The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | Marching Towards a Seasonality Comeback

Jenni: Hello and welcome to an all new episode of the Transfix Take podcast where we are performance driven. It’s the week of March 1st, and we are bringing you news, insights, and trends for shippers and carriers from our market expert, Justin Maze. Maze, we’re done with February!

Maze: Hey, Jenni, great to be back with you again this week as we turn the corner out of February.

Jenni: Now, February had a few twists and unexpected turns, but Maze, how did the month go overall?

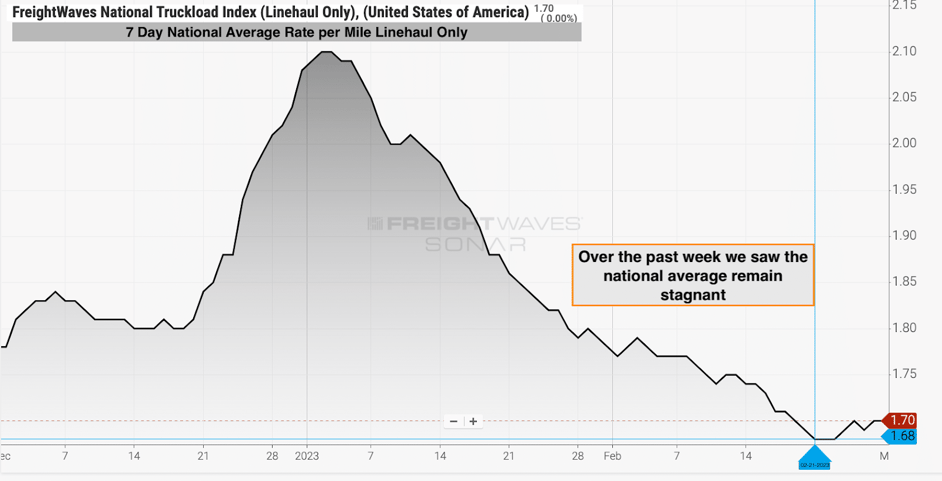

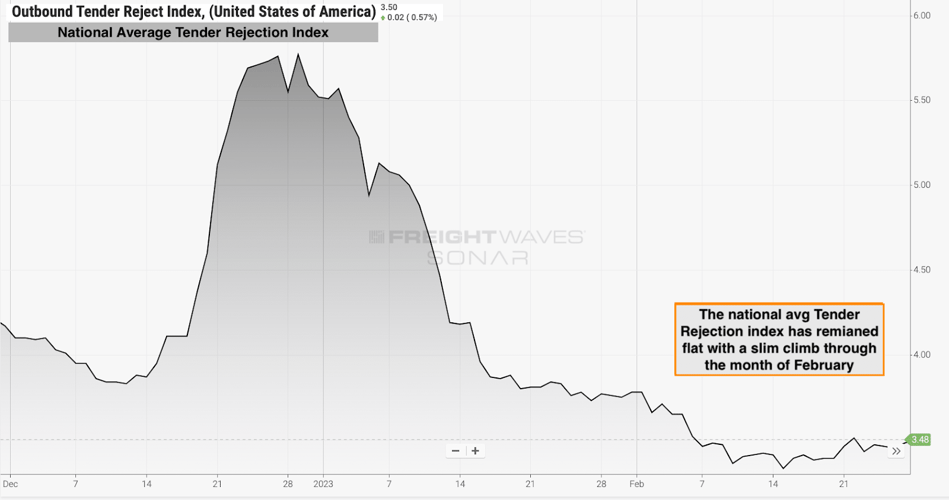

Maze: Well, Jenni, coming out of last week and heading into the final day of the month of February, we’ve actually seen some relief for carriers in the market. Rates actually remain stagnant over the last ten days with a slight increase. As of today, the national seven day average is $1.70 per mile for linehaul. This is compared to last week’s $1.68. At the same time we’re also seeing tender rejections slightly tick up. When I say slightly, I mean there is a very slim uptick in tender rejections, but they have remained flat almost throughout the entire month of February.

Source: FreightWaves

Source: FreightWaves

Jenni: Interesting. So is the market starting to pivot in the carriers’ favor?

Maze: I wouldn’t say just yet. We saw something very similar at the end of January going into February when rates kind of remained stagnant and then going into the month started dropping again. Now, I do believe we are nearing the bottom in some regions.

Jenni: Okay, walk us through that and where they are.

Maze: Specifically the Southeast, the South and West. I do still believe there’s going to be a short period of time through the month of March that we will continue to see rates drop out of these regions. But I believe there’s going to be even more of a significant drop out of the Midwest and Northeast which will drive the national average down through the first couple of weeks of March. This is due to the seasonality of the Midwest and Northeast changing as we continue our drive out of winter and into warmer months.

Jenni: Okay, and what about the flip side, Maze?

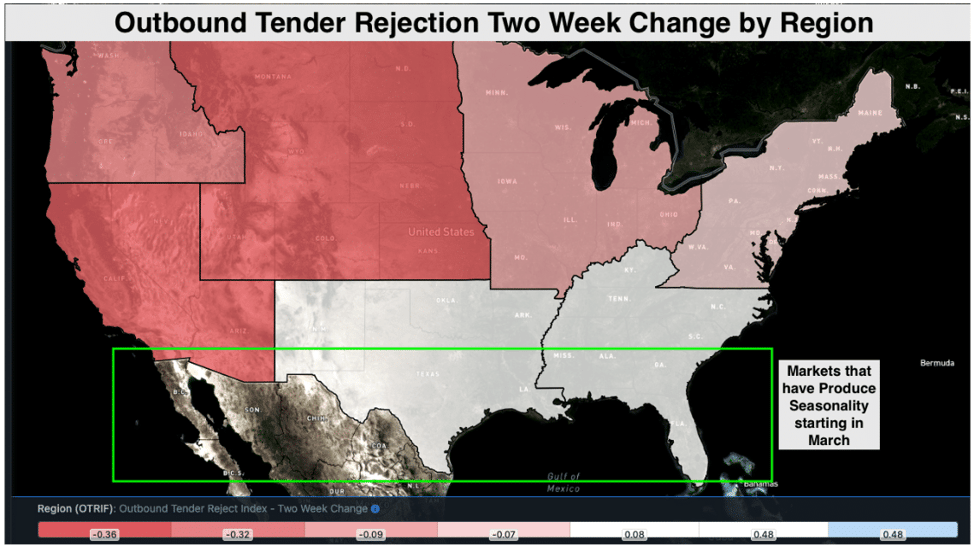

Maze: I believe we’re going to start seeing rates remain stagnant or slight increases week over week and parts of the Southeast and South as we head towards produce season.

Jenni: Now, I’ve been thinking a lot about produce season, especially this year. I’m expecting we’re going to have a more normal one, but what do you think, Maze?

Maze: Well, this year I believe it’s going to be different. We are going to see the apparent seasonality changes throughout the year that we traditionally saw prior to the pandemic.

Jenni: This is a trend that I think we’re starting to notice here, even though we’re only in the third month of the year. That’s heading back to 2019 levels, especially when it comes to seasonality.

Maze: Just as an example, last week we mentioned Valentine’s Day and how it brought seasonality in southern Florida from the imports of flowers from South America. In the month of March, we’re going to see more seasonality play out in the Southeast and South states such as Florida, Texas, and Arizona. These are the first states that are impacted by produce seasonality and then it starts its slow shift up throughout the continental U.S. For shippers and carriers, they need to be prepared for seasonality this year. Shippers need to be prepared for freight, and the changing of costs due to seasonality impacts. And on the flip side, carriers, since it is a very tough market out there, especially for smaller carriers, need to use seasonality trends in their favor to make sure that they are making the most money they possibly can.

Source: FreightWaves

Jenni: Obviously, we always want that for carriers. Now I want to jump into the follow-up of the winter weather watch from last week. So obviously the Northeast-New England area is experiencing snow as we record this episode and we are going to have some more later on in the week. But Maze, what else do you see and what should we be looking out for?

Maze: Last week we did see capacity tighten a little in the Pacific Northwest due to large scale snowstorms, and earlier this week, capacity continues to remain tight in the Plains states and parts of the South, such as Arkansas and Oklahoma, due to the severe storms we saw leaving the weekend.

Jenni: All right, well, you know when it’s time for our regional breakdown. Where are we starting, Maze?

Maze: We’re going to start with the Northeast and Midwest because we are going to see the largest rate decreases in the coming weeks happen in these two regions pending any late winter event. The Northeast right now is sitting around $2.08 per mile and I believe that we are going to continue to see this slide downward this coming week as we head into March. We may not see as much of a decrease this week due to the end of month and winter weather happening, but to be honest, the winter weather shouldn’t have much of an impact as he larger markets like Harrisburg, Pennsylvania and Elizabeth, New Jersey are well outside the impact zone of the snow that we are talking about here.

Jenni: Understood. And now where does the Midwest stand, Maze?

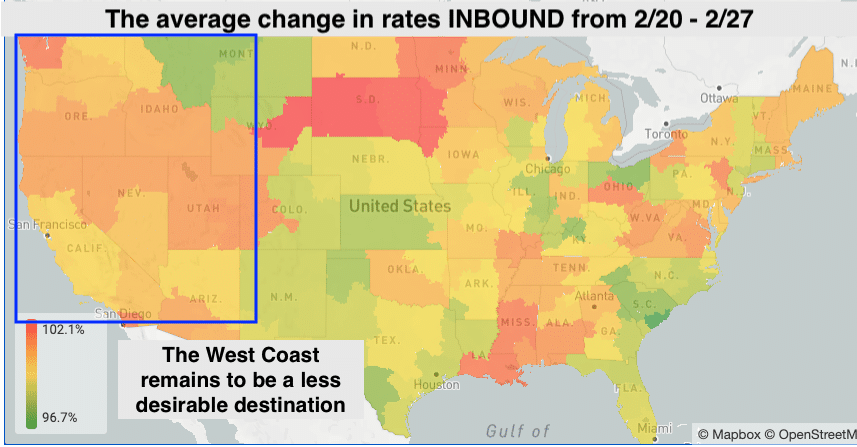

Maze: The Midwest has been somewhat stubborn but we are surely going to start seeing declines as the temperatures get warmer. Now, freight going to the West Coast is important to call out here because freight leaving just about any region but especially the Midwest going back to the West Coast is extremely tight. Carriers are not looking forward to going West with the lower rate they are seeing coming back.

Source: Transfix

Jenni: Let’s take a drive over to the coastal region, Maze.

Maze: I didn’t mention this earlier, but I do foresee rates falling pretty substantially in the coastal region, especially the Carolinas in the coming weeks. They were stubborn in the last couple of weeks, but this week already we are starting to see loosening.

Jenni: Let’s go a little bit further into the Southeast region.

Maze: Now this is where we need to keep an eye on. Rates leaving the Southeast, especially Southern Florida – I anticipate will remain stagnant week over week, if not slim increases. On the flip side, for freight going into the Southeast from just about any region, especially the Northeast and Midwest, we are going to see rates driven down in the market as carriers opt to go there.

Jenni: We will definitely keep an eye out on that, especially for next week. But now let’s go out West.

Maze: It’s still not a gold rush, Jenni. Though like I said earlier, I do believe we’re starting to see even the West Coast bottom out. Rates are somewhat flat week over week for the first time. Though a large part of this is due to winter storms in the Pacific northwest and the tighter capacity they caused. Now I do believe that there’s still room to fall on the spot side for the West Coast, but I wouldn’t be too surprised if we’re nearing the bottom of the spot market.

Jenni: You’ve been saying this for a while Maze, but let’s wrap this all up with the South.

Maze: Leaving the weekend, we saw pretty severe thunderstorms in Oklahoma and Arkansas.

We continue to see tighter capacity in these more remote markets due to weeks of severe storms. But going a little bit further south in Texas, we’re going to see rates fall out of Dallas and Houston as they are the larger freight markets. But I don’t think we’re going to see them fall too much, as the South somewhat starts shifting into produce gear. Markets along the border will especially continue to remain stagnant, if not see slim increases such as South Florida. Now a lot of people may say I’m calling produce season a little too early, but I’m not saying we’re going to see a significant impact in the next two weeks, but we’re going to start seeing it take shape as tender rejections flatten and rates slow their steady week over week declines.

Jenni: I’m hearing a trend of normalcy here as we head into March, but there’s still a couple of areas that I know we need to look out for, which we’ll report back on next week.

Maze: There was one more thing I wanted to mention and that is reefer freight. Refrigerated freight is seeing tender rejections drop to levels we haven’t seen since the beginning of the pandemic. It was during the very short two or three weeks at the beginning where there was really nothing shipping, and rates and rejections fell off a cliff before climbing up for over two years. Now, tender rejections for the refrigerated segment of freight is at 4.25% today. That is the lowest we have seen in the last four years outside of that small room in the beginning of the pandemic when freight almost stopped moving.

Jenni: What does that mean for our shipper partners and what they should be looking at at this point?

Maze: Refrigerated freight is where shippers should be pushing, since rates are at these lows, because this will not last. The Midwest is still seeing strong refrigerated volumes, and like I said, if we do start seeing the South and Southeast shift into produce gear in the coming weeks, refrigerated rejections will go up. Don’t anticipate this sticking around for too long, but shippers, take advantage of it while you can.

Jenni: All right, Maze, as always, great insights coming from you. It looks like we have a lot of things to look out for as we drive into March, especially any indicators that may predict a possible earlier produce season.

We’ll see you next week with an all new episode of the Transfix Take Podcast.

Until then, drive safely.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. Or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. Nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon as such. All views and opinions are subject to change.