The midweek market update is a recurring series that keeps shippers and carriers informed with market trends, data, analyses, and insights.

Transfix Take Podcast | Markets Are Running Stagnant, But What Are the Big Callouts?

Jenni: Hello and welcome to an all new episode of the Transfix Take podcast where we are performance driven. It’s the week of May 10 and we are bringing you news, insights, and trends for shippers and carriers from our market expert, none other than Justin Maze.

Maze, it’s always great to be with you. How’s it going?

Maze: Hey Jenni, it’s great to be back with you as well this week to talk more about freight markets and see how the last week played out and what we’re looking for in the coming weeks.

Jenni: All right, well, I know we’ve got a lot to cover today, so what is top of mind for you?

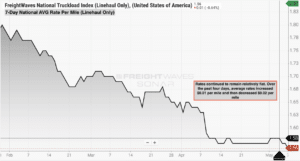

Source: FreightWaves

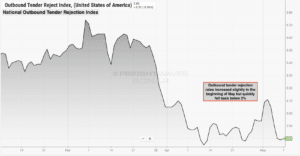

Source: FreightWaves

Maze: Well Jenni, to jump right into it looking at a national view, we saw the market continue to remain stagnant. Now I’m sure you think I’m just sounding like a broken record here, but really Jenni, last week we saw rates jump about a penny per mile to $1.58 up from $1.57 per mile down to a $1.56 line haul only this past weekend. And to be honest, Jenni, this week we’re going to continue to see that stagnation for the rate per mile line haul only at a national view.

Now, the last two episodes we talked about slight increases in tender rejections. Well this past week we actually saw tender rejections fall back down to right around the all-time lows. They were above 3% just a week ago. And now this week we are seeing them at 2.8%.

Jenni: And why do you think that is, Maze? Because this feels like something that is very unusual to the industry.

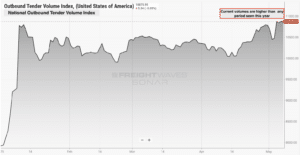

Source: FreightWaves

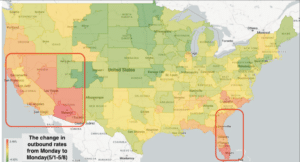

Source: FreightWaves

Maze: That is interesting Jenni, because at the same time we’re still seeing outbound tender volume at all-time highs year to date. That’s right, volume continues to be stronger and I use that word a little loosely because volumes are still very weak compared to the pandemic levels, but they are the strongest they’ve been all this year. And we did see tender rejections climb up past 3% not too long ago, but like I said, they are falling back below 3% while rates remain pretty stagnant at a national view.

Source: FreightWaves

Source: FreightWaves

Jenni: Okay, so it looks like the spot market has really taken a hit for the last couple of months. I know that we’ve said how low can we go when we’ve reached the bottom, but are we there yet?

Maze: That’s right, Jenni, it looks like at a national view we may have found that bottom of the spot market with rates bottoming out and only slight volatility in specific markets throughout the country. Not only that, if we look back over the past week, there were a lot of Q1 earnings reports that hit the street for large publicly traded companies and there’s a lot of the same sentiment of not knowing where the rest of this year will be. But reflecting back on April and understanding that it kind of sheds some light on a bottoming.

But just how long will the market remain where it is right now? Now, just to call it out, Werner’s CEO Derek Weathers said it particularly well and basically put it out there as we have seen the low in April. Just how long will it remain going sideways is the question in debate. Now, Jenni, I have no crystal ball but I am really starting to think that unfortunately for carriers, this low-rate atmosphere is going to continue farther than we originally anticipated, if not throughout the remainder of 2023.

Jenni: And so at this point it makes more sense for carriers to really stay focused on their shipper relationships as opposed to playing in the spot market.

Maze: There is still some optimism left in me. Let’s just look at next week. Next week is DOT Blitz week which we touched on last week, Jenni. But on top of that, as we mentioned, is the Memorial Day weekend and it is definitely one last opportunity carriers have to try to push up the stagnant national rate right now. And I do think we’re going to see some movement. Rates will go up, there will most likely be higher tender rejections leading to higher rates in the market and tighter capacity, but I don’t think it’s going to be much of an impact that’s super noticeable to anyone outside of the industry and not really a concern for shippers.

Jenni: But I do wonder what Memorial Day is going to look like this year around and then when we get into July, what is the 4th of July look like? And not to mention we are still very much in the beginning of produce season.

Maze: You’re right Jenni, it is also the beginning of produce season and to be honest, we are seeing some pockets that point to produce impacting capacity. You can look in Southern Florida or Northern Cali or different parts of California like the Fresno market where we’re seeing rates continue to increase and capacity tighten.

Jenni: Yeah, I couldn’t agree more. Those magic spots are definitely on the West Coast and the Southeast as we’ve been talking about for the last couple of weeks. But I know you’ve got a fuel update in there somewhere, Maze. So why don’t we hear it?

Maze: We are continuing to see the cost of diesel fall and this is going to be most likely the fourth consecutive week of falling prices. Now for carriers, that’s a great sign, it’s a relief at the pump and it also translates over to shippers as they have to pay less on the fuel surcharge. So it’s not all bad news. There is some good news out there.

Jenni: And our carriers really could use the good news. So love hearing that. You know what, it’s time for the regional breakdown. Some of these markets are going to start to sound the same as you’ve mentioned at the top of the show, but why don’t we start with the Northeast?

Maze: Every market is seeing downward pressure on rates. Rates continue to decline. This is especially true for freight leaving the Northeast destined to any market in the South, Southeast or Coastal region. These are carriers that are trying to get out of one of the lowest-paying regions to more optimistic parts of the country.

Source: Transfix

Source: Transfix

Jenni: Now let’s move on over to the Midwest, Maze.

Maze: It continues to show the same qualities as the Northeast. Every market outbound saw a week over week change with lower rates. Now again, rates going to the West Coast, going to the South and Southeast are the most desirable for shippers because these rates are decreasing the most as carriers again are trying to move towards these markets to get higher paying rate per mile.

Jenni: It’ll definitely be interesting to see where the West Coast is at the end of the month, but why don’t we move over into the Coastal region breakdown?

Maze: For Coastal, it’s a different story. The region remains pretty stubborn. Some of the larger markets like Charleston and Charlotte are still seeing some increases slightly week over week, while just about every other market leaving the Coastal region is seeing slim declines. Now again, just like the Southeast and Midwest, it depends on where the freight is destined. Carriers are not looking to go back to the Midwest from the Coastal region, but they are super optimistic on getting better paying freight if they end up in the Southeast and South. And that is where carriers are heading at lower rates week over week.

Jenni: And what’s going on in the Southeast region – our one to watch.

Maze: This is the region I continue to call out because we are still seeing Southern Florida heat up, not just Southern Florida, but just about all of Florida. And this could really point to produce season starting to pick up. Now one big change I would say is the Atlanta market. This is the largest market by volume out of the Southeast and on the East Coast. Last week we talked about how this market was starting to tighten. Capacity was getting a little more difficult. Well, just one week later, Jenni, we’re starting to see relief as rates continued to decline over the past week and I don’t think we’re going to see a change this coming week.

Jenni: Okay, well, I know we’re all dying to know what’s going on in the West Coast. So Maze, do you have any call outs, anything of note there? I know that all of our carriers that are listening right now especially want to hear about it.

Maze: It’s looking like one of the most optimistic origins for carriers. A lot of markets out in the West Coast are continuing to see that trend of increasing rates. Just take Southern California, Los Angeles and Ontario are now seeing over four weeks of continued rate increases. Yes, they are slim, but Jenni, they add up for carriers. Now one area of optimism for shippers is outbound Denver. We are now continuing to see rates decrease outbound Denver as we are, let’s hope, in the clear of bad weather for the rest of the year. When we move on down to Arizona – this is another flag for produce as the Phoenix market and all other markets throughout Arizona are really starting to see pretty substantial rate increases week over week. And like I called out earlier in the episode, Jenni, the Fresno market in Northern California, which is a pretty sizable market for produce, is continuing to see increases, pointing to potential pickup in produce a little early this year.

Jenni: Man, there is definitely a lot happening over there on the West Coast. But what’s going on in the South, Maze?

Maze: It’s definitely a mixed story. Like we called out last week, it’s not really pointing to anything saying produce is coming through the border markets as most of Texas continues to see downward pressure on rates. Actually, Jenni, just about every market except for Texarkana, Texas. Now Dallas, Fort Worth, El Paso, Laredo, Houston – the larger markets throughout Texas -continue to see that downward pressure with rates decreasing week over week for the second week in a row.

Jenni: Yeah, I feel like there’s a lot happening, but at the same time, not a lot happening. How can that be?

Maze: That’s right, Jenni. Not much of a difference. But we used to talk about crystal ball and how high are rates going to go, how long are they going to stay this high throughout the pandemic? And at this point, I see us ending the year right around where we are today. I think there’s going to be periods where we see the national average dip a little bit lower and then increase as well. But one thing that I cannot hammer away enough is carriers understanding the market to make the most of it, especially again if you do not run consistent contract freight. Know what markets and regions are hotter which months, because these things do change pretty rapidly.

Jenni: No truer words have ever been said on this podcast. If you hear this episode, carriers, and you find it helpful, please share it with your network. It’s really great to stay on top of these things. We’ll see you next week with an all new episode of The Transfix Take podcast.

Until then, everyone, please drive safely

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc. Or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable, but neither Transfix, Inc. Nor its affiliates, nor the companies with which the participants are affiliated warrant its completeness or accuracy and it should not be relied upon as such. All views and opinions are subject to change.