‘Tis the Season for Turkeys, Christmas Trees, & Imports

Welcome to the week of November 16th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

Industry Insights: Unpacking the Road Ahead

In this week's edition of Transfix Take, we bring you the latest updates and insights from the world of freight. Our market expert, Justin Maze, and Jenni Ruiz, share the following highlights and updates:

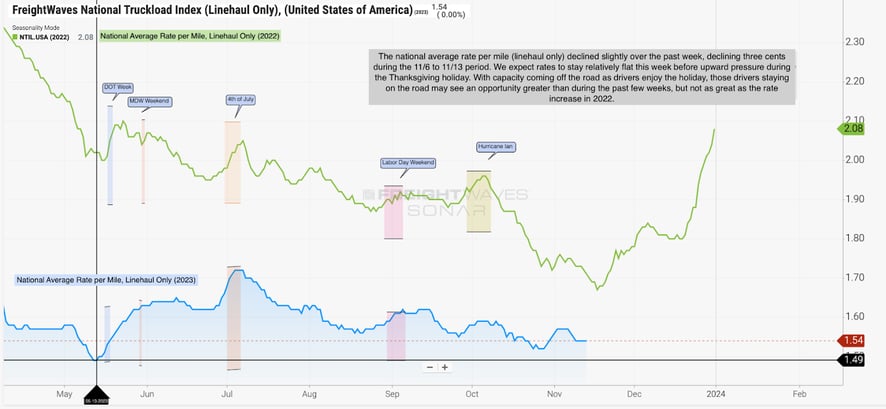

The National Average Rate Per Mile: This week, we experienced a slight decline at $1.54, mirroring the cooldown in the freight market observed over the past week. However, the larger story lies in the upcoming holiday season. Keep an eye on the national average, especially midweek, where we may see increased pressure on the spot market, particularly for longer lengths of haul.

Source: Freightwaves

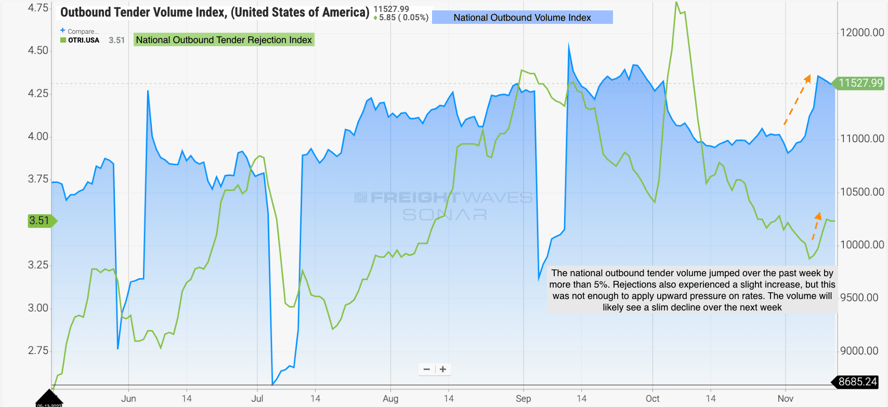

Tender Rejections: Still, there are no signs of a significant increase even though volume increased by more than 5%. This indicates the ample capacity in the freight market. This week, we’ve seen noticeable shifts in tender rejections in the South, Southeast, and West Coast markets. Some added pressure may show in reefer freight with the increased transport of turkeys leading up to the November holiday.

Source: Freightwaves

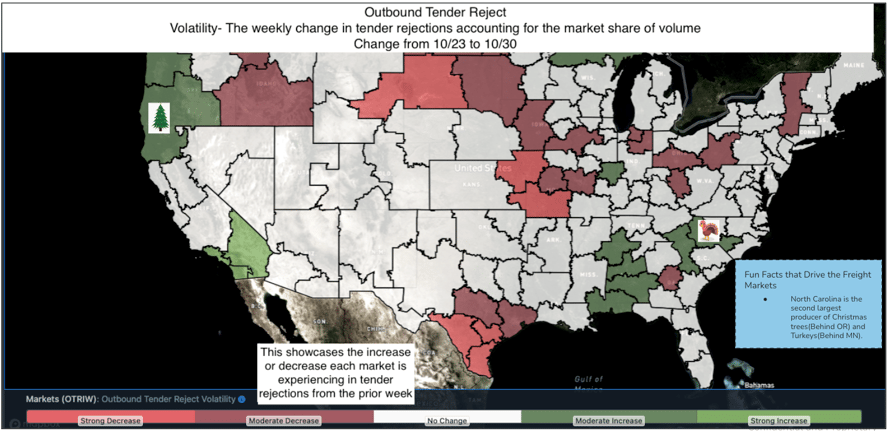

Source: Freightwaves

Regional Roadmap: Where the Rubber Meets the Road

Below is a regional breakdown of the freight industry, uncovering nuances and trends in various regions across the nation.

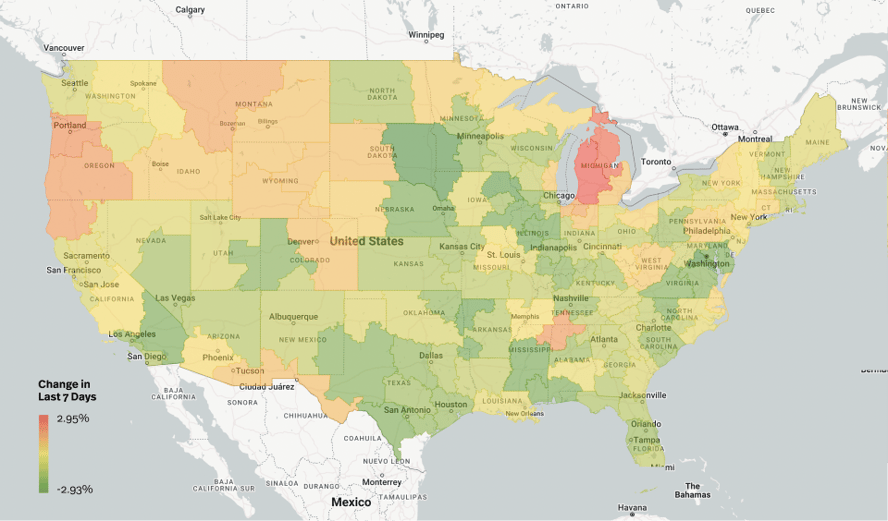

Source: Transfix Internal Data

West Coast: This region experienced a slight rate decline, particularly in the northern part, including the Pacific Northwest and remote states like Montana, Idaho, and Wyoming. Larger volume markets such as Ontario, Los Angeles, Las Vegas, and Phoenix also saw a decline in rates. However, keep an eye on the Pacific Northwest and the northern West Coast as they may show an uptick in tender rejections and a possible increase in rates.

Fun Fact: Oregon is the largest producer of Christmas trees in the US.

The Midwest: This region continues to see declines, with the largest volume markets like Chicago, Indianapolis, St. Louis, and Columbus experiencing decreases in the average rate over the past week. Michigan briefly tightened, but this might be short-lived. Carriers are still showing interest in hauling freight from the Midwest to the Northeast.

The Northeast: Some tightening is observed in the Northeast's highest volume markets, such as Harrisburg and Allentown, Pennsylvania, and Elizabeth, New Jersey. Winter weather disruptions may play a role in the Northeast's market dynamics with a possible snowstorm developing.

Coastal Region: The Coastal region is showing loosening trends, with rates declining in every market except Norfolk, Virginia. Reefer volume is increasing, especially with Thanksgiving around the corner, but this hasn't significantly impacted rates yet. However, we do expect that to change as we approach next week.

Fun Fact: North Carolina is the second-largest producer of turkeys in the US. Gobble Gobble!

The Southeast: The Southeast is characterized by a significant capacity surplus, leading to rapid rate declines. Carriers heading to the Southeast should negotiate premiums, as leaving the region may result in lower-paying freight options.

The South: The South is experiencing overall rate decreases, except for the El Paso, Texas market. Drivers out of the South show a preference for heading to the Midwest and Northeast, where more favorable freight markets exist.

On the Horizon: What Lies Ahead in the Trucking Terrain

Looking ahead, carriers should brace for potential changes in market dynamics as we approach the Thanksgiving holiday. While the national average rate may continue a downward trend this week, the following week could bring different challenges and opportunities. Carriers should pay close attention to lengths of haul, as drivers may aim to stay close to home during the holiday week. We also anticipate drivers going offline potentially bringing tightness to markets nationwide.

As we navigate through the holiday peak season, volatility in the spot market is anticipated. Inventory levels and import volumes will be key indicators to watch, shedding light on the market's direction in the coming weeks. Stay tuned for more insights and updates in our next newsletter. Drive safely!

DISCLAIMER: All views and opinions expressed in this podcast are those of the speakers and do not necessarily reflect the views or positions of Transfix, Inc., or any parent companies or affiliates or the companies with which the participants are affiliated and may have been previously disseminated by them. The views and opinions expressed in this podcast are based upon information considered reliable but neither Transfix Inc. nor its affiliates nor the companies with which the participants are affiliated warrant its completeness or accuracy, and it should not be relied upon. As such, all views and opinions are subject to change.