Optimism for Carriers Returns for the Holidays

Welcome to the week of December 6th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

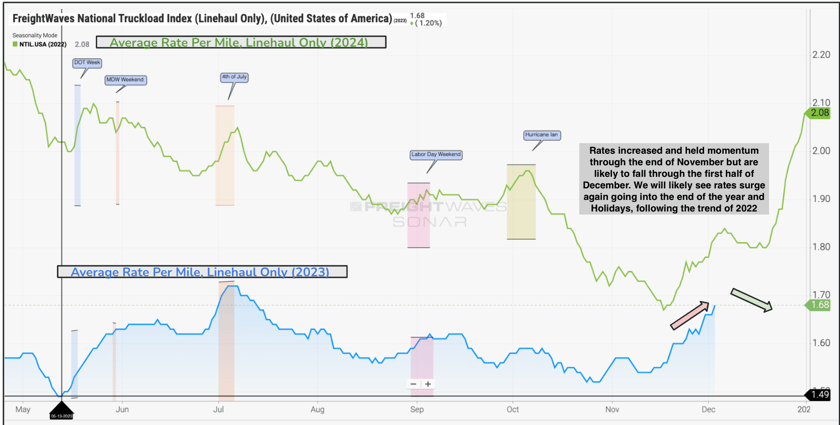

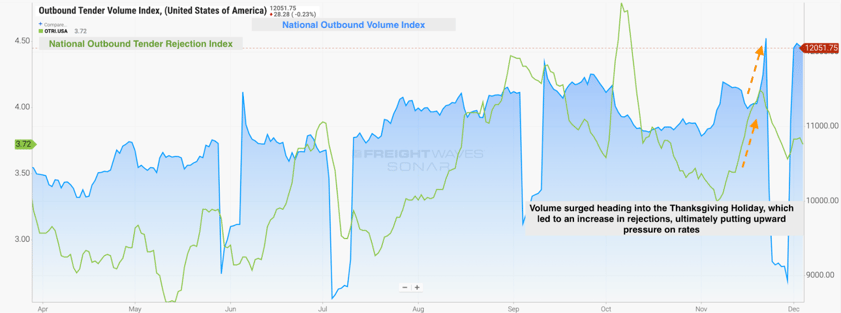

National Average Rate Per Mile & Tender Rejections: Post-Thanksgiving and Black Friday, the freight industry has witnessed noteworthy developments. In the first few days of December, the national average rate per mile has seen a significant uptick, escalating from $1.62 to $1.68, reflecting a 4% increase. Concurrently, tender rejections have risen above 4%, marking a substantial but manageable shift in market dynamics.

Source: Freightwaves

Source: Freightwaves

Optimism Returns for the Holidays: Fuel costs, on the other hand, have experienced a consistent decrease over the past five weeks, creating a favorable environment for carriers. The surge in rates, reaching the highest levels since the first half of July, coupled with declining fuel expenses, points to an encouraging trend for carriers. The optimism stems from an expected spike in volume preceding the holidays, contributing to a 4% increase in average rates. This growth, while not unprecedented, indicates a robust market response to consumer demand. As we navigate the final weeks of 2023, carriers are positioned for a positive turn following a challenging 2023 freight market.

Regional Roadmap: Where the Rubber Meets the Road

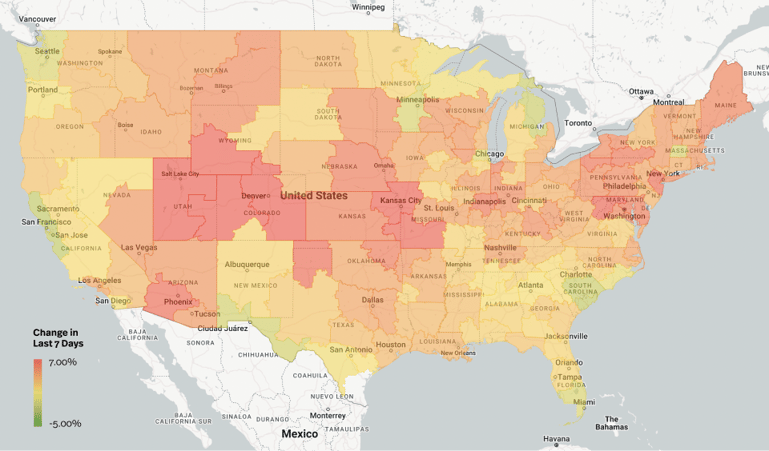

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

Source: Transfix Internal Data

Source: Transfix Internal Data

Northern Regions: Navigating Capacity Challenges

The Northeast: Weather-related challenges have emerged, leading to a 4% increase in average rates. Longer lengths of haul leaving the Northeast, particularly to less desirable regions like the Southeast and South, have experienced the most significant surge.

The Midwest: This region mirrors the Northeast's 4% average rate increase, with major freight markets like Indianapolis, Kansas City, St. Louis, and Columbus, driving the uptrend. As winter approaches, keeping an eye on the Midwest's evolving conditions is crucial for market participants.

West Coast: While remote areas of Montana and Idaho remain stable, markets like Colorado, Arizona, and Nevada have seen notable increases, potentially signaling expedited freight and volatility in the coming weeks. This region anticipates a decline in rates, especially in the Pacific Northwest, following the end of peak seasonality.

Southern Regions: A Landscape of Change

The South: There’s a focus on the major markets which have experienced a rate increase, with some volatility. As capacity adjusts, rates are expected to flatten or decline in aggregate, highlighting the importance of monitoring the region throughout 2024.

The Southeast: Longer lengths of haul have seen a slim increase in rates, yet carriers should anticipate a decline. Shippers are encouraged to advocate for lower rates as the region adjusts to changing dynamics.

Coastal Region: Markets in this region, especially the Carolinas, have witnessed a similar story, with city and local runs maintaining stability, but longer lengths of haul experiencing a slight increase. Rates are expected to decline in the next seven days, aligning with trends in the Southeast.

On the Horizon: What Lies Ahead in the Trucking Terrain

The Next Two Weeks: Comparing year-over-year rates, the industry is experiencing a familiar pattern similar to 2022, with a 14% increase in average rates during the Christmas and New Year period. But, let’s be clear–while we do anticipate an increase, it won’t be nearly as much as last year’s numbers. Looking ahead to the next two weeks, cautious optimism prevails, with expectations of flat to declining rates driven by regional dynamics in some markets particularly in the West Coast while the Midwest and Northeast are likely to maintain higher rates.

Get Prepared for 1H 2024: Don't miss our upcoming webinar on Wednesday, December 13th, at 02:00 p.m. EST, where our senior director of Freight Market Intelligence, Paul Poziumschi, will provide in-depth insights and trends to prepare for the first half of 2024. Secure your spot here.

Stay tuned for more insights and updates in our next newsletter. Drive safely!

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.