Seasonality Shines and Produce Season Kicks Off March

Welcome to the week of March 6th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the logistics horizon.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

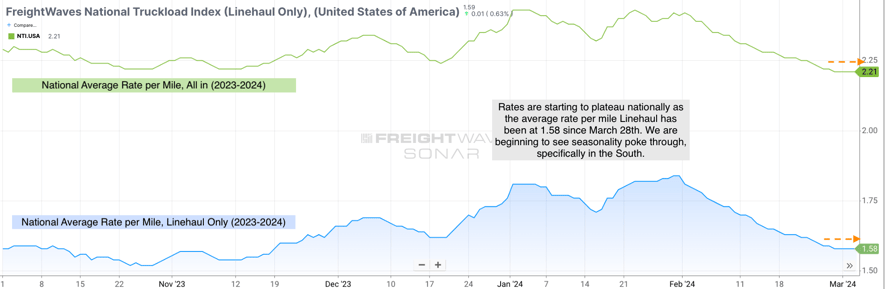

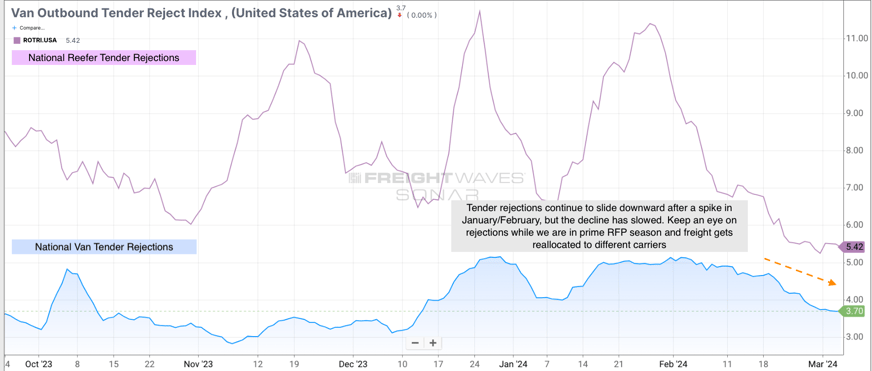

An Overview of the Freight Markets: The recent snowstorm along Donner Pass in California led to a temporary closure of I-80, affecting hundreds of trucks and causing significant delays over the weekend. While the weather impact is unfortunate for drivers, it's not expected to have a substantial effect on the overall freight market, especially beyond the West Coast. Despite the challenges, freight pricing and capacity are largely unaffected. The national average rates per mile has plateaued around $1.58, with tender rejections dropping to approximately 3.7% for dry van freight. However, March's volume trends could influence spot market dynamics, warranting close observation in the coming weeks.

Source: Freightwaves

Source: Freightwaves

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

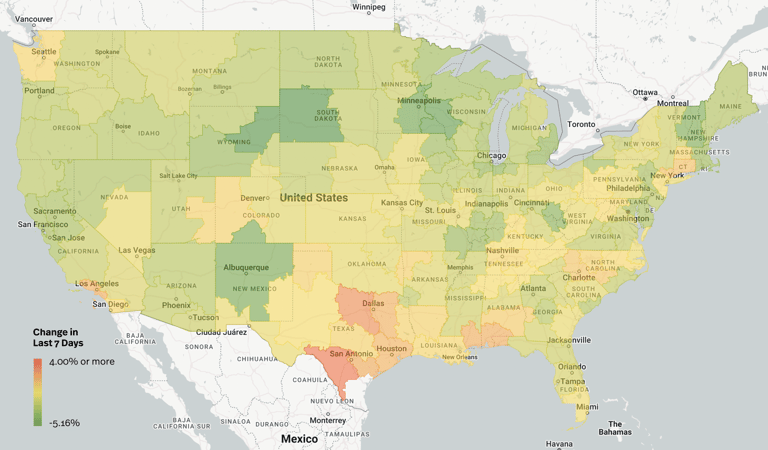

Source: Transfix Internal Data

Source: Transfix Internal Data

West Coast: Rates have seen a decline of nearly 9% over the last 60 days, but the market is showing signs of stabilizing, particularly in higher-volume markets like Southern California, Phoenix, and Las Vegas. While downward pressure persists, expect some leveling off and potential rate increases, especially in Southern border markets.

South: With the onset of produce season and avocados aplenty, the South is witnessing an uptick in freight demand, leading to tighter capacity and upward rate movement. Texas borderlands, in particular, are experiencing increased demand, signaling favorable conditions for carriers seeking higher-paying loads.

Midwest: Rates have been decreasing, though the decline is expected to slow down soon, reaching a plateau within the next month. Carriers are advised to capitalize on current rates, as the market dynamics may shift as the season progresses.

Northeast: While most markets are affected by lengthy, heavy rainfall throughout the week, this region continues its decline in rates. The exception is the Hartford, Connecticut market. While the region may experience further drops, it's crucial for carriers to target more lucrative markets as rates continue to adjust.

Southeast: Following a tight February, the Southeast is cooling down, with rates beginning to decrease. However, with the imminent arrival of produce season, namely oranges, rates are expected to rise gradually, offering opportunities for carriers, especially in high-demand markets like Miami.

Coastal Region: While the Coastal Region has shown resilience, signs of upward rate pressure are evident in markets like Charlotte, North Carolina, and Roanoke, Virginia. However, overall rates are anticipated to decrease further, albeit at a slower pace compared to neighboring regions.

The Crystal Ball Review

Looking ahead, national average rates per mile are projected to drop by around 3%, maintaining loose capacity and moderate demand. Tender rejections are forecasted to decrease to approximately 3.25% by month-end, driven by new contracts and market adjustments.

Fuel prices remain volatile, influencing both shippers and carriers. The South region is expected to remain the tightest market throughout the month, with the Midwest and Northeast projected to experience the most significant rate reductions. While the West Coast may see increased desirability in select markets due to seasonality, closely monitoring volume trends and high-demand freight markets is advised for carriers seeking optimal opportunities.

Source: Freightwaves

Lastly, our hearts go out to those who have been affected by the wildfires in Texas. We urge everyone to be safe and we’ll continue to keep a watchful eye on the situation. WIth that, we’ll see you next week.

To make sure you never miss an episode of the Transfix Take podcast, subscribe on Spotify or Apple Music.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.