The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | Dusting Off the Crystal Ball for May & June Projections

Jenni: Well, hello and welcome to an all new episode of the Transfix Take podcast where we are performance driven. It’s the week of May 3, and we are bringing you news, insights, and trends for shippers and carriers from our market expert, none other than Justin Maze. Maze, I know I always say this, but I cannot believe it’s another month gone.

Maze: Hey, Jenni, it’s great to be back with you as well as we turn the corner into May.

Jenni: So April was the least eventful month I think we’ve had in a while. Do you think May is going to change that?

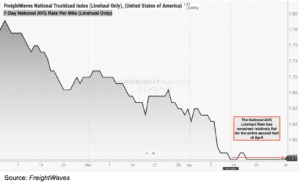

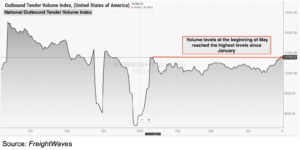

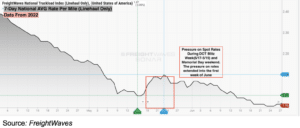

Maze: Well, Jenni, as we kept saying the last couple of weeks, nothing’s really changing at the national level. Since the 13th of April, we have seen rates at the national level basically sitting flat at $1.57 per mile, and that’s line haul. To unravel this a little bit, we actually have seen volume increase throughout the last two weeks of April with volume levels the highest they’ve been since January. Now, this definitely plays into the hand of why rates are naturally sitting flat. Additionally, Jenni, when we look at tender rejections, we don’t see much movement here. If anything, they’re continuing to move slightly upward.

Jenni: That leads us to the conclusion that we’ve all been saying for the last couple of months: I think we’re finally starting to see the bottom. You predicted it would be in May.

Maze: That’s right, Jenni. At a national level, these trends are starting to signal a bottoming in the market. But we’re going to dive into the regional outlook because each region is telling a slightly different story, as seasonality is popping up throughout the country. But as you said, nationally, it does look like carriers may potentially be finding the bottom of the market.

Jenni: In freight, what goes down usually comes back up, so this is going to be an interesting unraveling of events over the next two months, probably.

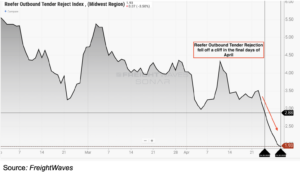

Maze: Well, Jenni, before we jump into the regional breakdown, I want to call out the reefer market.

Jenni: Go for it. Let’s hear it.

Maze: Over the last week of April, we have seen this market die down with rejections now below 3%. That is a record low rejection rate for reefer freight. This was heavily driven by two regions, the Northeast and Midwest, where tender rejections have actually fallen below 2% as we turn into today, May 1. Now, on the flip side, tender rejections in the South and Southeast are actually starting to see slight climbs, but not enough to compete with the drop seen in other regions.

Jenni: Which is something that both shippers and carriers can take advantage of if they play their cards right in the proper region. Is that right?

Maze: That’s right, Jenni. So shippers better look at this and take advantage of it out of the Midwest and Northeast. And for carriers out there, this is signaling room for opportunity – If you have a reefer unit in the Southeast and South.

Jenni: So May is already on track to being somewhat of a busier month than what we’ve seen in the past couple of months at the start of the year. Maze I know, we’ve got a big event coming up in the next two weeks that both shippers and carriers should be aware of.

Maze: DOT week – a little over two weeks away. What are we going to see? Is this flatlining nationally going to actually start seeing a slight increase? Well, we’re going to talk about that after the regional breakdown.

Jenni: Oh, man, the anticipation. All right, Maze, I’m calling you out here. What are you seeing at a high level when it comes to rates nationally?

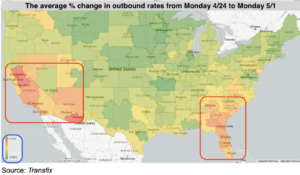

Maze: At a high level, out West and in the Southeast, especially California, Arizona, Florida, and Georgia, we are seeing capacity slightly tighten, putting pressure on rates, leaving these states.

Now, on the flip side, freight going into these areas are seeing rates trend downward. Additionally, the Midwest continues to see rates fall as capacity loosens. This will continue over the coming weeks, and carriers need to be aware of this.

Jenni: Great call outs from a macro perspective. But, you know, we’re all about the micro here at Transfix. So, Maze, where are we going to get started in this week’s regional breakdown?

Maze: Let’s jump up into the Northeast and start there. Jenni, we are seeing rates continue to drop pretty significantly week over week. Now, there are some spots of tightening, the Philadelphia market especially, which encompasses southern Jersey. But just about every other market in the Northeast is seeing continued declines week over week. Now, especially for freight heading out West or to the Southeast, we are seeing more significant declines. So carriers, you know, you’re going to get paid less going to the hot markets and shippers – make sure you keep an eye on this as you start moving potential spot freight down South or to the West Coast.

Jenni: Okay, why don’t we jump on over to the Midwest?

Maze: This is where there is the most opportunity for shippers, but also the most opportunity for carriers if they’re heading into the Midwest. Overall, just about every market is seeing a decrease week over week, just like the Northeast and this is the region with a lot of opportunity for continued downward momentum on rates, and we will likely see this continue throughout the month of May, with the exception of the holiday and DOT week, which we’re going to jump into later.

Jenni: Lots to cover there. Why don’t we take it on down to the Coastal region, Maze?

Maze: This is now the second consecutive week that we are seeing the average rate out of the Coastal region increase. Now, when you double click into this, you’re only really seeing rates increase if they’re picking up in the Coastal region if they are heading to the Northeast or Midwest. And it makes sense, Jenni. We just talked about it. Carriers are going to get paid less leaving the Northeast and Midwest. On the flip side, if you are picking up in the Coastal region, prepare for lower rates going down to the Southeast or South, even parts of the West Coast.

Jenni: Why don’t we move on down to what some would consider a hot region right now, the Southeast, Maze?

Maze: This is now the third week in a row really signaling a trend of continued rate increases. Now this may be produce season, it may not be, but overall the tightness in Florida has expanded throughout the state of Georgia as one of the largest markets by volume: Atlanta, Georgia has continued to see 2%+ increases in average rates leaving.

Jenni: And let me tell you something, 2% is quite a large jump considering the market. But why don’t we jump on over to the West Coast? Are they still the best, Maze? What’s going on there?

Maze: Looking up in the Pacific Northwest, there is not freight leaving there and rates continue to decline. But when you look at California and Arizona, like we mentioned earlier, these are opportunities for carriers to push to get higher rates, especially in Northern California. Now this is again three weeks similar to the Southeast that we’ve seen, the trend in California and Arizona point to more pressure on rates. The question is, how long will this last? Because Jenni, for one thing, these increasing rates out of the West Coast are actually making freight destined to the West Coast come down.

Jenni: Yeah, I figured that would be the case, considering that was more of an unexpected turn of events in regards to the California market. But why don’t we close out the regional breakdown with the South?

Maze: The South is a mix of two stories. We have some markets along the border seeing increases along with Fort Worth and Dallas, which are major markets, but how long will this last? And Texas has been flipping and flopping week over week, so there’s no clear trend just yet outbound Texas. Now for Oklahoma and Arkansas. These are much smaller states by the size of volume, but we really aren’t noticing too much change. It’s remaining relatively flat.

Jenni: So I’m a little surprised by that just because I’m fully expecting for the South to at some point flip and support the amount of Mexican imports that we’re going to see as a result of produce season, like we called out in the state of freight episode. But that said, I think we’ve stalled enough. Why don’t we get into the most pressing topic of this show.

Maze: That’s right, Jenni. DOT Blitz week is just weeks away. As you mentioned, it kicks off Tuesday, May 16 and ends May 18. This is a three-day blitz. And for those of you out there that don’t fully know what I mean by the blitz week, it’s a week where a lot of carriers actually take their capacity off the roadway. And a lot of drivers end up taking vacations because they don’t want to be put out of service, they don’t want to go through additional inspections. And this usually causes some pressure on rates and pushes more contract freight over to the spot market.

Last May, we were still somewhat at the beginning of a declining market. A lot of people didn’t think we’d see any pressure from DOT week combined with the Memorial Day weekend, but in fact we did see some pressure. We saw rates actually increase by just about 5% line haul wise. More importantly, it’s how long it lasted. We saw the pressure on rates last for almost a week and a half into June.

Jenni: Yeah, so there’s no surprise that we’re likely going to see an increase in tender rejections, especially out of the nationwide market. But another thing to note is that this comes up right on the heels of Memorial Day weekend where drivers also like to take their trucks offline, go on vacation and not run freight. So it’s going to be an interesting month.

Maze: And the question is, will carriers be able to use this period of time as an opportunity to put prolonged pressure on rates in the market? Now one thing they have going for themselves is that rates nationally have already started to flatline. How can they utilize DOT week combined with Memorial Day weekend to put prolonged pressure there? But again, when we go back to last year, we did see rates drop leading into the back half of June pretty significantly and that could happen again this year even if carriers are able to push up rates going into DOT weekend and Memorial Day weekend.

Jenni: Well, it’s been a while since we pulled out the crystal ball. So what do you say Maze, what do you think this is going to lead to in the next couple of weeks or I guess the next two months?

Maze: Well Jenni, we will see rates increase through the DOT week combined with Memorial Day weekend. I think it’s not going to be much different than last year to be honest. There’s still a lot of extra capacity out there. I know markets in Southern California, California as a whole and parts of the Southeast are starting to trend upwards. But at the end of the day, drivers are not making as much as they have been in the past couple of years and they’re going to be more reluctant to take their equipment off the roads. But by the second week of June we’re going to see these rates come back down because the demand is just not going to be there from the shippers.

Jenni: Well, good sir, we will just have to wait and see. Until then, we will see you next week with an all new episode of the Transfix Take podcast.

Drive safely.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. Or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. Nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon as such. All views and opinions are subject to change.