Will the Second Half of ‘23 Weather the (Rate) Storm?

Welcome to the week of August 30th edition of the Transfix Take! Gear up for the latest updates and trends in the trucking industry. In this issue, we're revving up with industry news, sprinting through regional breakdown highlights, and putting the spotlight on what's on the horizon for truckers.

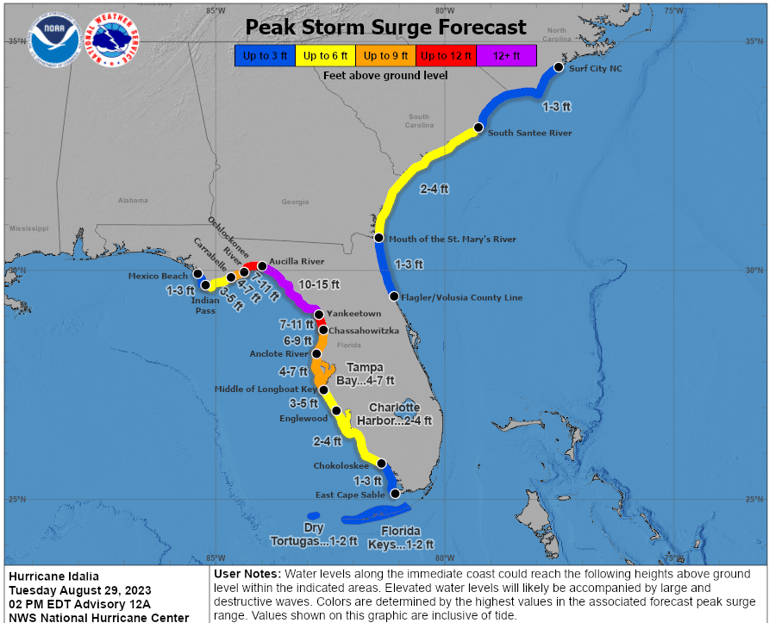

Hurricane Update: Navigating the Storms

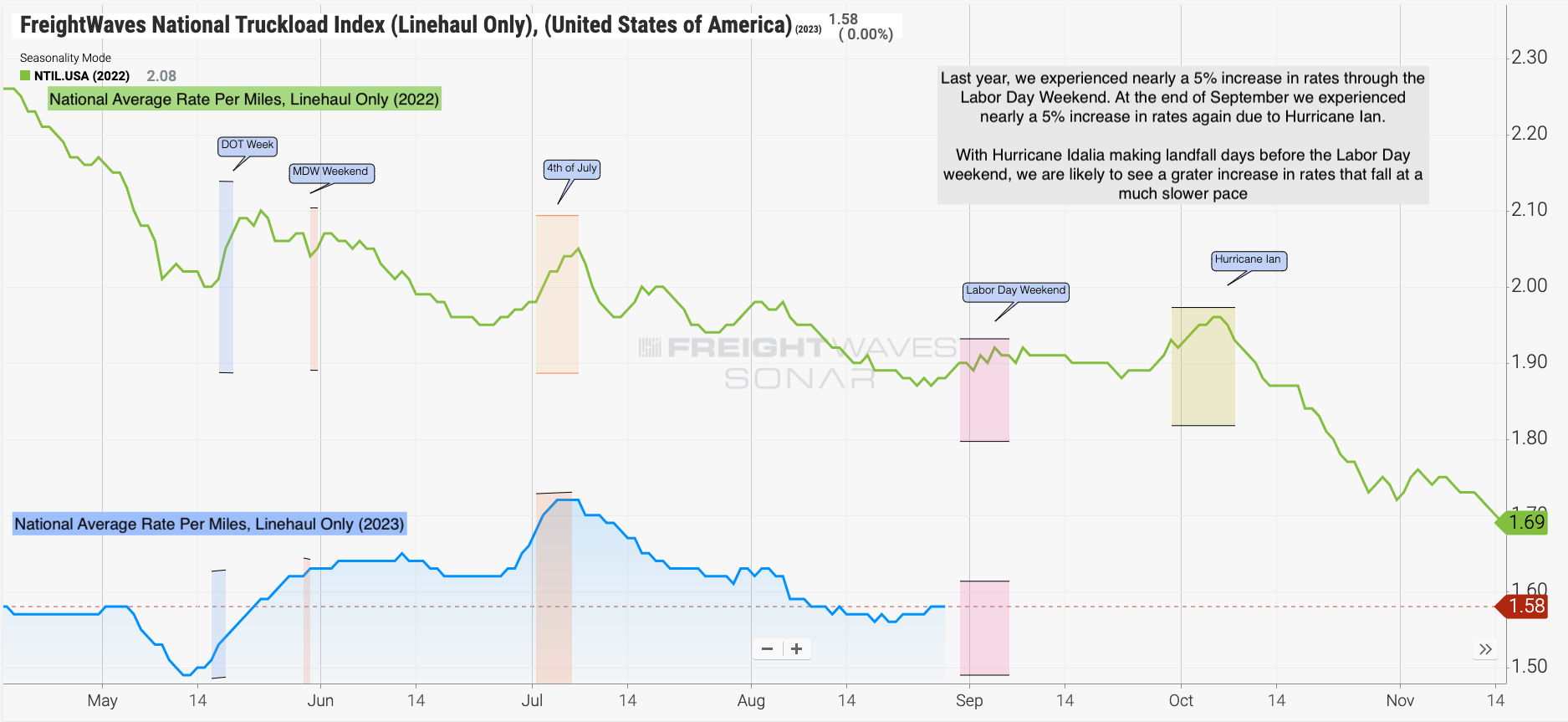

Hold onto your hats! Hurricane Idalia is rapidly gaining strength and inching closer to Florida's coastline. The potential impact on freight markets is enormous, with a projected 10% rise in rates, significantly higher than the 5-7% increase we originally anticipated. Brace for a double dose of disruption as we combine the hurricane's impact with the Labor Day weekend frenzy.

Source: NOAA

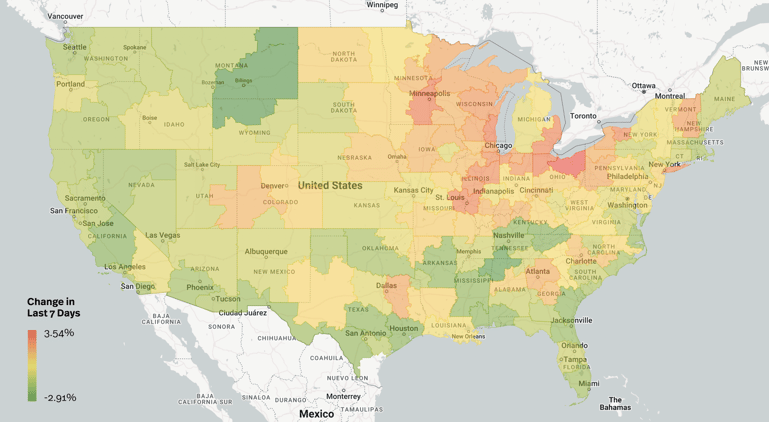

Regional Roadmap: Where the Rubber Meets the Road

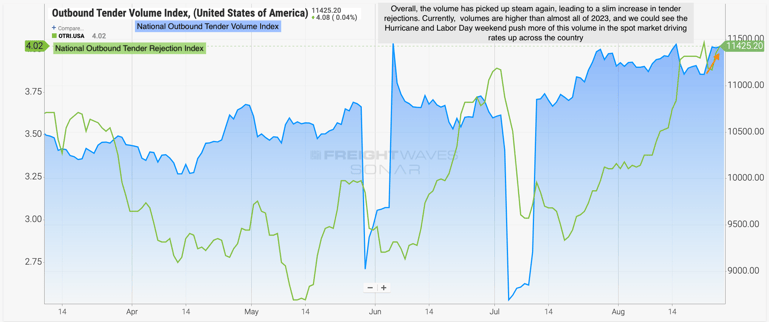

Freight Market Volatility Ahead

As August winds down, we're facing a powerful one-two punch: Hurricane Idalia and Labor Day. Anticipate supply chain shake-ups and market unpredictability that could redefine the course of 2023. Tender rejections on the rise, surpassing 4%, with potential to hit 5% in the coming weeks.

Discover the latest trends in key regions as we explore the dynamics across the nation:

Source: Transfix Internal Data

West Coast Region:

Southern California and Arizona are easing their grip, offering carriers more flexibility. Meanwhile, Texas retains its crown as the shipper's paradise, but remember, leaving the state might be a challenge. With a 4% increase in tender rejections, Texas-bound premiums are on the rise.

East Coast Region:

New Jersey and Ohio remain pressure cookers for shippers, with tender rejections surpassing 4%. Indiana and Illinois, caught in the tightening trend, experienced a 5% increase in rates. Keep an eye on this region,, especially post-Labor Day as rates continue to rise in this region.

Source: Freightwaves

Southeast Region:

Usually a pricey market this time of year, the Southeast's rate climb might be slower this time due to Hurricane Idalia. As carriers head in for relief efforts, a boost of capacity might temper the rate surge, keeping the Southeast in check but this is arguably the most volatile region to watch over the next few weeks depending on Idalia’s impact.

Midwest, Northeast, and Southern Regions:

Fall season means freight is picking up steam in the Midwest and Northeast, both regions anticipating rate hikes of 5% over the course of the next few weeks. In contrast, parts of the South and West Coast are witnessing a dip in pressure.

On the Horizon: What Lies Ahead in the Trucking Terrain

Source: Freightwaves

Drought at the Panama Canal

A critical issue that continues to be overlooked—the Panama Canal is facing a massive pile-up of vessels. With over 200 vessels waiting to navigate the canal, keep a close watch on potential supply chain disruptions that could ripple through inventories and lead to delays especially as we inch closer to the peak holiday season.

Drivers on the Frontlines

National Truck Driver Appreciation Week is just down the road and amid hurricanes and challenges, let's applaud the unsung heroes—the drivers! They keep the wheels turning even in the face of natural disasters. A salute to their dedication and hard work.

That's the wrap for this edition of the Transfix Take Newsletter. We'll continue to keep you in the driver's seat with the latest news, trends, and insights in the supply chain. Until the next pit stop, drive safe and stay ahead of the curve!

Drive safely!

Disclaimer:

The views and opinions expressed in this newsletter are based upon information considered reliable, but Transfix, Inc. does not warrant its completeness or accuracy, and it should not be relied upon. All views and opinions are subject to change and should not be interpreted as specific advice of any nature. Any reproduction or distribution of the content of this newsletter is prohibited without the explicit written consent of Transfix, Inc.