The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | Ontario Volumes Hit Yearly High

Jenni: Well, hello and welcome to another episode of the Transfix Take Podcast, where we are performance driven. It’s the week of April 26, and we are bringing you news, insights, and trends for shippers and carriers from our market expert Justin Maze. Maze, always great to be with you. How’s it going?

Maze: Hey, Jenni, great to be with you as well again, as we bring in the final week of April and get a pulse of what’s happening in the freight markets.

Jenni: So, Maze, I shared this sentiment with our portfolio manager Paul Poziumschi on a recent episode of The Transfix Take On podcast for the state of freight. I think the word of the month was likely “stagnant.” Is that right?

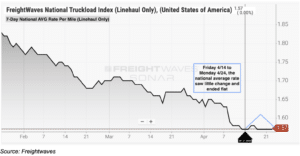

Maze: That’s right, Jenni. Last week we called out that freight markets most likely wouldn’t see too much of a change. When looking at it holistically from a national view, we really didn’t see much of a change at all in most markets, and the national rate itself remained flat week over week.

Jenni: That’s right. If we do a retro of the month, there were a couple of standout regions that you’ll get to that really helped move along produce season.

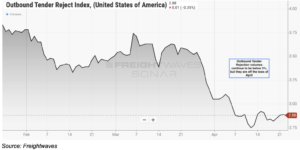

Maze: We’re going to double-click into some important call outs, such as the continued uptick in outbound tender volume in Southern California. Again, looking nationally, there

hasn’t been much change. We’re still right below 3% in tender rejections, but still higher than where we saw it bottom out in the last 60 days.

Jenni: What about with fuel, Maze? Have you seen any changes over the last week?

Maze: We saw that slight uptick that we were calling out for a couple of weeks, but overall, we’re seeing relatively flat fuel rates as well.

Jenni: Got it. So not a whole lot of volatility nationally. But why don’t we note where some of those changes are so that carriers can continue to look for advantages in the market? You know what it’s time for? It’s the regional breakdown. Maze, where are we kicking it off?

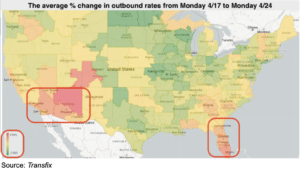

Maze: Let’s kick it off in the Northeast, Jenni. We continue to see rates decline out of the Northeast. Outside of the Midwest, the Northeast continues to have the most ground to see declining rates. When we look deeper into the Northeast, we see that the largest outbound tender volume markets like Harrisburg and Allentown, Pennsylvania and Elizabeth, New Jersey are seeing declines in spot rates greater than more remote markets up in New England. Shippers should be hesitant on outbound Pittsburgh. This market continues to actually see slight increases in outbound rates.

Jenni: We’ll continue to keep a close eye on that. Now, why don’t we move on over to the Midwest?

Maze: Like I’ve called out over the last several weeks, the Midwest is the one region outside of the Northeast that has a lot of room to see continued declining rates in the coming weeks. Now, Jenni, this is important because the winter weather definitely helped carriers maintain higher rates than the other regions around the Midwest. But we are starting to see this fall and we are going to continue to see this fall. To be honest, Jenni, it doesn’t matter what market or length of haul you’re looking at, rates are declining just about everywhere. Now, double-clicking into the larger markets by volume in Chicago, Detroit, St. Louis, Columbus, Cincinnati and Cleveland, all these markets are seeing noticeable declines. It’s only when you go out to more rural parts of Michigan or Minnesota that you’re seeing rates somewhat hold. But again, these are smaller markets with very little volume. Overall, the Midwest will continue to trend down in the coming weeks.

Jenni: Interesting that the East Coast and the Midwest are going to be big indicators for any potential market shifts. But that said, why don’t we look into the Coastal region?

Maze: In the next two to three weeks, we expect these rates to either remain stagnant or slightly increase in the Coastal region. Now this is going to be particularly for the North and South Carolina markets, but we still witnessed a slim decrease over the past seven days from last Monday to today. But again, do not get your hopes up that these decreases will continue because if I was a betting man, I would most likely put my money on the fact that these rates start to see a flattening, if not slight inclines in some markets depending on the destination, while other destinations see slight declines. But overall, I believe we’ll start seeing outbound rates flatten from the Coastal region.

Jenni: That’ll be quite a change considering that over the last couple of weeks we watched some tightness and some looseness happen along the Coastal region. But we’ll monitor that of course. Let’s move on down to the Southeast region.

Maze: Now this is a market that is starting to heat up.

Jenni: I’ve been waiting for the Florida update. Let’s hear it, Maze.

Maze: We can assume it’s produce season, although I’m still not sold that this is necessarily pressure put on by produce season. This is the second week in a row we are calling out Florida for heating up and it’s not a percent or two. We’re seeing markets such as Miami and Jacksonville see over a percent to almost 2% increases in rates, especially the local runs. We are seeing almost upwards of 4% increases out of these markets. Now Jenni, it’s not only the Florida market. Georgia, especially Atlanta, is also seeing pressure with over a percent increase week over week. This is something to keep an eye on, and we may actually start seeing a strengthening in what we anticipated produce season to be. But I am going to say it again, I’m not too sold on it just yet.

Jenni: There we have it, all eyes on Georgia and Florida. Now, why don’t we head on over to the Southern region, Maze?

Maze: We’re continuing to see easing. This is the second week in a row after a few weeks of tightening and to no surprise, most of the major markets such as Fort Worth, Dallas and Houston are seeing the greatest easing. Now I will call out the border markets such as Laredo and El Paso, Texas. They’re not seeing as much easing, but still more than most would suspect if this was produce pressures we’re feeling nationally. Now Jenni, I saved the West Coast for last.

Jenni: So now we are 95 episodes in and I have to say this is by far my favorite Maze-euphemism. What is going on on that coast?

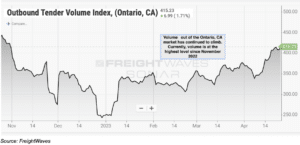

Maze: From last Monday to this Monday we actually saw rates in aggregate out of the West Coast rise. Now this is a big shock, because for months now we have been talking about rates declining out of the West Coast, but I will point to two specific lengths of haul–city and local runs are seeing almost a 2% increase in aggregate out of the West Coast and cross-country runs are starting to see a very slim increase in aggregate. Now, diving a little bit deeper into it, something I called out earlier was the volume in Southern California, the Ontario market to be specific. We are continuing to see an increase in volume even though it’s not having much of an impact on tender rejections. Volume out of the Ontario market is at the highest levels it has been at all year, and it has now been gaining some momentum for the last three weeks.

Jenni: Definitely good news for the West Coast, but any other callouts, Maze?

Maze: Well, Jenni, outside of Ontario, we’re also seeing pressure throughout the state of Arizona. This is the Phoenix market and even the more southern markets such as San Diego, California. This could point towards produce, but I think it is too early to call that just yet. Overall, I actually think that we’re going to see this trend continue on the West Coast. Lanes to be on the lookout for are going to be from Southern California up to the Pacific Northwest. The Pacific Northwest continues to only get looser with less volume, so it’s going to be hard to send drivers and carriers up to the Pacific Northwest from Southern California.

Jenni: Now, Maze I know you’re saying it’s too early to tell, but my gut instinct is telling me that, and I know yours is too, that this freight volume that we’re seeing an upwards trajectory in on the West Coast is probably directly related to produce season freight being hauled. We’ll check back in the next week to make sure. But I know you had one more callout in the Colorado region that we just spoke about. Why don’t you talk to us about that, Maze?

Maze: Well, lastly Jenni, for the West Coast, I will say that when you’re checking out Denver, Colorado, keep in mind that it has been a tricky market to judge because of the weather, but over the past week we’ve actually seen rates decrease by over 2%, leaving the Denver market. Hopefully, with weather really clearing up and leaving us for the season, we shall continue to see outbound tender rates continue to decline.

Jenni: That leaves us with an important question here. Why is it that we’re seeing outbound tender volumes increase even though those imports are continuing to decline?

Maze: That’s a great question, Jenni. Let’s check out imports. There is no great sign in sight just yet. Import volumes continue to be very weak and well below pandemic levels. Demand has seen a slight increase similar to what we saw in the beginning of March, but this will likely head back downward in the coming weeks. It’s important to really put into perspective that import volumes have fallen over 16% since this time last April for the Southern California ports.

Jenni: Now, before we head out, Maze, why don’t you give us a brief rundown on what’s going on on intermodal volumes and how that directly relates to the uptick in volume that we’re seeing on the inland freight side?

Maze: We’ve seen from large publicly traded companies and a lot of headlines that intermodal volumes are on a decline, just like the truckload market and the maritime market have been. Now this could be directly linked, obviously, to imports. Imports are down, so the amount of volume that needs to be moved through Intermodal is also declining. But additionally, we could start seeing more freight that a shipper may traditionally put on intermodal over the road instead, since over the road rates are continuing to decline. You are not saving so much money now picking a train over a truck.

Jenni: Boy, how things have changed. Well, Maze, I know next week we’re going to talk about how the potential impact of DOT’s Blitz Week, that is, May 16 through May 18, may potentially impact rates for carriers or potentially rejections. We’ll see.

Until then, we will see you next week with an all new episode of the Transfix Take podcast.

Drive safely.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. Or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. Nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon as such. All views and opinions are subject to change.