The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | An Unexpected Cold Blast – Our 1st Black Swan Event of ’23

Transfix Take Show Notes

Jenni: Hello, and welcome to an all new episode of the Transfix Take podcast where we are performance driven. It’s the week of February 1st, and we are bringing you news, insights, and trends for shippers and carriers from our market expert, Justin Maze. Maze, as always, it is great to be with you. What’s going on?

Maze: Hey Jenni, great to be back with you as well this week. Huge shout out to you for being part of the Road Dog Trucking Show on FreightWaves Radio this past Friday, going over our recent carrier survey. If anyone hasn’t listened to it yet, I highly suggest you tune in.

Jenni: Well, I definitely had some big shoes to fill, as I was filling in for you, but I appreciate the shout out, Maze. Now, I know we’ve got a lot to talk about, especially as it relates to winter weather. What have we got?

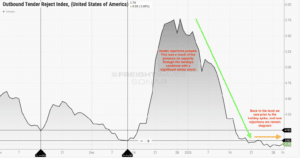

Maze: Well, Jenni, let’s get to it. As for the freight markets this week, we’re continuing to drive down the hill since the second week of January. That’s in regards to rates as they have declined rapidly, giving up all the gain from the holiday and winter storm volatility in 2022. Fortunately for carriers, we’re starting to see this decline slow. Tender rejections are stagnant along with rates. I don’t think this changes the fact that we will still continue to see declines overall over the next six weeks, but they will be much slimmer week-over-week than we have experienced in the past few weeks.

Source: FreightWaves

Jenni: In a normal world, this would make total sense, Maze. But that’s not how the supply chain works. So I know that we’re head to head with the Black Swan event. Let’s get into that and tell me what you know.

Maze: Well, Jenni, great call out. There is a plot twist to this. We have said it multiple times. It’s winter and the market can still have a misfire with any impactful storm as you called out. As we are speaking, winter weather issues are impacting one of the largest freight markets by volume, which is Dallas, Texas and several other markets from Little Rock, Arkansas to Memphis, Tennessee. The South is being hit by an arctic blast. Kind of brings back memories from a few years ago, but ice is hitting the roadways throughout today and potentially tomorrow with frigid temperatures, lasting for the next several days.

Jenni: Now, as of January 31, we are starting to see thundersleet being reported in Texas and Oklahoma, which could potentially have detrimental effects on the supply chain as far as moving freight around this week. And then on top of that, a polar vortex is hitting the Northeastern part of the US. So what can we expect?

Maze: We should expect increased delays, and we should not be pushing drivers to work in unsafe weather, but anticipate more delays than we traditionally see in these markets, as drivers may be slower than usual. We should also expect more loads being pushed out to future dates to avoid capacity issues, but also as facilities shut down.

Jenni: Okay, so all of that makes sense to me but one thing that we have not been speaking about lately is the fact that there could be this potential damage. So what can we expect after this all clears up, Maze?

Maze: We are going to potentially see a backlog of freight out of these markets, as less freight moves and incurs delays in the coming days. Potentially, shippers sourcing from other markets may lead to a small spike in the available spot market. That’s for shippers who have this capability. Additionally, we may see a small shift of capacity throughout the country as drivers and carriers alike avoid the markets that are impacted. When you think of Houston, Texas, it’s another huge outbound market and most of the routes out of Houston, whether it’s going to parts of the West, the Midwest, the Northeast, will need to travel through these areas that are being impacted by ice.

Jenni: Yeah Maze, this is not going to be an easy one but above all I know that this is where partnership really comes into play and of course proactive communication.

Maze: That’s right, Jenni. Most importantly we just need to make sure that the drivers are safe on the roads, and we need to ensure that we provide the support they need during events like this. We have to be reasonable when they’re going to be late to appointments or anything else that may pop up. We just need to be there to assist them.

Jenni: Well, we have some incredible shipper partners, so I have no doubt that this is going to be the par for the course, as they say. Now what impacts can we expect on the market relative to this?

Maze: Well Jenni, overall, I don’t see a significant impact to the market over the next few days due to this storm. I believe it’ll be focused in just the impacted areas, so we’re not going to see rates skyrocket. It may just delay further declining of the rates that we would have otherwise seen in these markets. But I’m sure next week we’re going to dig a little bit deeper and see what the aftermath is and what other domino effects may have been caused by this winter storm.

Jenni: Okay. And for other parts of the country, I know that we’re experiencing a little bit colder than normal, especially in the Northeast. I can sit here and tell you that it’s going to be seven degrees later on this week as the highest evening temperature, but everyone else is pretty much experiencing what they normally would. So why don’t we get into more of a regional breakdown. Give us the numbers, Maze.

Maze: Well let’s jump into it, the regional playbook. I think enough has been said for the South, and we made it pretty clear this winter storm is going to likely put a pause and potentially some pressure on the spot market over the next several days. We will keep a pulse here, and if this becomes a more meaningful shift of capacity and rates, along with any of the backlog of freight that could potentially hit the spot market.

Jenni: All right. What about over on the West Coast, Maze?

Maze: Well, Jenni, as for the West Coast, it continues to draw my attention as rates don’t seem to stop their decline. The question is when will it become unreasonable for drivers and carriers to head to the West Coast as the pay leaving the West Coast puts a driver in a worse position than when they arrived?

Jenni: So I saw that shippers that have shifted over to the East Coast ports are now moving freight back into the California ports. Will that affect anything, Maze?

Maze: Well, the potential for a slight increase in container volume from China after the Chinese New Year may help, but likely won’t be a material impact and rates will continue to decline for the coming weeks. There is no anticipation from anyone, I believe, that we are going to see a significant increase in imports

Jenni: I know that they’re starting to get right back into the swing of things as facilities start to open up after Lunar New Year. So let’s dive into the Southern markets.

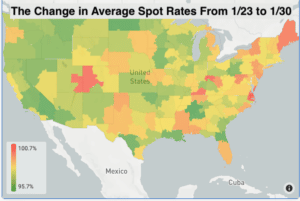

Source: Transfix

Maze: Let’s jump down to the Southeast. For the most part, it’s continuing to see the same declines that we witnessed the prior week. The big surprise to me is actually Southern Florida, as we have continued to almost see no change in rates from seven days ago, potentially showing that Southern Florida is near the bottom of the spot market since we are already witnessing extremely low rates. Other than Southern Florida, the remainder of the Southeast, including the largest market in the Southeast being Atlanta, Georgia, we are still seeing declining spot rates.

Jenni: This is a market to keep an eye out for, especially as we approach the end of Q2 right before produce season. Interesting stuff there.

Maze: Jumping up to the Northeast and Midwest. They may have escaped a significant weather event as we recalled earlier, but it is still frigid cold there, as temps are not going to be as impactful in this region, so there shouldn’t be any effect on supply. But we will continue to monitor this cold snap in case it does bring any precipitation in the future. These temperatures are low even for February and up until today, the Midwest was the top market for carriers to be picking up in as the Midwest continues to have the highest tender rejection rate. But I think over the next few days, pockets in the South may become more optimistic for carriers as capacity potentially shifts due to the weather. Overall, we’re still seeing the largest two markets by volume – Ontario, California and Atlanta, Georgia – continue to see rates on a downward trend steeper than smaller markets throughout the country and just about every market saw rate declines from seven days ago to today.

Jenni: And listen, we know that there is still a lot of capacity out there on the road, so not all is lost. It’s just a couple of different areas that you need to look out for from both the shipper and the carrier perspective. Now, I know you’ve got one more thing that you want to talk about.

Maze: Well, Jenni, I gave an earful this week of how the markets are doing. But other top news in the industry by far has to be the earnings reports that came out for Q4 over the past week. And as many in the industry would have most likely expected, they were not so hot and certainly not a mirror image to the previous few quarters. A slower than anticipated Q4 with declining rates on the spot market and contract as well, is certainly the culprit. Some of these earnings calls even pointed towards a similar outlook than we have said in recent weeks. A tough first half of the year for carriers to operate in with upside in the second half.

Jenni: Yeah, Maze, no surprises there, but I know we’re all waiting on pins and needles to desperately get to that second half of the year.

Maze: Well, Jenni, as always, it was great talking about the freight market with you.

Maze: And you as well, my friend. We will see you next week with an all new episode of the Transfix Take podcast. Until then, please drive safely.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. Or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. Nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon as such. All views and opinions are subject to change.