The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | January’s Freight Market Not as Soft as Expected

Transfix Take Show Notes

Jenni: Hello and welcome to an all new episode of the Transfix Take podcast, where we are performance driven. Each week we deliver news, insights, and trends for shippers and carriers from our market expert, Justin Maze. Maze, always great to be with you. What’s going on?

Maze: Hey, Jenni, hope you’re having a great week. As always, it’s great to be back with you this week to talk more about our favorite subject, the freight markets.

Jenni: Our favorite subject indeed. Now, Maze, I know we’ve had a couple of really interesting weeks, specifically right after the holiday, but where are we at now?

Maze: That’s right, Jenni. After a turbulent few weeks of volatility in the freight markets, we are seeing trends similar to early December or even November as capacity gets back on track. Shippers are feeling that relief as well in spot rates and just overall capacity to service their freight.

Jenni: And where do you think we are now, Maze? Because we’re right on the heels of the Lunar New Year, and that can affect capacity and make it just a little bit tighter before it goes soft. Is that true based on what you’re seeing?

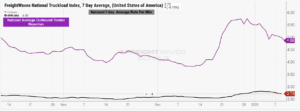

Maze: Well, Jenni, I’d still say that the market is not as soft just yet as we anticipated at the beginning of January. The Midwest and Northeast continue to see rate increases and tender rejections are still relatively high. The Midwest is still over 7% and the Northeast is just under 5% in tender rejections.

Source: FreightWaves

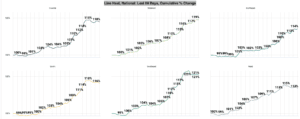

Line haul rates have essentially plateaued within most regions with seeing a very slim decrease, except for the Northeast and Midwest, where we’re actually still seeing a slim increase in line haul spot rates. And I may have jinxed it last week, but after seven consecutive weeks of declining diesel fuel prices, we saw increases in the past week.

Source: FreightWaves

Jenni: That’s right. Depending on where you are, it looks like we’re closer to the $5 per gallon mark than we were last week, when we were closer to the $4.50 mark.

Maze: As always, Jenni, weather is extremely important to keep an eye on. Weather was a primary factor in those turbulent, volatile weeks that we saw the last ten days of 2022. This week is no different, and we need to continue to keep an eye on it. One call-out would be the state of California, as most of the state is under a flood watch.

Jenni: This is certainly an event in 2023 that I don’t think any of us were expecting. Last Tuesday morning, there were severe thunderstorms that swept across north-central California. It knocked out power to tens of thousands of people, prompting rare tornado warnings, according to Axios. And this Monday, 34 million Californians, which is about 90% of the state’s population, were issued a flood watch warning. So it’s definitely something that’s impacting the supply chain industry and inhabitants of California on the West Coast.

Maze: Although we haven’t seen too much of an issue in the freight market, it’s still something to keep an eye on for most shippers and carriers who are heading to California that haven’t been there in the past two weeks.

Jenni: That’s right. So residents of California and those that are traveling in and out of it, please be careful. Drive safely, as always. Switching gears, Maze, let’s talk about where the state of capacity is. Is it in the shippers hands or is it in the carriers’ hands as we speak?

Maze: I’ve said it before and I’ll say it again, I do believe capacity is well into the shippers’ hands and will remain that way for most of 2023. Going forward, we’re going to start seeing seasonality trends that have been blurry in the past few years, since the start of the Pandemic. These seasonality trends, such as produce season, will likely be more defined in the data this year and be felt by shippers and carriers. These seasonality trends can actually turn out working in the carrier’s favor as they see slight bumps in different regions of the country on the spot market throughout different parts of the year.

Jenni: Now back to the age-old debate that we have not forgotten and is obviously top of mind for us. Where are we seeing contract and spot rates right now, Maze?

Maze: Well, for spot rates, I believe back in November, we were getting very close to where the bottom lies, but since then, like I stated, spot rates have gone up, so there is more room for these rates to continue to go down. But I do believe we will feel the bottoming out of spot rates later in Q1, if not very early, in Q2.

Jenni: You heard it here first. If you’re betting on this, write it down. We’re going to check back at the end of Q2 to see where we bottomed out.

Maze: As for contract rates, we are seeing a similar trend of decline, but farther from bottoming out. This trend will continue as new contracts become live and old ones run out. Additionally, Jenni, we are still seeing a lot of carriers and brokers renegotiate current contract rates to help maintain their relationships with the shipper, but also to ensure that they see that volume as some shippers may opt to push some contract freight out into the spot market to take advantage of the very low spot rates we are currently experiencing.

Jenni: So that does make me ask the question, are we going to see something very similar when it comes to the contract market and rates bottoming out as well there, Maze?

Maze: Well, Jenni, as we are in that reciprocal cycle, we will see a similar trend of bottoming out on the contract side, probably later in Q2 when we head into different seasonality factors such as produce season and even back-to-school season later on in the year. We’ve already seen contract rates fall 10%, so there is more room for these to fall. But just by how much is the big question, because at the same time, we don’t want to put carriers in the position where they park their truck, breaking the overall capacity available out in the market, starting that cycle even faster this year.

Jenni: And so I know we’re talking a lot about returning back to pre-pandemic type of seasonality, but what are some key factors that we should be looking out for as we get through the rest of the year?

Maze: Well, there are still some factors out there through 2023 that could push trends in slightly different directions. For instance, as weather gets warmer, we could see an uptick in infrastructure spending, which usually translates to more volume on over-the-road trucking. But at the same time we are starting to see consumer spending habits change and this is as money becomes more expensive.

Jenni: Right? And I think the focus now for shippers is to start infusing more efficient practices into their supply chain. So for example, we’re seeing shippers take multiple shipments and building them into one load to be picked up along the way or dropped off along the way. But Maze, do you think that is going to help in the long run?

Maze: Unfortunately, going into this year, we have not solved the issue of the reciprocal cycle of high demand and low supply and vice versa and what that does to full truckload rates. Hopefully through the year, we can continue to think of solutions to not have such vicious cycles going one way or another towards the carrier or shipper side of the business and instead focus more on relationships. One thing that we need to continue to take away from the pandemic and the hectic freight markets is relationships. This year, because freight volumes and rates are lower, carriers will understand the true value of relationships with brokers and shippers. Now, shippers cannot try to claw back rates as much as they can. Without a doubt, we are going to end in the same reciprocal cycle where shippers will be relying on these same carriers.

Jenni: Maze, I could not agree with you more. I think if nothing else, 2023 is certainly going to be about relationships from shippers to carriers to brokers to everyone else in between. Nothing else is going to surpass that. With that, we’ll see you next week with an all new episode of the Transfix Take podcast.

Drive safely.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. Or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. Nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon as such. All views and opinions are subject to change.