The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | Winter Weather Wears Off for Capacity

Transfix Take Show Notes

Jenni: Hello, and welcome to an all-new episode of the Transfix Take podcast where we are performance-driven. It’s the week of February 8th and we are bringing you news, insights, and trends for shippers and carriers from our market expert, Justin Maze. Maze, always great to be with you. What’s going on?

Maze: Hey Jenni, it’s great to be back with you as well, as we shift gears into a new week.

Jenni: So, I’ve been having a lot of conversations with you, our chief economist, and our portfolio manager over the last week, and what I’m hearing is that the market is getting much, much closer to the bottoming out that we’ve been predicting for the last month. What is it looking like on your end?

Maze: That’s right, Jenni. It looks like we may have turned a corner. At a higher view, we are seeing the industry hit a static patch. Tender rejections have flatlined, as carriers accept nearly all the contracted freight tendered to them. Only a smidge over 3.5% of freight is being rejected. And as tender rejections feel that they may be at their bottom, truckload rates look similar at a national level. They are trending much flatter with a very slim decline week over week.

Jenni: If you’ve been paying attention, Maze predicted this a couple of weeks ago. But what I’m starting to see is that capacity has taken a little bit of a toll because of that winter weather, right Maze?

Maze: That’s right. I would say the winter storm last week played a role here, as we have seen capacity tighten in the back half of last week and I expect for today and tomorrow at the minimum. This is due to the backlog of freight that we spoke about last week that was not able to move for several days, as a lot of large freight shipping points, like Dallas and Little Rock, nearly shut down due to winter weather.

Jenni: But good thing not for long, right? Because the deep freeze of Texas, if I’m not mistaken, really affected the South in ways that were completely unexpected for the supply chain in the winter. But keep going.

Maze: The impact of the storm that we saw last week disrupts a shipper’s network and displaces capacity. So we could see rates remain relatively flat week-over-week as networks untangle themselves.

Jenni: So the trending topic for us here at Transfix is obviously: when will rates bottom out? I think that’s been the name of the game for the full supply chain and what everyone is talking about. But are we there yet, Maze?

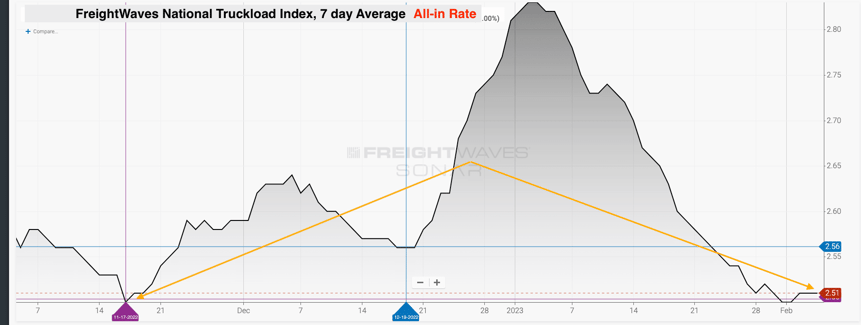

Source: Freightwaves

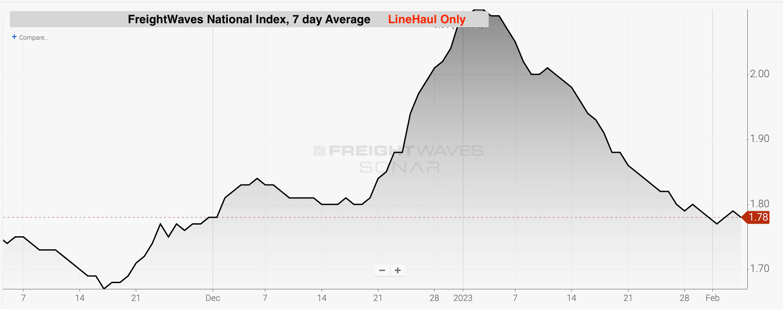

Maze: I wouldn’t say it’s the end of declining rates Jenni, not just yet. I do expect rates to continue their slow decline after the backlog of freight is cleared. This could happen as early as Tuesday or Wednesday [of this week]. Looking at the national average all in rate, we are almost at the identical level to the bottoming of rates we saw in November, which many can agree is near the lowest point that spot rates can reach for carriers to run at least a break even. But pull fuel out of there and you’ll see that line haul still has about a ten cent window or 6% to continue to decrease, to hit the line haul we saw back in November.

Source: Freightwaves

Jenni: Yeah, and carriers have really been hurting, I mean, since Q3 of last year, maybe even before then. But really what they’re looking at is the spot market and waiting to see when the rates will increase.

Maze: That’s why, Jenni, it looks like we are nearing the bottoming of spot market and there’s not much more room for shippers to take from carriers. And we all know what this means. It’s going to start closing that gap between contract and spot freight.

Jenni: And such as this vicious cycle that the industry has been going through. The only difference in what we’ve been talking about here quite a bit internally are those cycles are getting shorter and shorter and shorter. But you know what it’s time for? Our regional breakdown, Maze, let’s get into it.

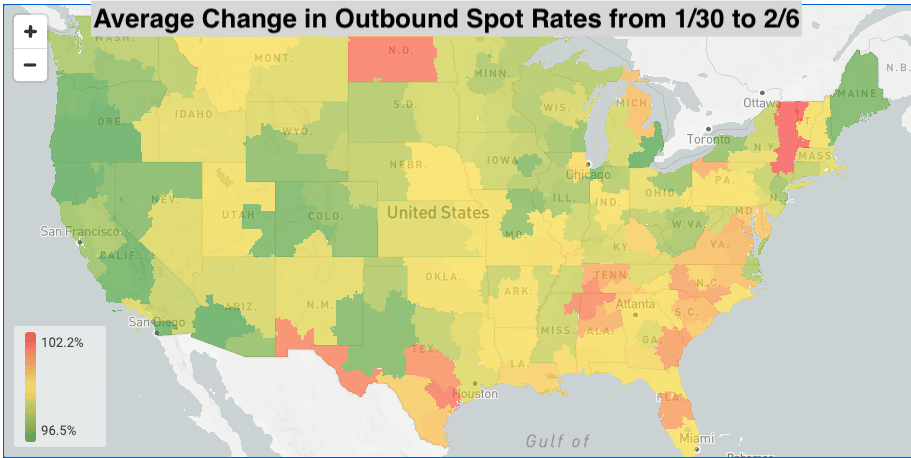

Maze: Let’s do it! Let’s do the regional breakdown. The South, as we mentioned, is definitely one to watch out from earlier this week. Expect more freight to hit the spot market. Rates will most likely see some pressure as a backlog of freight moves across the South. On top of this, it’s the season of love, Jenni, and Valentine’s Day is right around the corner. This holiday doesn’t have a significant impact on the South, but the markets along the border may see a slight tightening with flowers coming in.

Jenni: Super fun facts for you on this Valentine’s Day coming up when it comes to the floral supply chain. Now, obviously, with the exception of domesticated flowers, if they’re being imported, it takes anywhere from about four to five days to reach a truck that is obviously a reefer truck, and then in that process, anywhere from eight to ten days to reach the flower shop where you’ll be purchasing your flowers during Valentine’s Day. So really cool process there.

Maze: And Jenni, speaking of flowers, we’re going to flip over to the Southeast. Believe it or not, Valentine’s Day does have a little bit of a seasonality twist in the Southern Florida markets, as flowers mostly come from South America and are being shipped up through Miami as the gateway to the U.S.

Jenni: And another fun fact for you – flowers really have a short lifespan, which I think we all know, right, but they usually last anywhere from twelve to 15 days in the process of being imported. So timing is of the essence when it comes to flower delivery.

Maze: We have already been seeing tightening in Florida, as we mentioned last week, but this week, expect rates to continue to slightly increase week over week. And this is on top of extremely low tender rejections below 2% in Southern Florida. But I do not believe that the tender rejections and rates were necessarily tied to each other this week, as carriers are still accepting everything they can, but with the increase in demand for a very short window, I do believe we will see some pressure on spot rates.

Source: Transfix

Jenni: Yeah, I’d be interested to see how this pans out for next week when we’re at the height of Valentine’s day, but let’s keep going. What about the Atlanta, Georgia area?

Maze: Well Jenni, in Georgia we’ve also seen some tightening in the past week, but I do think we’re going to see that turn the corner with Georgia in the remaining Southeast states that will most likely see some loosening.

Jenni: Okay. We are just missing out on the West Coast.

Maze: Well, Jenni, moving from the sunshine state to the golden state, the West Coast and more specifically the shipping mecca of Southern California remains anything other than a gold rush. Rates continue to see softening and this week will be no different.

Jenni: Yeah, my gut is that we are going to see that change though, once imports start really ramping up on the West Coast as shippers start to rediversify their freight from the East Coast back to where it originally came from.

Maze: Well Jenni, I don’t think we’re going to see any pressure on West Coast markets for a while. That’s unless there’s some weather event. Other than that, imports are still very low compared to what we saw in the last two years and there’s no signs of changing in the coming weeks.

Jenni: Yeah, that feels like a produce season Q2-Q3 problem.

Maze: The Northeast and the Midwest are areas that I believe still have more for greater declines in the coming week, as rates have been inflated by weeks of weather disruption. And as long as weather stays out of the picture, these regions are where we will see more downward pressure on rates brought on by shippers.

Jenni: So we’ve really been examining the markets for any shifts and spikes that could potentially change the trajectory of the market. But Maze, when do you think we’ll get a really clear picture?

Maze: Over the next 60 days, we would definitely get a clearer picture long-term on the markets as a large portion of new contracts are kicking off. I believe the second half of the year would depend on who drives the power in the market.

Jenni: Do you mean shippers or carriers or where are you going with this, Maze? I love this concept.

Maze: Well Jenni, what I mean by that is there are three core parties. There are the brokers, like Transfix, there are assets who usually your large asset carriers also have a brokerage division, and then there are the shippers. It was clear that prior to the turn in the downward market a few months ago, back in March, brokers and carriers were the winners for several years. The past few months shippers have really navigated taking back the market as supply has continued to increase and demand has slowed. But a large factor is how assets are positioned through this RFP season. And the big question is, will shippers push too far on the rates of these new awards, which then pushes your largest asset carriers to reprice, causing that domino effect quicker than anticipated with brokers and small carriers. The current RFP cycle many shippers are going through could close the gap between that contract and spot spread, which would point to a market with more seasonal capacity shifts we haven’t really seen in the past two years. It could also mean that the bottom of the spot market is sitting somewhere in the coming weeks.

Jenni: That’s great background info, Maze, especially on RFP season and how it affects the industry when it comes to spot and contract freight. But what are we talking about in terms of where that leaves shippers now?

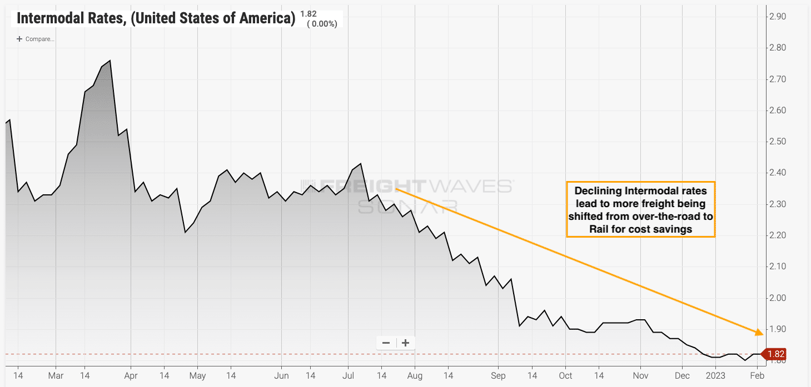

Maze: I’ll tell you that we are starting to hear from a lot of shippers that there is a shift back to moving more of their longer haul freight via the rail, since there is a lack of urgency and the volume is lower than they’ve seen in the past two years. At the same time, rates in the rails have continued to decline, just like the truckload sector. And the current level of imports, like I mentioned, is not significant and much lower than we’ve experienced in the last two and a half years. There should be no issues on getting spots on the rail for most of these large shippers. So what does that mean? We are seeing the average length of haul continue to drop in recent weeks, which will also allow a truck to be utilized on more loads, which essentially gives more capacity to the overall market.

Source: Freightwaves

Jenni: Which is great for shippers. But then when it comes to those carriers that play exclusively in the spot market, that market becomes now even more competitive than what we’ve seen over the holidays. But Maze, is there anything else in the news cycle that you’re looking at right now?

Maze: Other than earnings calls which has taken up a large portion of the news, the recent Class Eight truck order data has been circulating a lot, but in my opinion, it’s not something we should put too much of a bearing on. The number was still relatively high. It may be lower than the previous few months, but a lot of this is also weighted toward the backlog created by supply chain bottlenecks from the prior two years. As always, I look forward to next week diving back into the freight markets and seeing what else makes it to headlines for the freight industry.

Jenni: As do I, Maze. Now, I do want to take a moment to plug a new Transfix spin-off podcast series called “The Transfix Take On,” where we have a number of guests that come in and give us their take on a specific subject. Our first episode is already up with WeWork and our very own Lisa Rossi here at Transfix. I highly encourage that you listen to this episode on DEIJ, especially as you continue to explore your ESG needs. New episodes drop each Friday, and with that, drive safely. We’ll see you next week.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. Or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. Nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon as such. All views and opinions are subject to change.