The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | National Tender Acceptance Remains Above 96%

Transfix Take Show Notes

Jenni: Hello and welcome to the Transfix Take podcast, where we are performance driven. It’s the week of January 25, and we’re bringing you news, insights, and trends from our market expert, Justin Maze. Maze, of course, it’s always great to be with you. How’s it going?

Maze: Hey, Jenni, great to be back with you this week as we continue our drive through 2023.

Jenni: Maze, we’re nearing the end of January, and it has been an interesting month to say the least. But things are normalizing. Is that right?

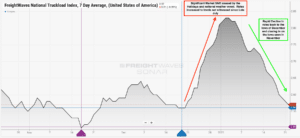

Maze: Well, this past and going into the current week, as expected, markets continued to loosen throughout the entire country, as shippers pushed down spot rates even further. As of January 23, the national average spot rate was $2.57 per mile. This is compared to the lowest point in December, which was $2.56. And Jenni, we are even getting to the lows that we haven’t seen in years, except for in November, which was at $2.50. So we are closing in on the lows that we have seen in recent times, just $0.07 away. I’m going to be a betting man and say that in the next few weeks, we will see the national average get even lower than that $2.50 mark.

Source: FreightWaves

Jenni: Well, how low can rates go? We are just weeks away according to Maze. But let’s get into tender rejections and capacity. Where do shippers and carriers stand relative to those two things?

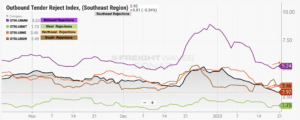

Maze: Well, Jenni, capacity continues to be oversupplied and demand is continuing to decline. Shippers will experience a prolonged period where there is close to no challenge on acquiring the capacity for their needs. Carriers will continue to accept nearly all of the contract freight sent their way. In fact, the national tender acceptance remains above 96%. Looking even further into it, tender rejections in all the largest freight markets by volume are now below the national average. That’s with the exception of Harrisburg, Pennsylvania. This market may not be below the national average, but it’s not too far off. Right around 95% of the freight heading outbound Harrisburg, Pennsylvania market is being accepted by the contracted carriers. So, Jenni, there is no sign of any loosening when the highest volume markets are having no issues whatsoever supplying enough capacity to meet their demand.

Jenni: This is the news that shippers have been waiting for since, I would say, the second half of last year. Also an indication that relationships between shippers and carriers are headed in the direction of a contract market, which is not necessarily a bad thing, but definitely one to watch for those carriers that exclusively play in the spot market. I want to shift gears and go into a regional breakdown. Maze, which area do you have your closest eye on?

Maze: The Northeast to Midwest continues to be in the corner of my eye, as we saw tender rejections quickly decline after a rapid spike at the end of 2022. But recently we’ve seen the tender rejection level slightly increase in these two regions. That’s unlike any of the other regions throughout the U.S.

Source: FreightWaves

Jenni: So what are some contributing factors to this particular trend, Maze?

Maze: Well, it’s not necessarily due to the weather. The weather hasn’t been too much of an issue in the majority of the country. Even as Denver experienced a significant snowstorm in the latter part of last week, the truckload market saw little to no impact. And as we’re speaking, the Northeast – parts of upstate New York and New England – is experiencing pretty heavy snow. And to be honest, I do not believe this is going to be much of a factor when it comes to the truckload capacity.

Jenni: Interesting. So what that’s telling me is that the winter weather in the Northeast region really has not had a significant impact as we’ve seen in the past on the trucking industry, which is great.

Maze: That’s right, Jenni. So I do not foresee too much changing with the current trend. I believe this week and next week we are going to continue to see that downward trend of spot rates, and tender rejections may just plateau, since nearly all of contract freight is being accepted.

Jenni: You know what I just realized, Maze? We have not spoken about imports recently. Why is that?

Maze: Well, Jenni, we haven’t talked about imports lately because I guess no news is good news. That’s to say the least, but it is a leading indicator of the truckload market and even more so a macroeconomic factor.

Jenni: This feels like a recession discussion coming on.

Maze: So it’s always something that we keep in the side view mirror. In fact, imports continue to be lower than in recent years and are trending very closely to what we witnessed in 2019 prior to the pandemic. But one thing to call out is that the East Coast looks like it may possibly be keeping some of the gains captured throughout the last few years, as volumes are still noticeably higher at these ports than prior to the pandemic.

Jenni: This is a long-standing result of the port diversification that we saw shippers gravitate towards in Q3-Q4 of the California port clogs.

Maze: After all, 2022 was a record-breaking year for ports along the East Coast from Savannah, Norfolk, to the Carolinas.

Jenni: So Maze, I don’t know if you’ve noticed, but it seems like forecasting these days when it comes to 2023 has been very conservative because we’re not really sure where we land in terms of a recession. We have predictions, but there are really no hard rules of thumb. There never is.

Maze: That’s right, Jenni. A lot of people continue to put together their forecast for 2023, as some people may have different projections after the surge in spot prices we saw in the last weeks of 2022. Even though we saw these rates come down quickly after the fact.

Jenni: Honestly Maze, as I think at this point we’re all just kind of waiting on pins and needles for the next big thing to happen in the supply chain like it usually does and it comes out of nowhere. But we’ve got a pretty good understanding of how the macro economy really plays a role in where we are going in Q1 and Q2. What I’m curious to know is do you have any insight or do you have any worries or what have you for the second half of the year that we should be looking out for from both a shipper or a carrier perspective?

Maze: Well, Jenni, one forecast that I am hoping I get wrong and is not true, is the shift for the industry going back to old ways.

Jenni: After three years of volatility, you really think that we’re going to head back?

Maze: I’m a little hesitant to say this, but I do believe that we are starting to see the industry take a step backwards.

Jenni: Okay, help me understand what you mean here. Maze.

Maze: The pandemic taught us a lot of lessons. We’ve made a lot of investments as an industry, but it seems like we are going to go back on the old ways we’ve operated in. A little less efficiently, forgetting about relationships. Shippers are certainly going back to how they would price prior to the pandemic with these longer-term RFPs with multiple rounds to drive down rates. And I’m hoping that this is just a slight glimpse of that and that it’s not going to hold true throughout the rest of the year and the other advancements we’ve made in the industry. I hope that we continue to be more efficient as an industry and really cut back on areas of waste and continue to improve the lives of the drivers for ultimately keeping the supply wheel running every single day.

Jenni: I think we’re headed in a positive direction, but where I think we are right now is in January. We’re still trying to figure out how we can beat this inflationary pressure that all of us are feeling from shippers to carriers and trying to figure out a really happy medium as we head or drive into Q2. But with that, thank you so much for your insights this week, Maze, and we’ll see you next week with a new episode of the Transfix Take podcast. As always, drive safely.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. Or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. Nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon as such. All views and opinions are subject to change.