Maze, tell me a little bit more about the spot market because for quite a couple of months we haven’t seen much activity swing in favor of carriers. What are we seeing now?

Maze: Well, Jenni, if we look at rates going back to the West Coast, we are seeing a similar situation. Rates are continuing the rise on the spot market.

Jenni: And what would be the reason for that shift?

Maze: The reason? Because Southern California continues to be extremely loose and carriers frankly just don’t want to go back to Southern California where they are going to be stuck with low rates leaving.

Jenni: Wow. Okay, well, I can’t believe that we are right upon 2023. Maze, did we want to do a look back on the year?

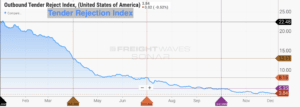

Source: FreightWaves

Maze: That’s right, Jenni. It seems like just yesterday that we were back in January of 2022 and boy have times changed. When we opened up the year, we were at over 22% tender rejections. And now as we come into the last two weeks of the year, we are below 4%. This all started back in March when we saw the spot market really take a steep decline. When we ended Q1 in April, we were still around 13% tender rejections, dropping down to 8% in July, and coming in a little above 5% in October. And we have continued to see a slow decrease in tender rejections and I believe we’re going to leave the year right around 4% even as we go through the holiday week.

Jenni: Okay, well, good news for shippers, but let’s get into the trajectory of rates.

Maze: It is quite incredible because we are actually more similar to 2019 rates than we are to the last two years. When looking at line haul rates, we are right around $1.80 and back in 2019 we were around $1.68 at this time, compared to last year when we were at $2.77. Even in the first year of the pandemic, we were around $2.32. So you see that steep drop in spot rates we’ve experienced playing out year over year, that we were within twenty cents of the line haul that we saw back in 2019, yet almost a dollar away from where we were last year at this time.

Jenni: And given the year the spot market has had, it is no surprise, although interesting, that we are back to pre-pandemic levels and I’ll be curious to see where 2023 leads us.

Maze: When we came into this year, we were facing COVID, and an extremely volatile market that also was going through some winter storms. At that point in time, we were asking ourselves how high can rates go? As the spot rates were hitting record highs along with tender rejections.

Jenni: You’re absolutely right. And it feels like as we head into 2023, we’re starting to ask ourselves a slightly different question, which is how low can rates go and how long can they be sustained as we are heading into levels that we have not seen, to your point, since 2019? And it doesn’t stop there. Right? We’re starting to see contract rates decline just a bit at the tail end of Q4.

Source: FreightWaves

Maze: That’s right, Jenni. Contract rates are also on the decline. They’re down to about $2.60 right now. That is down from over $2.90 that we saw just in July. I think it’s going to take until over the next quarter to start seeing that continuing to go down and closing the gap between contract and spot, that is going to be one of the big indicators going into next year on when the market may start shifting out of the shippers’ favor.

Jenni: And listen, given the state of the market, this has just been a long time coming, as we’ve seen shippers hold favor of the market as opposed to carriers. But as we all know, a market shift is inevitable. We always see these types of swings. It’s just a matter at this point of when.

Maze: Well, Jenni, some of the key things I would monitor going into next year to see how volatile the freight market will be are: The spread between contract and spot rates. It’s something to keep a close eye on. Second, would be the fuel volatility we see throughout the next year.

Jenni: I couldn’t agree more. I think fuel is going to be a huge wild card in 2023. But what’s that last indicator we should be looking out for?

Maze: The third would be looking at the consolidation of carriers or large carriers shutting down for good.

Jenni: Which is another great point you raise, Maze, because as we saw in Q3, at the top of it, into what I’m imagining into Q4, we saw net new carrier revocations go up. So I’m hoping that that does decrease. But given the state of the market, we may see that go up just a bit more.

Maze: Like we mentioned previously, this year we’ll be finishing polar opposite to how it began. It began heavily in the carriers’ favor and will be ending heavily in the shippers’ favor. And most likely throughout next year it’ll continue to be a shipper-favored market.

Jenni: What makes you think that, Maze?

Maze: Well, Jenni, I think next year will be a lot less guessing because I think most of the first half of the year we’re going to remain in a relatively flat area with slim declines. I think tender acceptance will be extremely high as volume is being fought after by carriers.

Jenni: You’re right. And there are so many other key factors that we need to keep an eye on, namely with maritime freight moving from the West Coast over into the East Coast. And I think that we’re going to start to see quite a lot of movement in the ports there as well. More on that in an upcoming episode with Chris Caplice and Ayeh Bandeh-Ahmadi as they do a State of Freight on 2022 and looking forward to 2023. So with that, Maze, I cannot believe we have closed out another year of the Transfix Take podcast and we have way bigger things in store for you guys that we cannot wait to unveil. With that, everyone drive safely and we’ll see you next year.

Disclaimer:

All views and opinions expressed in this blogpost are those of the author and do not necessarily reflect the views or positions of Transfix, Inc. or any parent companies or affiliates or the companies with which the participants are affiliated, and may have been previously disseminated by them. The views and opinions expressed in this blogpost are based upon information considered reliable, but neither Transfix, Inc. nor its affiliates, nor the companies with which such participants are affiliated, warrant its completeness or accuracy, and it should not be relied upon as such. In addition, the blogpost may contain forward-looking statements that are not statements of historical fact. All such statements are based on current expectations, as well as estimates and assumptions, that although believed to be reasonable, are inherently uncertain, and actual results may differ from those expressed or implied. All views, opinions, and statements are subject to change, but there is no obligation to update or revise these statements whether as a result of new information, future events, or otherwise.