April Showers Brings Potential Rate Hikes

Welcome to the week of April 3rd edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the logistics horizon.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Co-hosts Justin Maze and Jenni Ruiz share the following highlights and updates:

The (Hopefully) Last Big Winter Storm in Spring: This week, the Midwest to Northeast corridor is bracing for a significant winter storm, potentially causing shipment delays and driver risks. The Top 5 Worst Weather Lanes, powered by WeatherOptics, include Minneapolis to Chicago, Buffalo to Boston, Boston to Philly, Los Angeles to Phoenix, and Kansas to Chicago. With projected delays and elevated risk scores, it's advised to reroute shipments along safer lanes, particularly south along US 6 and I-70. While the storm hasn't yet impacted movement, lower-volume markets and lanes are most susceptible. This weather event may offer carriers a rare opportunity for rate increases, especially in affected regions.

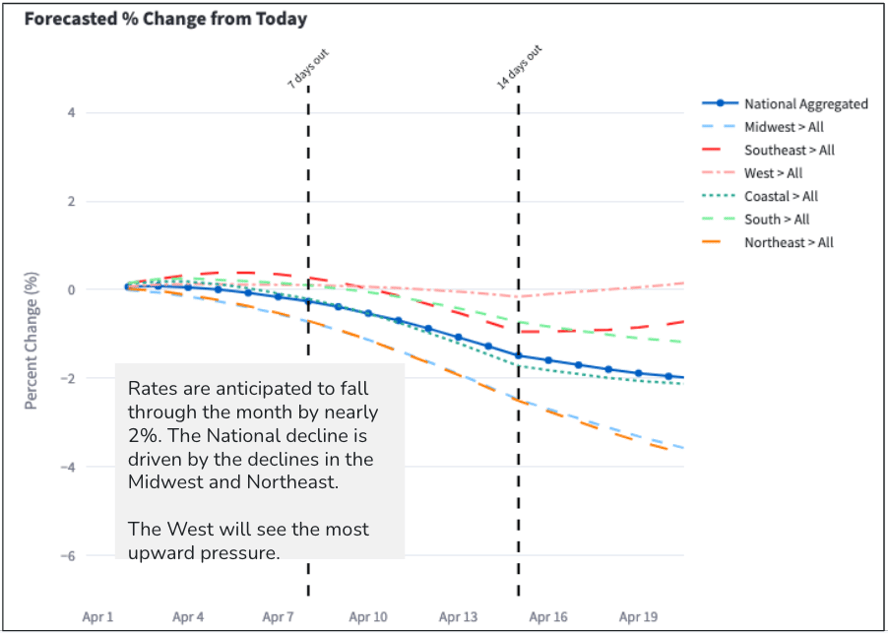

A Continued Flat Market: As Maze noted, we’re kicking April off with a National Average Rate Per Mile that’s sitting $1.65 linehaul only. Even all-in rates remain flat at $2.28 and may continue the trend through the next 7 days. When we look at tender rejections, there’s a slight uptick from last week with van rejections at nearly 3.5% and reefer rejections at 4.65%. Maze anticipates seasonality playing a role in the third week of April which could show some more notable upticks in these numbers.

.png?width=889&height=421&name=Screenshot%202024-04-03%20at%209.15.44%20AM%20(1).png)

Source: Freightwaves

Source: Transfix Internal Data

.png?width=887&height=421&name=Screenshot%202024-04-03%20at%209.13.15%20AM%20(1).png)

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

Source: Transfix Internal Data

Source: Transfix Internal Data

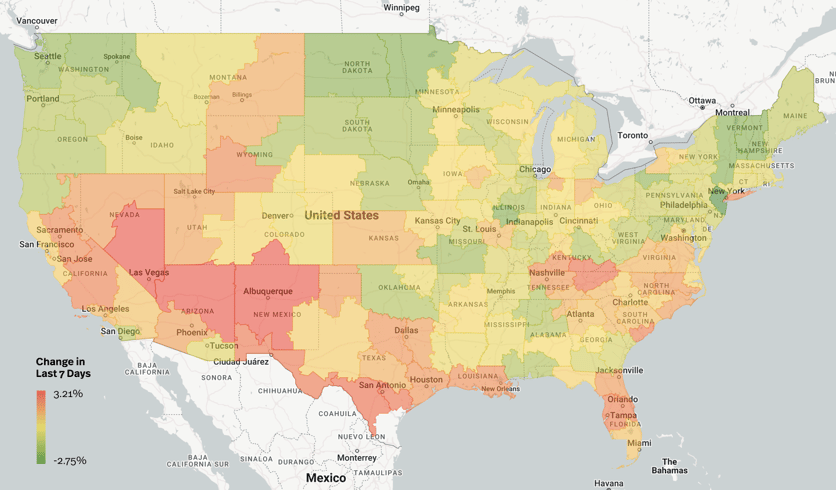

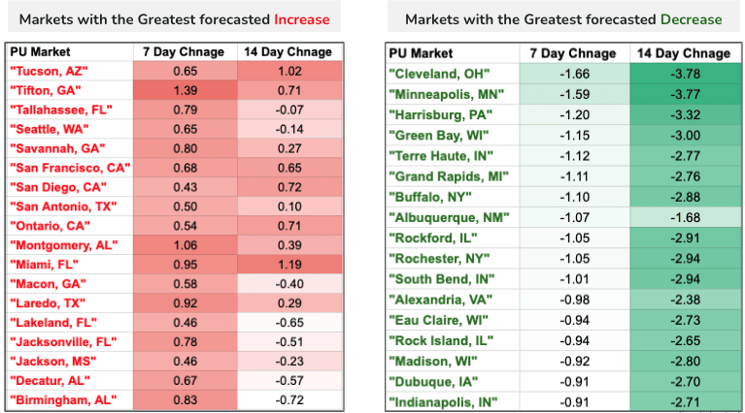

South: Tightness persists in Texas, notably in San Antonio and Laredo, driving rate increases due to capacity constraints, potentially attributed to imports from Mexico. Anticipation builds for the upcoming produce season.

Southeast: Continues to tighten across all lengths of haul, particularly in Florida and Atlanta. Rate increases remain marginal but are expected to gain momentum as produce season progresses.

Coastal Region: Experiencing a split in tightening, with freight going north tightening while southbound lanes are loosening. This dynamic is influenced by destination markets, with rates fluctuating accordingly.

Northeast: Despite marginal gains in certain markets like Brooklyn, Buffalo, and Rochester, overall loosening continues, especially for freight heading south. Anticipation of further downward pressure, particularly in the second half of April.

Midwest: Mixed trends with high volume markets remaining stable while rates for freight heading south and southeast are on the rise. Expected to see a slight decrease in rates over the next two weeks with more significant downward pressure later in April.

West Coast: Witnessing tightening across most markets, particularly in Nevada and California, driving rate increases. Importantly, shifts in capacity due to weather impacts are influencing rate dynamics, with rates expected to continue fluctuating rapidly.

Source: Transfix Internal Data

The Crystal Ball Predictions for April

A new month means it's time for another set of crystal ball predictions. Here’s what Maze predicts.

- National Outlook: Justin Maze predicts a slight softening of the freight market in April. Anticipated changes include:

- Average Rate: Expected to decrease by approximately 1.5% nationally.

- Tender Rejections: Predicted to remain relatively flat, ranging between 3.25% and 3.75%.

- Regional Variations:

- Midwest and Northeast: Likely to see significant downward pressure on rates, potentially up to a 4% decrease in the second half of the month.

- Southeast and West Coast: Expected to see an average rate increase of about 2%.

- Factors to Watch: May is anticipated to bring more volatility due to DOT Week and peak produce season.

Happy Q2 and we’ll see you next week with an all new episode of the Transfix Take podcast. Until then, stay dry and drive safely.

To make sure you never miss an episode of the Transfix Take podcast, subscribe on Spotify or Apple Music.

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.