National Rate Averages Continue to Take a Nosedive

Welcome to the week of February 21st edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the logistics horizon.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

An Update on The Great Carrier Purge: The Great Carrier Purge continues to reverberate through the market, with a notable 12% increase in net active truckload operating authorities dropping since November, as reported by FreightWaves. Justin Maze underscores the persisting challenge of declining rates, which has prompted many smaller fleets to reconsider their positions in the market. While demand remains robust, it's not yet strong enough to absorb the surplus capacity, which continues to exert downward pressure on rates. This ongoing erosion of rates, particularly in the spot market, poses a significant challenge for smaller carriers reliant on spot freight for their livelihood.

With RFP season in full swing, the gap between spot and contract rates looms large, potentially accelerating the departure of carriers from the market. Yet, as Maze notes, the resilience of certain regions, such as the Southeast, adds an intriguing dimension to the market dynamics, hinting at potential shifts as produce season approaches.

A Look at the Current State of the Markets: Despite pockets of strong demand, the current national rate per mile stands at $1.63, while tender rejections show little change, hovering around 4.7%, signaling a market that, while not overly tight, is far from a complete reversal.

.png?width=872&height=380&name=Screenshot%202024-02-20%20at%2011.16.40%20AM%20(1).png)

Source: Freightwaves

.png?width=872&height=379&name=Screenshot%202024-02-20%20at%2011.36.22%20AM%20(1).png)

Source: Freightwaves

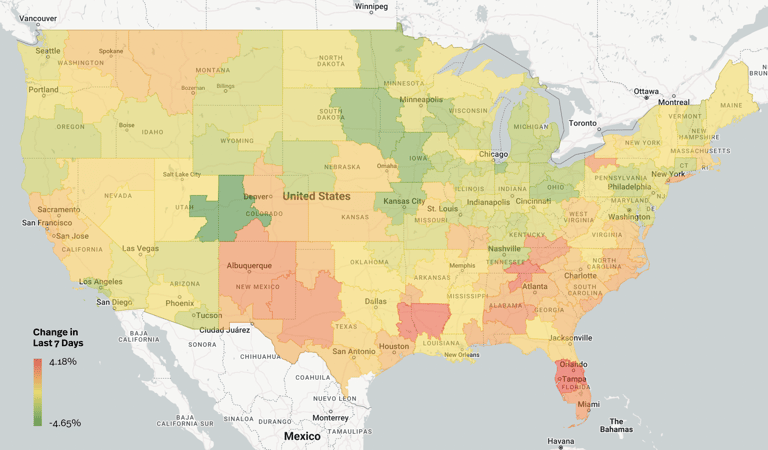

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

Source: Transfix Internal Data

Source: Transfix Internal Data

Northeast: Despite grappling with recent bouts of winter weather, the Northeast finds itself on a trajectory of declining rates, shedding the gains accrued during the winter storms. Rates remain about 5% higher than they were 60 days ago, signaling ongoing adjustments in response to market conditions.

Midwest: Following a pattern similar to the Northeast, the Midwest experiences a gradual decline in rates, albeit at a slightly decelerated pace. Maze highlights the impact of rising diesel fuel costs, which may further temper the rate decreases in the coming weeks.

Southeast: Contrary to expectations post-Valentine's Day, the Southeast maintains its resilience, with rates holding steady or even inching upwards, particularly in Florida. Maze speculates on the implications of this anomaly, wondering whether it foreshadows a robust produce season ahead or merely a temporary reprieve.

South: A mixed bag characterizes the South, with some markets tightening while others cool down. Freight destinations within and outside the region play a pivotal role in shaping these fluctuations, underscoring the interconnectedness of regional economies.

Coastal Region: Despite showing resistance to the downward trend, the coastal region anticipates an imminent decline in rates, with Maze predicting a domino effect within the next two weeks as market forces continue to exert pressure.

West Coast: Holding firm to its reputation as the least favorable region for carriers, the West Coast witnesses a consistent drop in rates, standing 5% lower than 60 days ago. Maze highlights the absence of significant pockets of tightening, signaling continued challenges for carriers operating in this region.

On the Horizon: What to Expect On Next Week's Episode

As February draws to a close, Maze forecasts a continuation of prevailing trends, with national rates poised to reach a new nadir in the spot market before the onset of seasonal shifts in March. Looking ahead, the industry braces for further adjustments as it navigates the complex interplay of supply, demand, and external factors shaping the transportation landscape.

Join us next week for an all-new episode where we close the month out with where we netted out on our February predictions. Until then, drive safely.

To make sure you never miss an episode of the Transfix Take podcast, subscribe on Spotify or Apple Music.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.