Winter Weather is Rolling In and Every Region Will Be Affected

Welcome to the week of January 10th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

Navigating Storms Across the Country: Winter weather takes center stage, posing potential challenges across the nation. Storms are brewing from coast to coast, bringing not only snowfall but also flooding rain, high winds, and even tornadoes. While it's hard to predict the exact impact on the trucking industry, especially after the significant natural disasters that caused disruptions in 2021, our market expert, Justin Maze, suggests potential tightening in the Northeast and Midwest regions due to the adverse weather conditions.

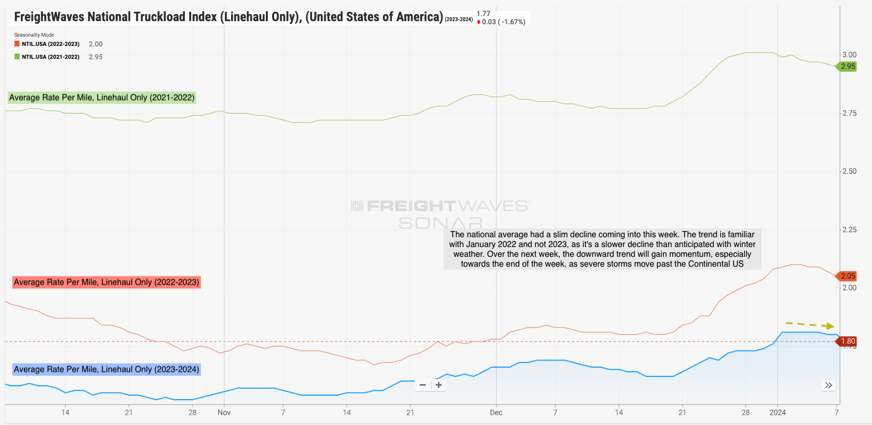

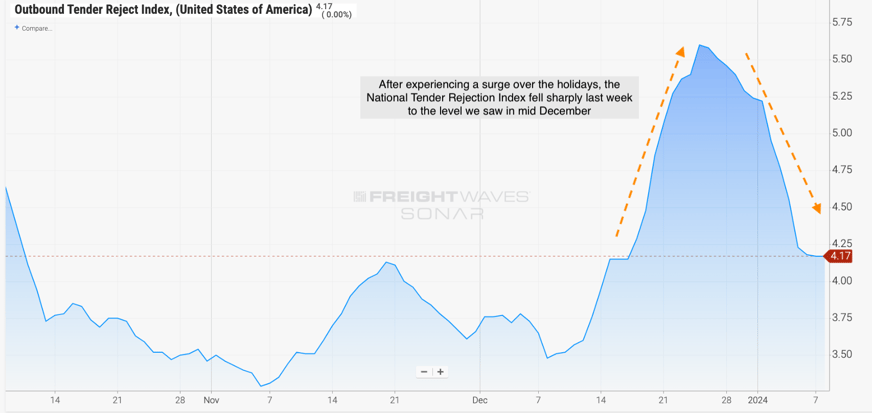

National Average Rate per Mile and Tender Rejections: The national average line haul rate per mile has experienced a slow downward trend, decreasing by about a penny from last Monday to this Monday. However, despite the ongoing storms, there's an anticipation of a faster decline in the national average this week, potentially falling to around $1.73 per mile by Friday. On the other hand, tender rejections fell back to mid-December levels, standing at 4.17 percent, indicating continued loose capacity as we enter 2024. Tender rejections, which surged to around 5.5% in mid-December, have quickly dropped to 4.17% this week. This trend highlights the persistently loose capacity in the market.

Source: Freightwaves

Source: Freightwaves

(Not So) Freight Fun Fact: The impact of winter weather on the supply chain can result in billions of dollars in losses annually. For example, a study by ATRI suggested that the cost of congestion due to weather-related disruptions could range from $2.2 billion to $3.5 billion annually.

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

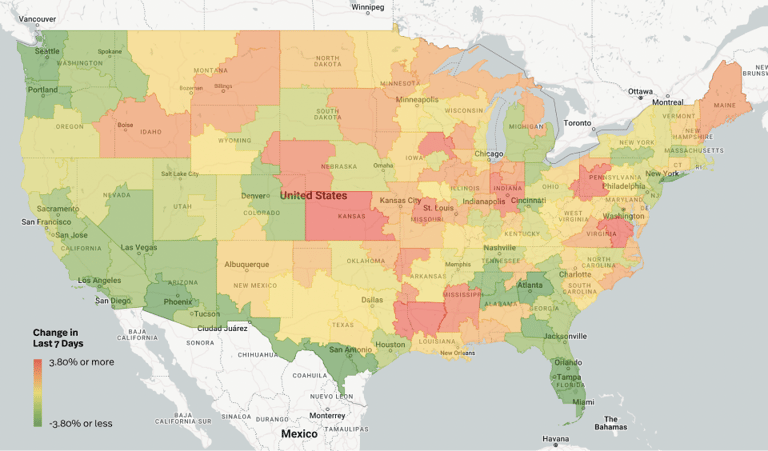

Source: Transfix Internal Data

Source: Transfix Internal Data

The Northeast: While the snowstorm impact in the Northeast wasn't as significant as anticipated, rates increased for freight originating in the region. Continued tightening is expected, with potential power outages and flooding creating challenges for shippers and carriers, especially in Allentown and Philadelphia, Pennsylvania, and Elizabeth, New Jersey.

Coastal Region: Rates leaving the Coastal region, especially in North and South Carolina, are expected to soften after the storms pass. Maryland and Virginia may experience ongoing tightening due to capacity issues in the neighboring Northeast.

West Coast: The West Coast is experiencing a mixed story, with rates trending downward in the largest volume markets. Rural areas with significant snowfall may see some impact, but overall, the West Coast remains favorable for shippers with the exception of Billings, Montana, and Grand Jot, Colorado which had the biggest rate gains.

The Midwest: The entire Midwest is poised for an increase in demand due to back-to-back snowstorms, resulting in widespread capacity issues. Shippers and receivers should anticipate delays and disruptions as drivers navigate challenging weather conditions specifically in Wisconsin and Iowa. Snowy and frosty conditions will mainly affect Omaha, Kansas City, and Quincy.

The Southeast & The South: The Southeast, especially Florida, has significantly loosened up over the past week, with rates softening. Similar trends are expected in the South, with markets like Laredo, Dallas, Fort Worth, and Houston experiencing capacity softening.

On the Horizon: What Lies Ahead in the Trucking Terrain

Maritime Mayhem: Looking ahead, maritime challenges, particularly in the Red Sea and the Panama Canal, remain a concern. Stories about right-sizing inventory and potential disruptions in maritime freight could lead to a shift in imports back to the West Coast. The impact on the trucking industry may unfold in the coming months, potentially applying pressure on spot market rates.

Early Predictions for Q2 and H2: While the issues in the maritime sector could lead to pressure on the spot market, an overall market turn in favor of carriers may not materialize until the second half of the year. The timing will depend on various factors, including the persistence of maritime challenges, a strong produce season, and the gap between contract and spot rates.

As we face the challenges posed by winter weather and potential shifts in the maritime sector, the trucking industry remains dynamic. Stay tuned for further updates and insights in our next episode of the Transfix Take podcast. Drive safely, and for shippers and receivers, anticipate potential disruptions in the flow of transportation during these challenging times.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.