The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | Winter Weather in the Pacific Northwest to Watch

Jenni: Hello and welcome to an all new episode of the Transfix Take podcast where we are performance driven. It’s the week of February 22 and we’re bringing you news, insights, and trends from our market expert, Justin Maze. Maze, always great to be with you. How’s it going?

Maze: Hey, Jenni, great to be back with you as well this week as we continue our drive through February.

Jenni: Now, February may almost be over, but I know that we’ve got some updates right up front on rates.

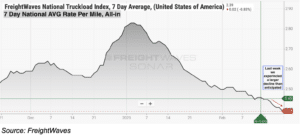

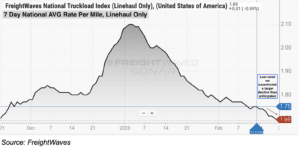

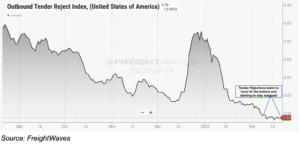

Maze: Well, Jenni, I will say to my surprise, we saw a reacceleration in the decline of national rates in the past week. We actually witnessed a five-cent drop in a seven-day national average, bringing it down to just $2.41 all-in rate per mile. And linehauls almost saw an exact mirror as they dropped $0.05 from $1.75 a mile to $1.70 per mile. This comes as tender rejections have held relatively flat, just under 3.5%, showing that we really hit the floor on tender rejections.

Jenni: That’s as you predicted, Maze, about two weeks ago, but let’s look into what the reefer markets look like right now.

Maze: We are continuing to see softening, but it looks as if we may have found a similar floor on tender rejections at right above 4%. And Jenni, just to put it in perspective, in 2019, when we thought we were in a very loose freight market, tender rejections on reefer freight still sat above 8%. So just allow that to put things into perspective, the current market conditions we are in today.

Jenni: Okay, so all of this is at the heels of the news we broke last week, which is that there are a couple of different weather events that are occurring or developing.

Maze: Jenni, you are right. There is a winter storm coming this week. We are not yet out of it. We are still driving through the middle of winter, especially for the Midwest. And when we get into the regional breakdown, we’ll look where we may see some interruptions on capacity, because like I stated last week, the Northeast and Midwest are still the better regions for carriers to receive a higher rate per mile than just about anywhere else in the country.

Jenni: Okay, well, time waits for no one. Maze, let’s get into the regional breakdown. Where are we starting?

Maze: Jenni, this week we’re going to start on the West Coast as it continues to be the loosest region with declining rates and low volumes. But be cautious this week in the Pacific Northwest, as we are expecting a pretty substantial snowstorm sweeping coast to coast. I do not think we’re going to see too much of an impact on capacity, specifically in the Pacific Northwest, just because of how loose it has become, but it’s still extremely important to keep an eye there.

Jenni: So by this Thursday and Friday night, we’re going to experience heavy rain and snow with some very low snow levels, but damaging winds that can go up to 100 mph near the New Mexico and Arizona area. San Diego is also expected to experience high gusts of up to 50 mph. So that weather is mostly going to impact Interstates 8, 10, 25, and 40. What else have we got, Maze?

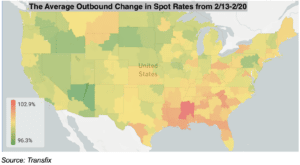

Maze: Jumping down to the South, we are seeing capacity in Texas start to loosen, but due to the ongoing continuous storms in states like Mississippi and Alabama, we’re still seeing rather tight capacity in those more rural markets.

Jenni: Okay, so let’s move on over to the Southeast, Maze.

Maze: We’ve started seeing easing in the larger markets in the Southeast, specifically in Georgia and Florida, but Tennessee, just like Alabama and Mississippi, continue to see tight capacity. Again, this is due to the weeks of storms that we have seen. Capacity in Tennessee and Mississippi is surely not in the favor of shippers, but carriers – this is where you will get a higher rate per mile.

Jenni: Good advice for carriers. Now Maze, let’s get into the coastal regions.

Maze: The Carolinas continue to be stubborn. We’ve really just seen the rate per mile stay flat in these two states. Virginia and Maryland are continuing to show somewhat similar patterns to the

Northeast with higher declines in rates. But markets around Charlotte have certainly held flat week over week. I do anticipate us starting to see looseness come out of all markets throughout the Southeast and coastal region in the coming weeks. That includes the state of Tennessee.

Jenni: All right, we will definitely keep an eye out for that. Now what else have we got, Maze?

Maze: Now, let’s go up to the two regions that carriers will get paid the highest rate per mile– the Midwest and Northeast. The Midwest has seen the fastest drop in rates in the last 15 days, but unfortunately we’re not out of winter just yet and this week could stall the decline of rates. Again, I do not think we’re going to see a significant impact to capacity and even rates, but it’s something to keep an eye on.

Jenni: It does look like the winter weather is going to have one last significant impact on the trucking markets, which we’ll know in the next week or so. But let’s go over the Northeast.

Maze: Rates have continued to decline and more importantly, when you look at the largest freight markets by volume, Harrisburg, Pennsylvania and Elizabeth, New Jersey, these markets are continuing to see volume drop and capacity loosen, driving down rates throughout the Northeast. But once again, as I said, this storm is sweeping from coast to coast. Parts of the Northeast, New England and upstate New York in particular could potentially face some tightening capacity in the coming days.

Jenni: This storm is proving to be much larger of an impact than I initially thought it was, even though we talked about it last week. But what does this mean for rates, Maze, and where do you see us going by the end of the month?

Maze: At a high level on a national level Jenni, rates are continuing to decline faster than I actually thought they would at this point in February. But there are still pockets that are favorable to carriers such as markets in Tennessee, Mississippi, and parts of the Carolinas. But shippers continue to hold caution, especially as we are still in the winter months and we could see some impact to capacity from the Pacific Northwest through the Midwest and in the Northeast. But I will say the most noticeable thing is that the largest freight markets by volume continue to see decreasing volume and rates. These markets are Southern California to Atlanta, Georgia, Elizabeth, New Jersey, and Harrisburg, Pennsylvania.

Jenni: But I do see that changing because if we’re talking about this storm impacting mainly the regions that you just mentioned, that’s just going to have to go up.

Maze: If you continue to go down the East Coast, you will see that a lot of the port markets such as Savannah, Norfolk, and we’ve already mentioned Elizabeth, New Jersey, the Port of New York New Jersey, volume is definitely going down and leading into the impact,- the domino effect– into the other markets loosening up as well.

Jenni: All right, now one of my least favorite topics to discuss, but one that’s incredibly relevant regardless, let’s talk net new carrier revocations as they are right now, Maze.

Maze: That’s right, Jenni. There has been some updated data released in the past several days.Trucking authority revocations remain at historically high levels, reaching just over 9,000 in January with a net change of negative 4000 carriers in the industry. Now this comes as spot rates continue to decline and close in on the cost it may take many of these small carriers and owner operators to operate.

Jenni: Now, where do you think these net revocations primarily lie, Maze?

Maze: I do not think this stands for the majority of owner operators in the industry, especially those who have over a decade of experience and have gone through turbulent markets such as this one. The problem lies with the group of drivers who opted to get their own authority during the pandemic, at record high spot rates, or drivers who are new to the industry.

Jenni: Which given what we know now and hindsight is always 20/20: it was probably the worst time to enter the industry as a newbie.

Maze: I do believe we’re going to continue to see the numbers of revocations be high. But again, looking at just the net change of negative 4000, we have a long way to go with a continued increase in authorities granted throughout the last two years.

Jenni: That’s right. Like you said, I do think that a lot of these carriers are operating on a leased-on level. But before we go, let’s get into intermodal and its effects on the entire trucking industry.

Maze: That’s right, Jenni. We can’t leave intermodal out of the update this week, because there has been a focus on the news of recent derailments. But I will say that in the grand scheme of things, these derailments actually happen very often – about a thousand a year. And about 10% of that thousand actually are tied to hazmat materials, though nothing near to the level that we saw in Ohio in the recent weeks. It’s important to note on the transportation side that Norfolk Southern has said they have not experienced any issues due to the incident of the Ohio derailment, so we’re not seeing this actually impact truckload movement in the US. In fact, last week we saw another derailment just outside of Detroit, and this week there was another one in Ohio just on the other side of the state, though those are very minor derailments compared to the one that we saw in East Palestine, Ohio.

Jenni: Well, I certainly did not know that derailments happen that frequently, but good to know in terms of its effects on the freight market.

Maze: Well, Jenni, we’re going to continue to stay on top of everything that’s happening in the freight industry. Hopefully everyone stays safe with the significant winter weather storm hitting across the country this week, and we look forward to next week to see where we leave the month of February and begin our journey through the month of March.

Jenni: That’s right, you heard the man. We’ll see you next week with an all new episode of the Transfix Take Podcast.

Until then, drive safely.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. Or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. Nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon as such. All views and opinions are subject to change.